Unlocking Investment Success: 5 Essential Tips for Savvy Investors

5 essential tips to help you make informed decisions and achieve financial success

It was the immediate aftermath of the dotcom bubble and we were still very much trapped in a bear market. It was against this backdrop that I first dipped my toes into the world of equity market investing, and it was a baptism by fire. In so many ways, I wish I knew then, what I know now.

This is the guide I wished I had when I started my investing journey over twenty years ago. I’ll try to make this a comprehensive guide that empowers you with knowledge crucial for your journey in the world of investing. In this article, I cover 5 tips you should always keep in your back pocket, and should help you make informed decisions and achieve financial success. These 5 tips are for everyone - whether you are a newbie to the world of investing, or a seasoned pro.

You Are Playing The Long Game

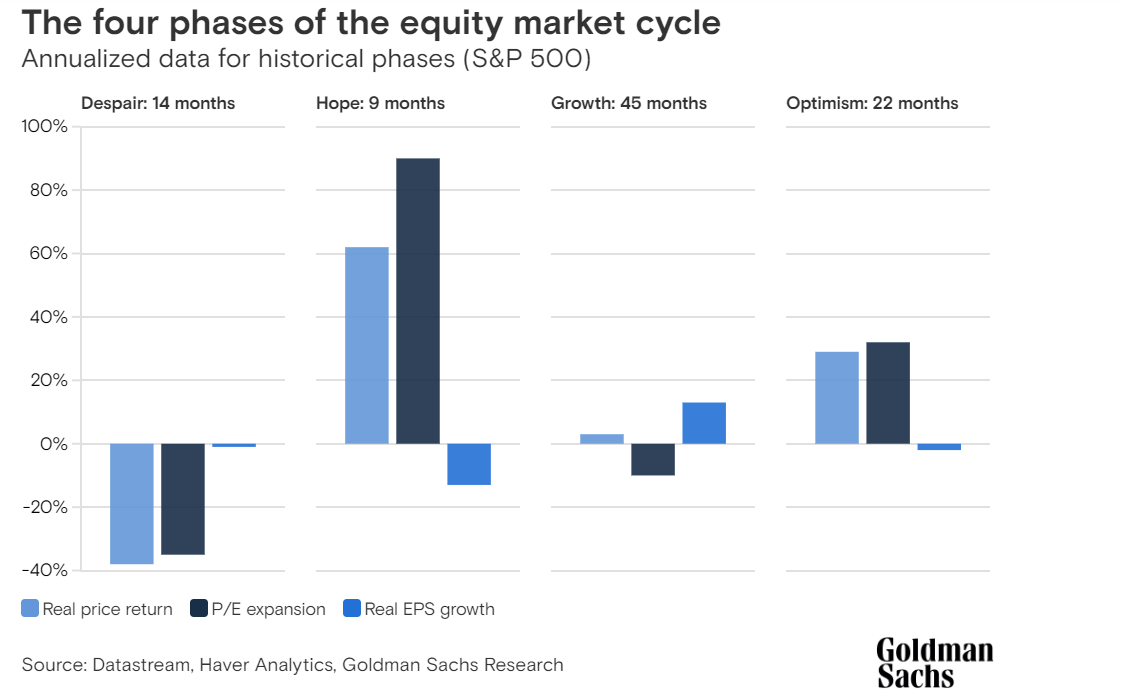

As an investor, remember that you are playing the long game. Markets, like seasons, have a cycle and according to Goldman Sachs, the equity market cycle has four phases:

Despair - this is the first phase in the cycle and is usually associated with a period of stock market and economic declines, and negative sentiment.

Hope - this is the strongest and shortest phase and follows Despair in the cycle. During this phase, markets and valuations rise in anticipation of a future profit growth recovery.

Growth - This phase follows Hope. During this phase, profits recover but valuations and returns are still depressed.

Optimism - this is the final phase in the cycle and is usually associated with increasing valuations even as interest rates rise.

These equity market phases tend to run alongside phases in the business cycle i.e. recessions, booms, expansions and contractions. It is important to understand (1) that a market cycle exists and (2) where we are in the cycle.

