Why Investing in Women’s Health is the Next Big Opportunity

As women continue to rise in economic power, their influence over household spending and investment decisions has also grown. Today, women control or influence a remarkable 85% of consumer spending—a statistic that underscores their pivotal role in shaping our economy.

But this isn’t just about household items; it’s about investing in a future that prioritizes women's health and well-being.

I founded Notes to Selfe to explore the perspectives that shape my investment decisions, particularly as they relate to the evolving landscape of women’s health.

My investment thesis is made up of two layers of demographic shifts: longevity and women’s increased economic power. We know that women are living longer—on average, women in Europe outlive men by about 6 years. This reality is critical for investors who want to tap into this evolving landscape.

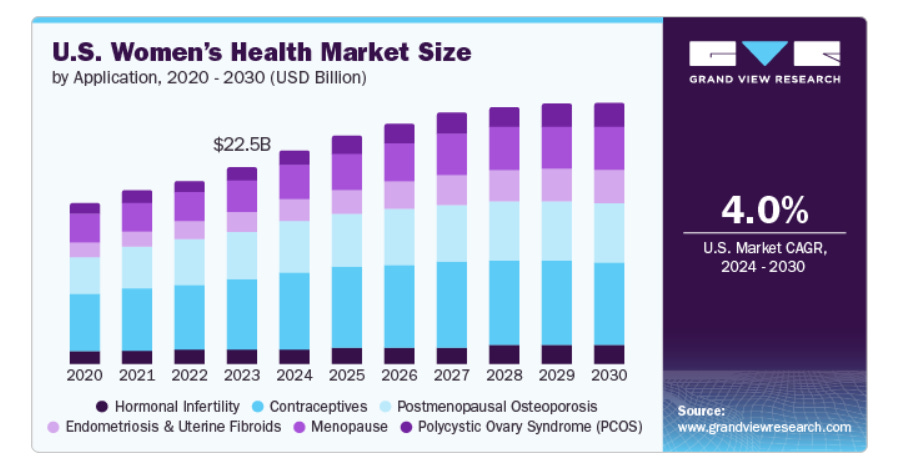

By focusing on demographic shifts such as aging and women's increasing earning potential, we can unlock significant opportunities in a market projected to surpass $50 billion by 2025.

While many investors evaluate opportunities in women’s health mainly through the lens of female founders, it’s equally important to recognize the parallel opportunity in women's health itself. This involves investing in innovations that enhance the health and well-being of female consumers. The impact is already evident, with companies like Flo Health achieving remarkable valuations.

