Understanding the Unique Investment needs of Women - Part 3

Using tailored investment strategies to support financial success

Two roads diverged in a wood, and I —

I took the one less travelled by,

And that has made all the difference.

— Robert Frost

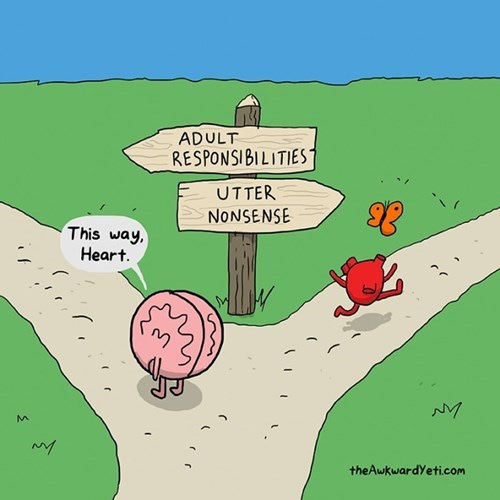

Have you ever arrived at a fork in the road and didn’t know which way to turn? You look ahead, and both paths are filled with opportunities and possibilities, but without a map, the journey ahead feels daunting or tentative.

It’s a feeling many women know well—You've put in the effort to build your business and save for your future, yet still face uncertainties about where to invest, how to handle life's unexpected turns, and how to ensure long-term success.

The good news? With the right guidance, we can choose the path that leads to a brighter financial future.

In the first two parts of this series, we explored how women are growing in influence in finance and the challenges that come with taking control of their wealth. Now, in this third installment, we’ll explore how tailored investment strategies can help women navigate crossroads and achieve financial success.

Please help us grow by liking this post and sharing it with a woman you know! It really helps a lot :)

1. A Personal Approach to Investing

As women, our financial paths are often different from men's and influenced by priorities like raising a family, building a career, or planning for retirement.

In life, when we reach a crossroad, the first thing we need is a destination. The same applies to investing.

I have seen many friends and colleagues take a step back from their careers after having children, and I know it’s not an easy decision. There's often a lot of worry about what this break means for their financial security—how it might impact their long-term savings, retirement plans, or even their sense of financial independence. These concerns are valid and can be overwhelming.

But I have also seen how, with a well-thought-out investment strategy, they’ve been able to adapt and make the necessary adjustments. Instead of losing ground, they’ve been able to stay focused on their financial goals, ensuring that time away from work didn’t mean falling behind.

It’s about finding ways to keep moving forward, even when life takes a different turn, and the first step is understanding your personal goals.

Are you investing for retirement, a home, or perhaps your children’s education?

Setting clear objectives helps you make choices that align with your future.

2. Embracing Risk Without Fear

From a young age, I was taught the importance of saving. I remember filling my piggy bank and learning to put money aside for a rainy day—it was a concept that felt natural.

But investing? That was never part of the conversation.

It wasn’t something I grew up learning about, and as I got older, I realised it was something that many women, myself included, simply weren’t exposed to.

I was always encouraged to save but never to invest, and that mindset stayed with me for years. As a result, I tended to shy away from taking risks—not because I was scared, but because I didn’t understand how to manage them in a way that would work for me. It wasn't until much later that I discovered that risk isn’t necessarily a bad thing. It’s not something to be avoided; it’s actually a tool that can help you move forward, as long as you understand how to use it wisely.

Many women have been guided to favour low-risk options like savings accounts or bonds. These choices feel safe, and they do offer some level of security. However, they often fall short when it comes to generating the kind of growth needed for long-term financial success.

I have learnt that it’s not about avoiding risk altogether; it’s about understanding how much risk you’re comfortable with and then building an investment strategy around that.

It’s about finding that balance where your portfolio delivers the best possible returns for the level of risk you’re willing to take—what’s known as being on the 'efficient frontier.'

This approach is about positioning yourself for success over the long term, ensuring you’re getting the most out of every opportunity without taking on more risk than you can handle.

Now, you might wonder, do risk-adjusted returns really matter? Isn’t it the actual return that counts in the end?

That’s a valid question.

But recent market shifts, like the volatility we saw in the second quarter of 2024 after years of steady gains, show why it's crucial to look at returns through the lens of risk. It’s not just about how much you make; it’s about how much risk you took to get there. Understanding this balance can make all the difference in navigating unpredictable times and staying on course toward your financial goals.

3. Closing the Gender Pay Gap with Smart Investments

The gender pay gap across Europe remains a challenge, and it impacts the way women invest. With lower average salaries, women often have less to contribute to their savings and pensions. But smart investment strategies can make up for these differences.

Tax-efficient investments, such as Individual Savings Accounts (ISAs) or pensions, allow women to grow their wealth faster. For instance, I have found that contributing a little extra to my retirement fund each month not only helps catch up on lost time but also takes advantage of compound interest. Over time, these small steps build momentum, allowing women to overcome financial hurdles.

4. Preparing for Life’s Interruptions

Life doesn’t always follow a straight path, and many of us experience moments when our financial plans take a backseat. Whether it’s stepping away from work to raise a family, taking time off to care for ageing parents, or navigating a health challenge, these interruptions are a reality for many women. I’ve seen friends and family go through this, and I know how easy it is to feel like these pauses will set you back for good. But they don’t have to.

I like to think of these interruptions as a season, not an ending—much like winter in a garden. It may seem like everything stops growing, but that’s not true. It’s simply a period of rest, a time to regroup and prepare for the next season of growth.

This perspective can help reduce the pressure we feel to always be moving forward, and instead, we can focus on how to prepare for these pauses in a way that keeps our financial goals in sight.

One way to do this is by choosing flexible investment options that make it easy to keep contributing, even when life changes. For example, setting up automated contributions, even if they’re small, can help maintain your momentum and prevent you from falling too far behind. It’s a way to stay in the habit of investing, even when your focus is elsewhere.

And it’s also important to remember that it’s never too late to catch up. Many European pension schemes recognise that women often have career interruptions and allow them to increase their contributions later on, helping to make up for any gaps. This means that even if you’ve taken a break, there’s still plenty of time to get back on track. It’s about being patient with yourself, recognising that these pauses are part of life, and knowing that they don’t have to stop you from achieving your financial goals.

Tailored investment strategies go beyond just choosing the right stocks or funds. They’re about creating a plan that fits the realities of your life—your goals, your risk tolerance, and the times when you need to step back.

In the final part of this series, we’ll dive into how financial literacy can help women take control of their financial futures.

Have a great week ahead

Maryann

Disclaimer

The content in this newsletter is for informational purposes only and does not constitute financial, investment, legal, or medical advice. Opinions expressed are those of the author and may not reflect the views of affiliated organisations. Readers should seek professional advice tailored to their individual circumstances before making decisions. Investing involves risk, including potential loss of principal. Past performance does not guarantee future results.