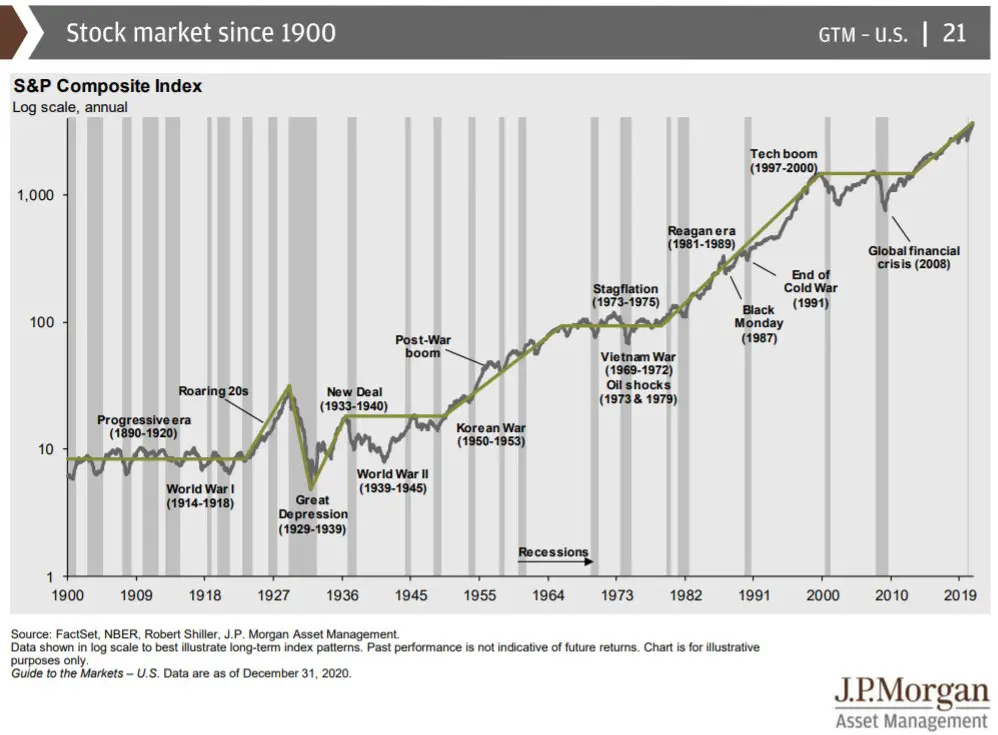

As can be seen in this chart from JPM, short-term fluctuations are inevitable. Despite short-term turbulence, stocks do tend to rise in the long run, highlighting the importance of adopting a long-term perspective. Of course, this is based on historical data and we know the future may look nothing like the past. Still, history is one of the few tools we have available that can tell us something about the future. Hence, it is essential to remain focused on your long-term investment goals.

Understand The Power of Compounding

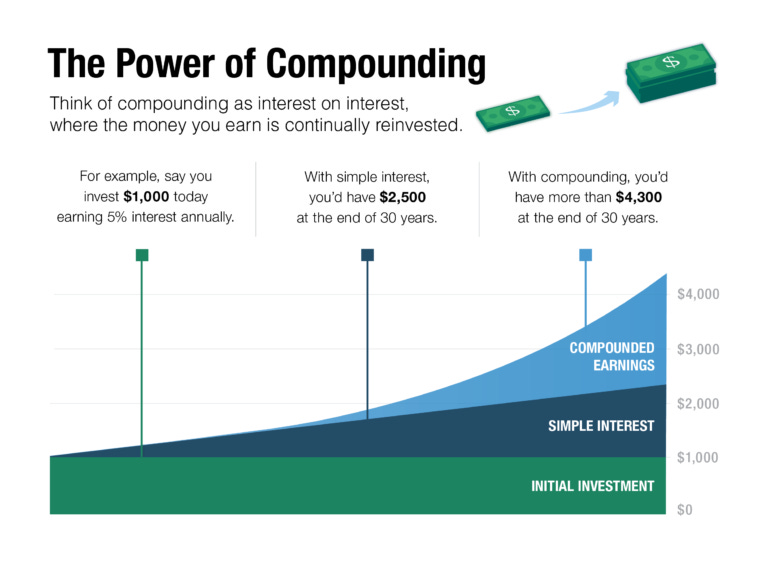

Regardless of your initial investment, compounding is your ally. Over time, it can significantly grow your wealth. But what exactly is compounding? Compounding is when your initial investment starts to earn compound interest. Compound interest is interest earned on interest, or in other words your initial investment plus your earnings are reinvested and you earn on the whole sum.

