The Rise of Female Breadwinners: Shaping Society, Finances, and the Future

The day of my thirtieth birthday began like any other. My 5:30 am alarm had gone off, slicing through the early morning silence with its relentless insistence. Groaning, I dragged myself out of bed and embarked on my usual morning routine, the well-practiced steps that framed the rhythm of my life.

As I walked through the still-dark streets towards the train station, I couldn't help but ponder the significance of the day. I was now officially thirty, a milestone that felt oddly weighty. I had spent the better part of my twenties climbing the corporate ladder and now, I was an analyst at a reputable firm. From my humble beginnings, it was no small feat to have made it this far in my career.

As I settled into my train seat, my phone rang. It was my mother calling to wish me a happy birthday, and to inquire about my plans for the rest of the day. Her voice was filled with warmth, and I couldn't help but smile as we chatted for a few moments. It was a reminder that, despite the distance and the years that had passed, my family remained an unwavering source of support and affection.

But the call also served as a reminder of the stark contrast between my life and my mother's when she had reached this same age. At thirty, she had been a seasoned mother of five, married for more than a decade. Her world had revolved around the bustling household she had created, filled with the laughter and chaos of her children. In contrast, my world was a quiet and ordered one, centred around data, charts, and business meetings.

I couldn't deny the disparity between our lives. While I had been lucky to have family and friends who supported and respected my decision to focus on my career, it didn't shield me from the occasional well-intentioned comments and concerns. Family gatherings often featured aunts and uncles who couldn't resist reminding me about my ticking biological clock, as if it were a bomb waiting to go off.

My friends, equally well-meaning, expressed their own worries. They fretted about my prospects in the realms of romance and companionship, given the ever-shrinking pool of eligible bachelors our age. I knew that they meant well.

But I was not alone.

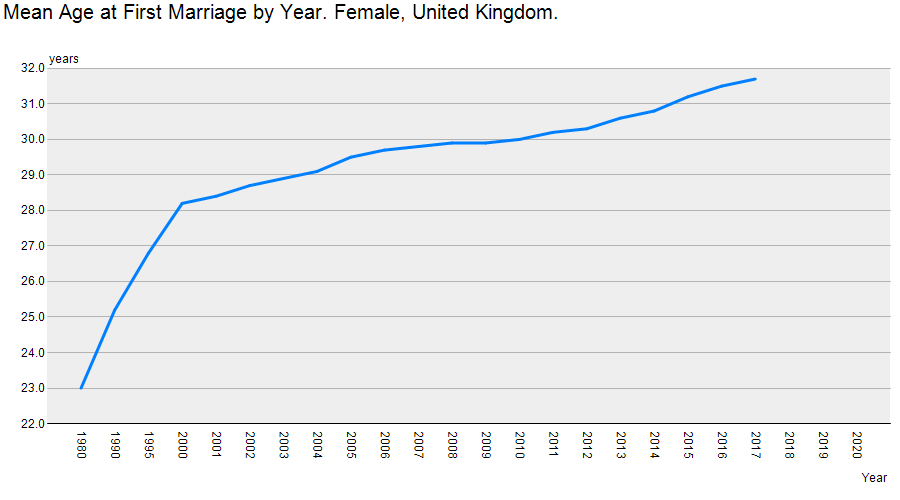

Taking the United Kingdom as a case in point, today, women are having fewer children and are as university educated as men. The median marriage age for women has increased, and changing norms such as part-time working and hybrid working are enabling more women participate in the labour force.

