What 2025 Taught Investors About Healthcare

From Narrative to Durability and the Implications for Women’s Health Investing

📌 Special note 1: This newsletter is free. But it takes hours each week to research, write, and produce at this level. Here are 5 ways to support my work: 1. click “❤️” to amplify 2. subscribe 3. share this publication 4. buy me coffee 5. become a partner.

📕Special note 2: The Billion Dollar Blindspot (the book) is almost ready to step into the world. If you want to follow the journey, early excerpts, behind-the-scenes notes, and launch news, you can sign up for early access here.

Connect and collaborate with me here! Email | LinkedIn

This essay examines how the 2025 healthcare market reset reshaped investor behaviour and why women’s health felt the impact first. I explore:

Why women’s health remains underfunded despite rising awareness

How public healthcare market repricing reshaped how women’s health assets are evaluated

What changed in founder quality, capital expectations, and where durable progress is actually happening

New Here?

If you are an investor, operator, or women’s health advocate, start here.

→ Preorder the book: The Billion Dollar Blind Spot

→ Subscribe to the podcast: Blindspot Capital

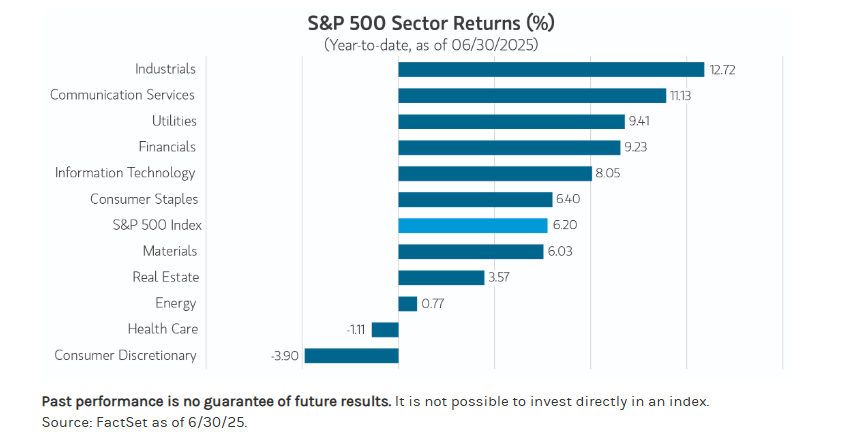

In March 2025, the S&P 500 healthcare index was trading at 1741.65. Two months later, it was down 14%. It would take another six months to return to its March level.

There was no single crash. No dramatic capitulation. No moment when the floor fell out. What there was instead was a steady drumbeat of pressure, playing out in headlines week after week.

Tariffs on medical-technology supply chains. Renewed focus on drug pricing. Pharmacy benefit managers pulled back into the political crosshairs. Questions around research funding and federal priorities. None of these stories was subtle. They were everywhere. And together, they weighed on investor confidence. Capital moved quickly and healthcare stocks sold off.

That mattered, because healthcare is supposed to be where capital hides. In financial markets, the healthcare sector is labelled defensive for a reason.

When volatility rises and sentiment turns, investors have historically retreated into healthcare. Demand is steady in healthcare. Illness doesn’t respect cycles. In a slowdown, consumers delay cars, travel, or renovations not insulin, oncology treatments, or cardiac care. That revenue durability is exactly what investors prize when macro visibility collapses.

But in 2025, that assumption was tested…hard.

Healthcare didn’t collapse but it stopped being automatically trusted. The benefit of the doubt disappeared. And when markets become more selective, the parts of healthcare that rely on time, patience, and structural belief feel it first. Women’s health sits squarely in that category.

❤️ Enjoying this? If this post sparked something for you, click the ❤️ at the bottom. It helps more than you know and tells me you're reading.

How Investors Repriced Healthcare Risk in 2025

As prices slid, investors didn’t abandon healthcare entirely. They narrowed their focus. Vision on its own stopped being enough. Big stories without near-term substance lost momentum. Capital moved toward something simpler: companies that could absorb policy noise, supply-chain disruption, and regulatory delay without breaking.

In capital-markets terms, 2025 marked a shift from narrative-driven healthcare investing to durability- and cash-flow-driven allocation.

You could see the shift in where money went and where it didn’t.

When private equity stepped in to take Mayne Pharma private, or when Blackstone moved on Hologic, these weren’t rescue missions. They were acknowledgements. These were solid businesses with meaningful women’s-health assets, predictable demand, recurring revenues, and real cash generation.

Why Women’s Health Is More Sensitive to Capital Cycles

And this is where women’s health comes into sharper focus. For years, underinvestment in women’s health was explained as neglect. A lack of awareness. A failure of imagination. By 2025, that explanation no longer fully holds.

Don’t get me wrong. I still think more needs to be done to establish gender-specific health as a recognised healthcare subsector with investment potential. But the deeper issue is structural.

The underfunding of women’s health is not primarily a demand problem. It is a capital-structure problem, shaped by long clinical timelines, complex regulation, uneven reimbursement, and evidence gaps created by decades of exclusion from research.

In a market recently disciplined around time and cash flow, those frictions became impossible to ignore.

Where Women’s Health Progress Continued Despite Capital Tightening

Something else happened in 2025 that was harder to see from the outside. The founders who kept moving weren’t the loudest. They weren’t the best storytellers. They were the ones building patiently, working through clinical endpoints, regulatory pathways, and unglamorous execution.

This is why Daré Bioscience matters as a reference point not because it’s perfect, but because it shows what building in women’s health actually looks like when the capital cycle is unforgiving.

In 2025, Daré advanced multiple assets despite the backdrop: initiating the commercial rollout of its evidence-based topical arousal cream for women, securing additional non-dilutive grant funding, and continuing progress in its Phase 3 contraceptive programme. None of it was flashy. But all of it mattered.

What 2025 Clarified About Women’s Health Investing

Looking back, 2025 didn’t make women’s health easier to invest in. It made the trade-offs explicit.

It forced a reckoning with time. With structure. With which kinds of capital belong where. And it stripped away the illusion that awareness alone unlocks markets.

2025 leaves me with one clear conclusion. Women’s health doesn’t need more enthusiasm. It needs capital that understands duration.

Next week, I’ll share the women’s-health trends I’m watching for 2026 as an investor in this healthcare subsector.

Because markets always tell you what they value.

Sometimes it just takes a year like this to hear it.

To go deeper, pre-order my upcoming book The Billion Dollar Blindspot to learn why women’s health is the future of healthcare investing.

Join Our Network

Are you building or backing credible, under-the-radar solutions in women’s health?

We want to hear from you. Reach out privately or reply to this post. We curate brands and breakthroughs that deserve broader attention in the women’s health ecosystem.

I write weekly at The Billion Dollar Blind Spot about capital, care, and the future of overlooked markets. If you are building, backing, or allocating in this space, I’d love to connect.

Disclaimer & Disclosure

This content is for informational and educational purposes only. It does not constitute financial, investment, legal, or medical advice, or an offer to buy or sell any securities. Opinions expressed are those of the author and may not reflect the views of affiliated organisations. Readers should seek professional advice tailored to their individual circumstances before making investment decisions. Investing involves risk, including potential loss of principal. Past performance does not guarantee future results.

For those building or investing in healthcare: did things feel harder, slower, or just different this year?

If you had to sum up healthcare in 2025 in one word, what would it be?