With compounding, time is your friend as over time, compounding can mean a significant difference of thousands of dollars or euros.

Discipline Your Emotions

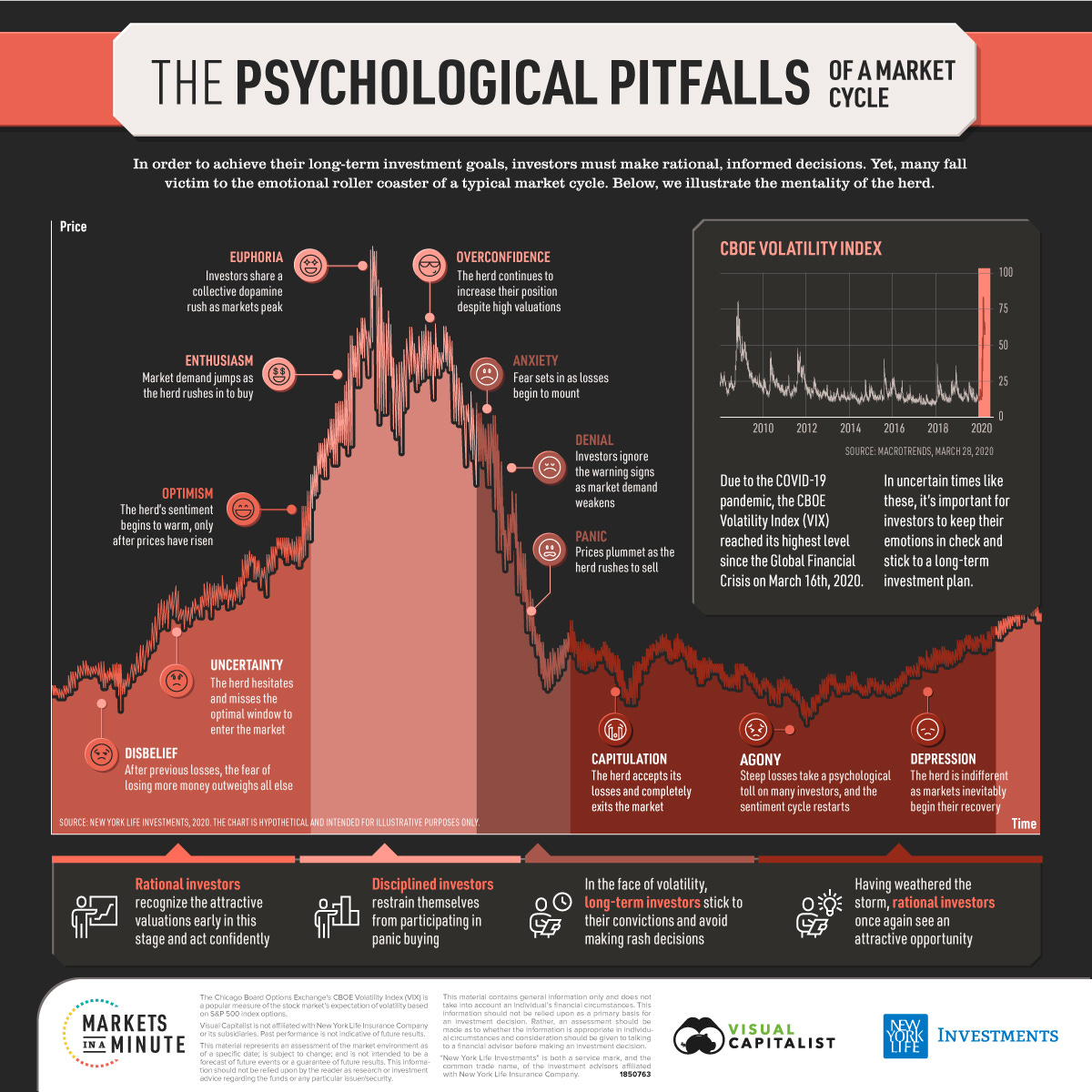

On average, investors struggle to outperform the broader market. This underperformance often results from emotional decision-making.