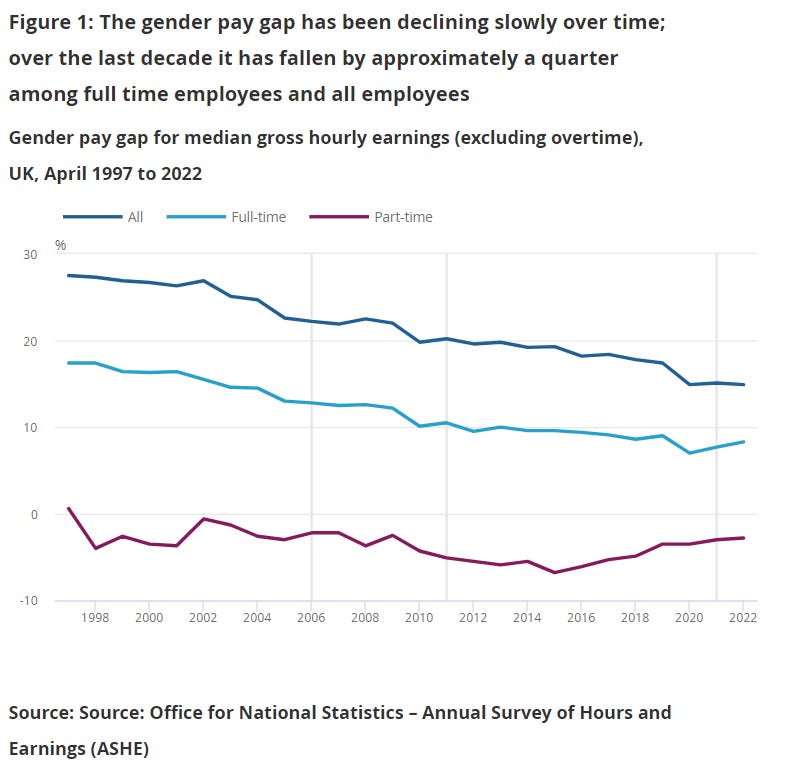

And although the gender pay gap remains stubbornly wide, women are making strides in their careers and entrepreneurial endeavours, and emerging as a formidable economic force.

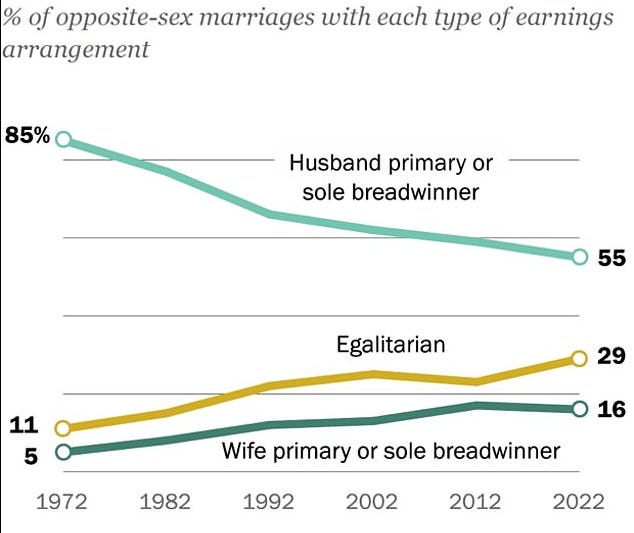

In 23% of UK households1, women are the main earners. This figure rises from just 19.8% in 2004. At the same time, the number of households in which men are the primary or sole breadwinner has drastically reduced from 85% in 1972 to 55% in 2022. In 16% of married households, women are the sole breadwinners.

The increasing number of women who are the primary earners in their families or earn on par with their male partners has profound implications for society, affecting how couples share caregiving responsibilities, manage their finances, address gender pay and pension disparities, and influence the demand for financial services.

In recent years, the media and society have rightly focused on topics like gender diversity, the wage gap, and women's roles in the workplace. These discussions have led to advancements in education, professional opportunities, income equality, and women's impact on consumer choices. Although substantial progress has been made, there is still more to achieve.

As women continue to gain prominence in the workforce and as entrepreneurs, they accumulate wealth, assets, and financial influence. They're no longer just passive bystanders; they're actively engaged in managing their finances, making informed decisions, and building a secure future for themselves and their families. Looking forward, women have the potential to shape the economic landscape, by redefining consumer choices, influencing discretionary spending and contributing to GDP growth. And the rise of this female economy (femeconomy) presents interesting opportunities to wealth managers keen to meet the needs of this burgeoning segment.

***Disclaimer***

All opinions are mine and personal. Please do not construe any of my posts as investment advice. I do not provide any buying or selling recommendations, nor offer any investment advice. You are advised to conduct your own research and due diligence when making financial and investment decisions.

Data as of 2019