What Can’t Be Printed Away: Hard Assets and the Future of Women’s Health

From Nixon’s gold shock to JPMorgan’s “debasement trade,” why investors are rethinking what counts as real value and why women’s health companies may be the hardest assets of all.

This newsletter is free. But it takes hours each week to research, write, and produce at this level. Here are 5 ways to support my work: 1. click “❤️” to amplify 2. subscribe 3. share this publication 4. buy me coffee 5. become a partner

Connect and collaborate with me here! Email | LinkedIn | Instagram

On the evening of August 15, 1971, President Richard Nixon appeared on national television. He looked straight into the camera and announced that the United States would “temporarily” suspend the dollar’s convertibility into gold.

In other words, the very system that had anchored the U.S. dollar since World War II - that every dollar was backed by gold - was being dismantled. The Bretton Woods era, the scaffolding of the postwar financial order, was over.

It was called the “Nixon Shock.” Stock markets reeled. Allies fumed. But at home, the speech was wrapped in reassurance: America would stay strong, workers would be protected, prosperity would continue.

What it really marked was a shift in ideology. The U.S. government had once bound itself to a discipline it could not bend: Gold.

From that night on, money became whatever Washington said it was. Scarcity gave way to flexibility. And flexibility gave way to temptation.

The temptation was simple: print now, pay later.

New Here?

If you are an investor, operator, or women’s health advocate, start here.

→ Preorder the book: The Billion Dollar Blind Spot

→ Subscribe to the podcast: Blindspot Capital

→ Join the FemmeHealth Alliance Circle

The Ideology Behind Debasement

Earlier this month Mohamed El-Erian shared a line from CNBC that gave me pause. The bank had given a new name to something retail investors and emerging market central banks have been acting on all year: the debasement trade.

I find it telling when a phrase like that goes viral. It tells you the unease isn’t confined to the “finance circles” that I am a part of, but has spilled into the broader mood. This sense that money itself is slipping and that what we hold in our hands today may not carry the same weight tomorrow.

But what does “debasement” actually mean? And why should it matter to you? Let’s unpack this.

Governments claim to like discipline but in reality, they like options. And when debt piles up, the fastest way to shrink it isn’t austerity or growth. It’s inflation.

If a dollar today is worth less tomorrow, then today’s dollar-denominated debt looks lighter tomorrow.

That’s what “debasement” really means.

And this is not new. In ancient Rome, emperors clipped coins and mixed base metals into silver. In Renaissance Europe, kings shaved gold edges to fund their wars. Today, the methods are dressed up in technical language; “quantitative easing,” “emergency facilities,” “fiscal expansion.”

But the principle is identical.

The cost doesn’t fall on emperors or kings. It falls on the holder of the currency. Every paycheck, every savings account, every Treasury bond - all worth a little less tomorrow than today..

Why JPMorgan Is Warning About “the debasement trade”

When JPMorgan puts a label on a trend calling it “the debasement trade” it signals it’s already happening and about to go mainstream1.

But what they are really saying is that in the U.S., the math is no longer mathing.

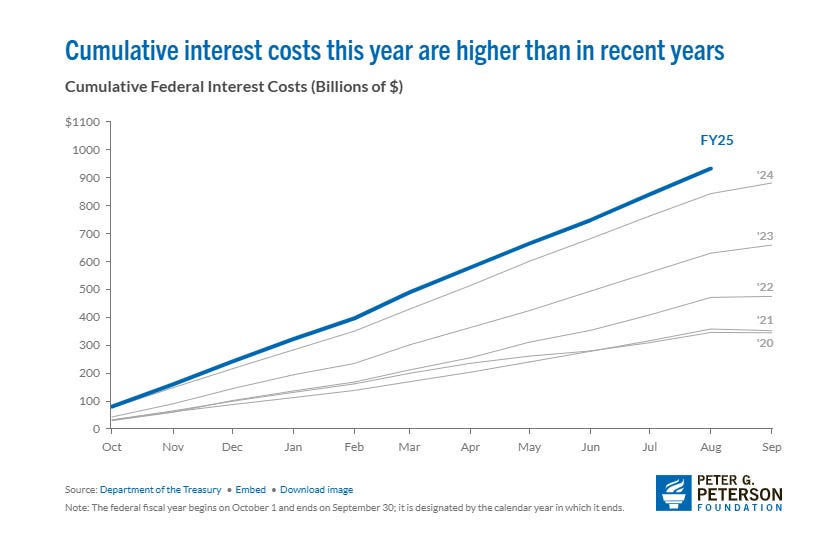

Interest payments on the national debt are projected to surpass USD$1.6 trillion annually by 2034, outpacing defense spending, historically one of the largest and least-questioned categories of the federal budget2.

When debt service costs more than defending the nation, it signals a structural break. And even today, the U.S. spends over USD $1 billion a day just servicing its debt3.

Deficits are entrenched: Washington spends far more than it collects in taxes, year after year4.

And political consensus on fiscal discipline? That remains to be seen. Because the Federal Reserve whose official mandate is price stability and full employment will, when forced to choose, prioritize keeping the system solvent over keeping the currency pristine.

In plain English: the dollar is on a treadmill.

❤️ Enjoying this? If this post sparked something for you, click the ❤️ at the bottom. It helps more than you know and tells me you're reading.

How Currency Erosion Shows Up in Everyday Life

So how does this “debasement” actually show up in your life? It shows up in your grocery bill, your savings account, your plane ticket. Let me illustrate.

Spending outpacing income:

When Washington spends more than it earns. It plugs the gap by issuing (selling) debt through the Treasury. And when markets can’t or won’t absorb all that debt at the price needed, the Federal Reserve steps in, buying the debt and expanding its balance sheet5. More dollars end up in circulation, chasing the same goods. And prices rise.