Investor psychology plays a crucial role in financial success. Understanding and managing emotions is essential for thriving in the world of investment. Having worked as an investment advisor for several years, I can attest to how so many investors including seasoned investors fall prey to their emotions and make terrible investment decisions which come with a heavy financial penalty.

One such mistake is falling prey to the herd mentality syndrome. Herd mentality is driven by peer influence and often triggers emotional decision-making, especially in investing. It is easy for investors to get sucked into irrational decision making due to herd mentality in today’s world where investors have real-time access to several sources of information e.g. social media and media outlets sensationalize headlines for clicks.

Another mistake is falling prey to emotional reactions, which often lead to panic selling at the most inopportune time, causing investors to underperform. In order to achieve your long-term investment goals, one must make rational, informed decisions. Visual Capitalist does a great job of illustrating how emotions can get in the way of rational investment decision making using the sentiment cycle. This is where working with an investment advisor who can act as a sounding board can be highly beneficial versus doing it yourself.

A Drawdown Is Your Friend

Drawdowns, while daunting, create opportunities for investors who can distance themselves from emotional reactions. But what is a drawdown? A drawdown is defined as the largest potential for loss in the value of an investment measured as a difference between the highest peak and the subsequent lowest trough in the market for a specific period of time. It is important to note that this is different from a loss which is calculated as the difference between the purchase price and the subsequent sale price of the asset.

Severe stock market drawdowns also known as market corrections can be unsettling. During this process, stock prices reset to better reflect a company’s long-term earnings expectations, and is usually accompanied with uncertainty and volatility in asset prices.