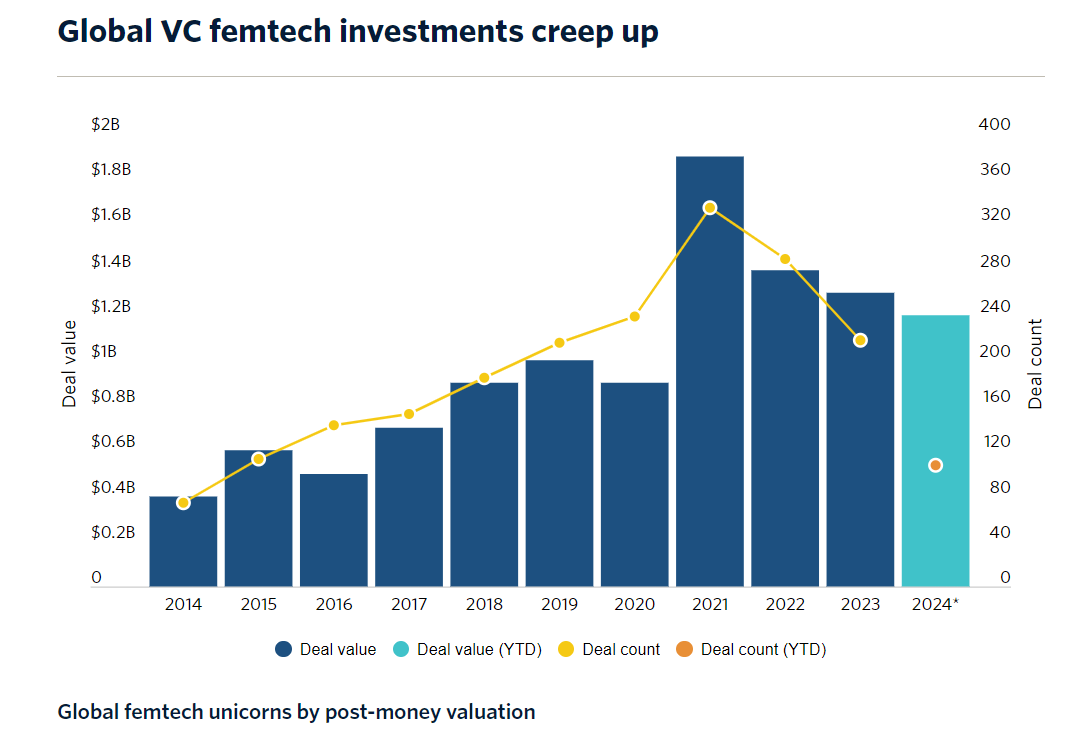

Activity is also on the rise. Recently, Levy Health (the fertility health company) just raised a $4.5 million seed round. The Femtech start-up Perelel has also recently acquired LOOM, a sexual health start-up backed by the Founders Fund.

These kinds of deals may fly under the radar, but they signal significant momentum. According to PitchBook, Femtech start-ups are on track for record venture capital funding, with 2024 potentially surpassing the $1.9 billion record set in 2021.

How Women’s Health Became a Growth Market

So, how did women’s health become such a compelling growth market? Several factors are driving this shift:

Increased Workforce Participation: Today, women represent nearly 47% of the global workforce, a substantial increase from previous decades. In the U.S., women's labour force participation hit 57.4% in 2023, highlighting their critical role in the economy.

Education Advancements: This surge in workforce participation is closely linked to higher educational attainment. According to the National Centre for Education Statistics, women earned 57% of all bachelor’s degrees in the U.S. in 2021. This achievement reflects the increasing qualifications and capabilities of women entering the workforce.

Earning Potential and Asset Control: Despite ongoing gender pay gaps, women are earning more and controlling a larger share of assets than ever before. In the U.S., women own about USD10 trillion in investable assets, and in Europe, women’s shares of AUM is projected to grow to EUR 10 trillion by 2030. This financial power translates into a significant influence on consumer spending and investment opportunities.

Healthcare Decision-Making: Women are responsible for approximately 80% of healthcare decisions within their households, positioning them as key players in the healthcare market.

Funding Disparities: Historically, women's health issues have received only a fraction of the funding compared to other medical sectors. This creates a substantial investment opportunity for addressing these gaps and improving health outcomes.

Focus on Gender Equity: The emphasis on gender equity in healthcare has been reinforced by initiatives like the Global Alliance for Women’s Health, which aims to mobilize billions for women’s. Just last week, Pivotal, a Melinda French Gates organization, launched Action for Women’s Health, a $250 million global open call that will fund organizations around the world that are improving women’s mental and physical health. This reinforces the need for targeted investments in this vital sector.

Market Growth Potential: According to a report by Grand View Research, the global women’s health market is projected to exceed $50 billion by 2025. This statistic reflects the increasing demand for tailored health solutions that meet women’s unique needs.

Four Key Investment Themes in Women’s Health

These factors position women’s health as a crucial and promising sector for investment, blending social impact with substantial financial returns.

As companies strive to close the gender gap in health and wellness, they are creating significant investment opportunities for those looking to engage in this growing market. Women are the largest consumers of healthcare, based on their own health needs and their roles as primary decision-makers for their families.

Here are four major categories in women’s health that have accelerated the flow of consumer dollars:

Reproductive Health

This area encompasses products and services related to family planning, fertility treatments, prenatal and postnatal care, and menopause management. For example, start-ups like Tia are revolutionizing reproductive health by integrating gynaecological care with wellness services, addressing the needs of women holistically.

Chronic Conditions and Disease Management

Women are disproportionately affected by chronic conditions such as cardiovascular disease, autoimmune diseases, and mental health disorders. Companies like Ginger are making strides in this area by providing on-demand mental health support through a user-friendly digital platform, tailoring solutions to women's unique challenges.

Wellness and Preventive Care

This sector promotes holistic health solutions, including nutrition, mental health, physical fitness, and lifestyle management specifically designed for women. Noom is a prime example, offering personalized wellness programs that empower women to take charge of their health in a sustainable way.

Health Technology and Innovation

The integration of technology in healthcare solutions tailored for women is transforming the industry. Companies like Nurx are at the forefront, providing telehealth services that make it easier for women to access essential health services, including contraception and STI testing. This innovation not only meets women’s needs but also presents a significant investment opportunity.

Looking Ahead: Investing in Women’s Health

Women should no longer be viewed as a niche market; they represent one of the most significant growth opportunities we’ve ever encountered. By strategically investing in women's health, we can drive substantial financial returns while contributing to a healthier and more equitable society. The time to act is now—embracing this dynamic market is not just an opportunity but a necessity for forward-thinking investors. Let’s champion this cause together and make a meaningful impact for women everywhere.

Have a great week ahead

Maryann

***Disclaimer***