Negative Real rates:

Your bank might offer 5% on deposits. Headline Inflation is officially 3%. That looks fine... until you realize the inflation you feel (rent, childcare, healthcare) runs higher6. Your “safe” savings are actually shrinking in real terms.

Currency Slippage:

A weaker dollar makes imports more expensive. Think fuel, electronics, travel. You pay more, without earning

Every bailout, every emergency liquidity program, every “temporary backstop” is funded with freshly created money. That firehose never really turns off. None of this is new. What’s different today is the speed and scale. This isn’t a slow erosion over decades. It’s acceleration in real time.

Which is why JPMorgan in echoing what gold investors have known for centuries is pointing to Bitcoin as a modern hedge.

Not because crypto is flawless. But because, like gold, it can’t be printed away.

The Investor’s Core Question: What Can’t Be Printed Away?

That leaves investors with the most important question of all: What should you own that can’t be printed into worthlessness? The traditional answers are familiar:

Gold.

Real estate.

Commodities.

And now, digital assets with built-in scarcity.

But there’s another category we often overlook: productive companies.

Are Companies the Overlooked Hard Assets

Technically, no.

A company isn’t a shiny bar of gold or a tract of farmland. But the best companies behave like hard assets. Why? Because they own or create things that can’t be conjured out of thin air:

Intellectual property.

Regulatory approvals.

Proprietary data.

Networks of trust with customers and clinicians.

The ability to generate real, recurring cash flow.

That’s not a soft claim on the future. It’s tangible capacity to deliver value regardless of how many dollars get printed.

Women’s Health as a Hard Asset Class

Now take that logic into one of the most underinvested areas of the economy: women’s health. Here’s why it matters in a world of debasement:

Scarcity of capital: Less than 4 % of all biopharma research and development spending goes toward female-specific conditions7. That scarcity itself creates opportunity for early entrants.

Secular demand: Menopause, fertility, chronic conditions aren’t fads. They are demographic inevitabilities.8

Defensibility: Regulatory approvals, clinical trial data, and intellectual property form strong barriers to entry.

Cash flow potential: Healthcare isn’t discretionary. It’s sticky, recurring, and resilient even in downturns.

In short: these companies provide services tied to needs that don’t vanish when the dollar stumbles.

A Historical Echo and a Modern Inflection Point

Think back to Nixon’s 1971 speech. The world was shocked. But over time, the investors who owned real assets like land, commodities, businesses with pricing power came out ahead. Those holding cash and bonds saw their wealth eroded.

We are standing at a similar inflection point today. JPMorgan’s forecast isn’t really about Bitcoin hitting $165,000. It’s about acknowledging that the U.S. will keep inflating away its debt. And when the largest bank on Wall Street says it out loud, you know the trade has already begun.

Reflection: The Case for Owning What is Real, Scarce, and Necessary

Every generation of investors faces the same question: What do I own that can’t be printed away?

For some, the answer will always be gold. For others, Bitcoin or real estate. But for those looking not only for protection but for growth, the answer can also be companies especially in sectors that combine scarcity of capital, inevitability of demand, and defensible innovation.

Women’s health is one of those sectors.

Because in a world where governments debase currencies, the only true safety lies in what is real, scarce, and necessary. And women’s health innovation is all three.

So yes, own gold if you want ballast. Own Bitcoin if you believe in code. But don’t overlook the companies building the future of health. They may be the hardest assets of all.

P.S. In a few weeks we’ll be opening membership for the FemmeHealth Alliance, a new non-profit platform to connect capital, science, and policy for women’s health. If you’d like to be among the first to join, link here.

If this essay moved you, share or restack it.

This essay is part of my ongoing series on the billion-dollar blind spot in women’s health, wealth, and capital. You can subscribe to receive new essays every Sunday and join the conversation shaping the future of investing

To go deeper, pre-order my upcoming book The Billion Dollar Blind Spot to learn why women’s health is the future of healthcare investing.

Join Our Network

Are you building or backing credible, under-the-radar solutions in women’s health?

We want to hear from you. Reach out privately or reply to this post. FHV curates brands and breakthroughs that deserve broader attention in the women’s health ecosystem.

I write weekly at FemmeHealth Ventures about capital, care, and the future of overlooked markets. If you are building, backing, or allocating in this space, I’d love to connect.

Disclaimer & Disclosure

This content is for informational and educational purposes only. It does not constitute financial, investment, legal, or medical advice, or an offer to buy or sell any securities. Opinions expressed are those of the author and may not reflect the views of affiliated organisations. Readers should seek professional advice tailored to their individual circumstances before making investment decisions. Investing involves risk, including potential loss of principal. Past performance does not guarantee future results.

References

CoinDesk. “Bitcoin Could Reach $165K Based on Gold’s Record Run: JPMorgan.” Oct 2, 2025.

The Federal Budget in Fiscal Year 2024: An Infographic | Congressional Budget Office

Peter G. Peterson Foundation (PGPF). “Interest Costs on the National Debt.” 2025.

Pew Research Center. “Key Facts About the U.S. National Debt.” Aug 2025.

Federal Reserve Board. “Factors Affecting Reserve Balances (H.4.1 Release).

U.S. Bureau of Labor Statistics (BLS). “Consumer Price Index Summary.”

Women’s health investment trends | Deloitte Insights

Closing the women’s health gap | McKinsey

The average person does not understand finance, sadly we don’t teach this in schools. So when deregulations on how our dollars work happens again the average person won’t understand a lot of the legal and financial jargon. This isn’t just about politics, but it has definitely played a major part in how we are here.

Maryann - Thank you for championing women’s health in this way. Your perspective is unique and one we need to keep hearing about.