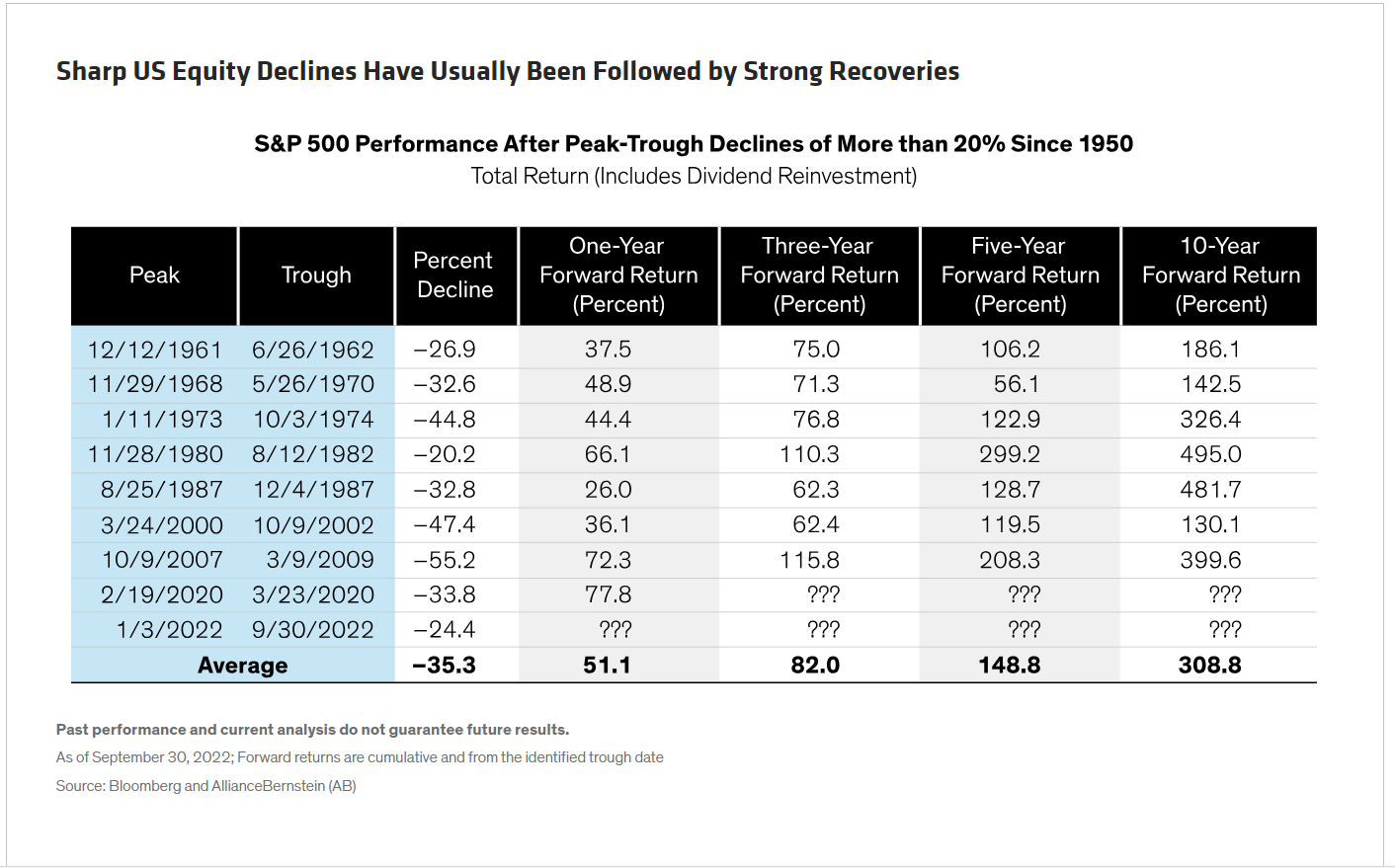

But what happens after a drawdown is encouraging. Following sharp US market declines since 1950, equities typically roared back with gusto. Analysis by AllianceBernstein shows that from the low point in eight US market downturns of more than 20%, equities delivered a 51.1% forward return after one year on average, and a three-year return of 82%. These investors continued to reap these gains five and ten years down the line.

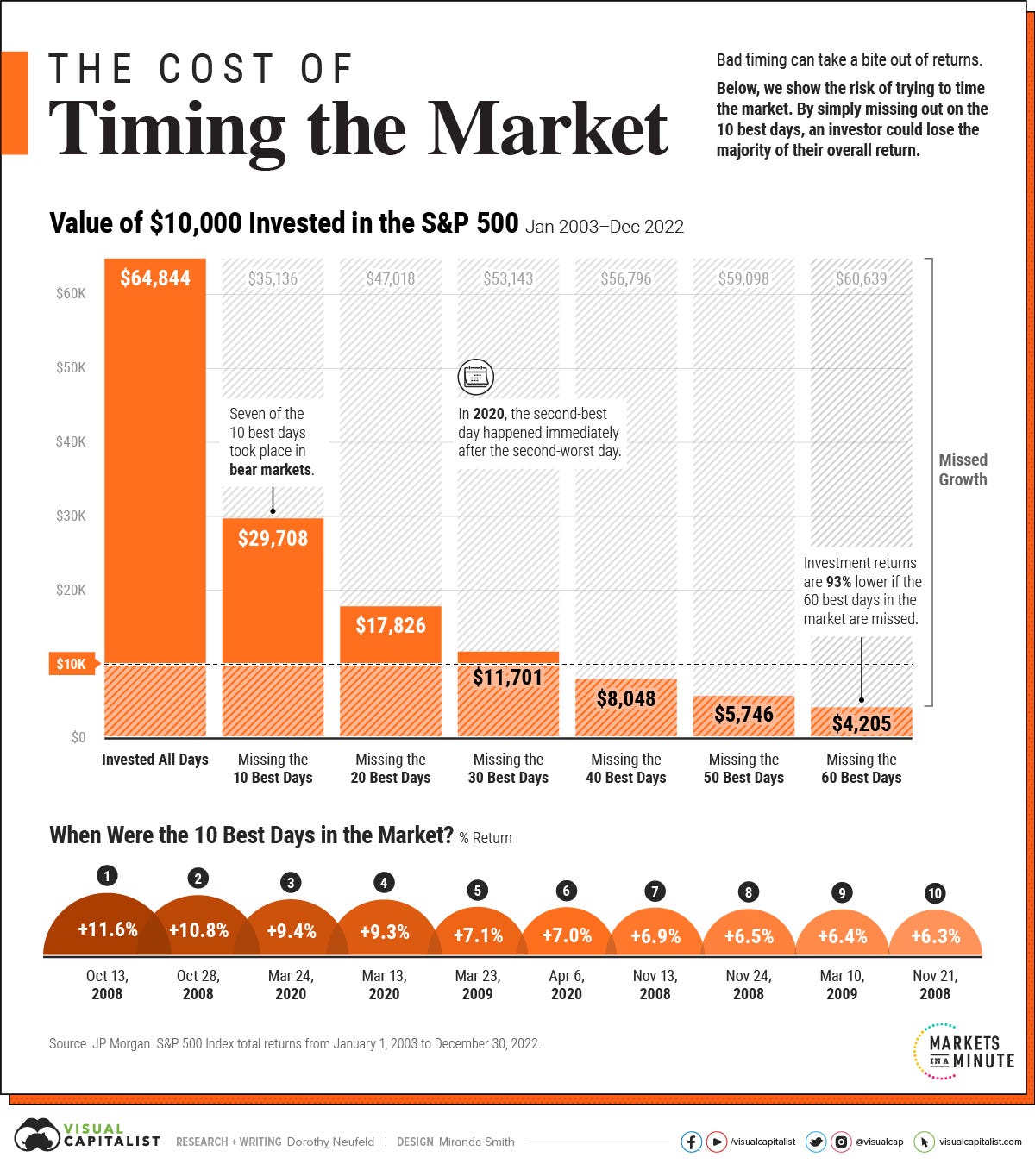

Conversely, investors who panicked and sold during a drawdown or investors who waited on the side-lines to try to time the markets got severely punished. The best days for stock market performance usually happen immediately after the worst days and in the middle of a bear market. So investors trying to time the market will most likely miss the best days. As illustrated in the visual below from Visual Capitalist, missing only the best ten days of the stock market performance between Jan 2003 and Dec 2022 would have cost an investor up to 54% of their overall return.

Geopolitics and the Stock Market

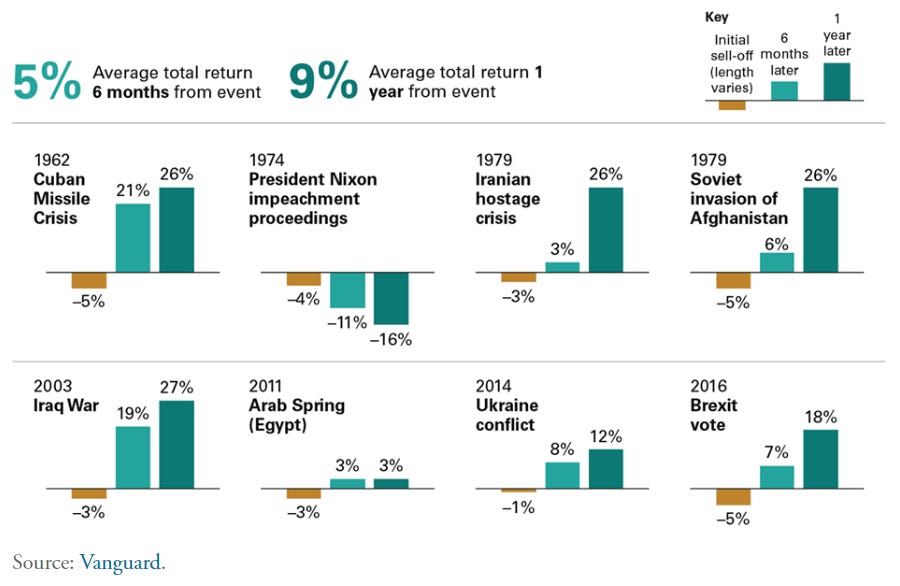

In general, markets face uncertainties ranging from political and economic issues to inflationary and geopolitical factors. Of these, geopolitical risks tend to be the hardest to gauge as they have the widest range of outcomes. However, when geopolitical tension rises, so does stock market volatility. Looking back on history as a guide, most geopolitical sell-offs are short-lived, and markets tend to rebound even before a full resolution of the geopolitical event in question.

With geopolitical issues, there’s always the risk that the situation could drastically and rapidly escalate, leading to more volatility and drawdowns. However, it is important to remember just how resilient markets are. Markets have endured countless wars, recessions, depressions and have always come back stronger.

I hope that these 5 tips serve as guardrails offering a framework for your investment decision making process. Investing is a long-term endeavour, and your ability to make rational decisions while staying focused on your goals will ultimately lead you to success.