Uncomfortable by Design

How Neglect in Women’s Health Diagnostics Became a $10B Investment Opportunity

Two days ago, I posted a short note. It hit a nerve and exposed a $10B blind spot in women’s health diagnostics. Hundreds of replies later, the signal is clear: this isn’t niche. It’s overdue and investable.

Creating work like this is a choice. It takes time and effort to resist the pull toward noise and stay anchored in depth. If this newsletter has offered you something valuable, I invite you to consider supporting it, either with a one-time gift or a regular contribution. Your support helps me stay true to the kind of work that asks better questions, listens longer, and builds something lasting. I’m deeply grateful you’re here.

New here? Tap the subscribe button to follow along each week inside the app.

The Note That Touched a Nerve

Two days ago, I posted a short note:

“the Pap smear hasn’t changed in 80 years. It’s uncomfortable, under-innovated, and long overdue for reinvention. If this procedure had historically impacted a broader, more dominant patient population, it’s likely we would have seen faster innovation by now.”

It hit a nerve: over 65,000 views, 3,700 likes, and nearly 500 comments and reposts across Substack and LinkedIn. It wasn’t the numbers that got my attention (although I did briefly consider hiding under a digital rock). It was the content of the replies.

From PMDD and speculum trauma to mammograms and colposcopies, women flooded the comments with personal stories that were visceral, painful, and remarkably consistent: discomfort and dignity are still treated as luxuries in women’s health.

This wasn’t just catharsis. It was market signal.

Discomfort Has Been Normalized But That’s a Design Choice

Women shared experiences of cervical and uterine biopsies without anesthesia. Smear tests that triggered trauma. Mammograms so painful they led to skipped appointments. Endometriosis diagnoses delayed by nearly a decade. Vaginal atrophy post-menopause causing burning pain during routine procedures.

Some men replied, saying, “It’s not like prostate exams are fun either.” And they are right.

And that is the point.

None of this should be normal.

The deeper question is: why haven’t systems moved faster to fix it? The answer isn’t biology. It’s investment.

Innovation Lags Where Investment Lags

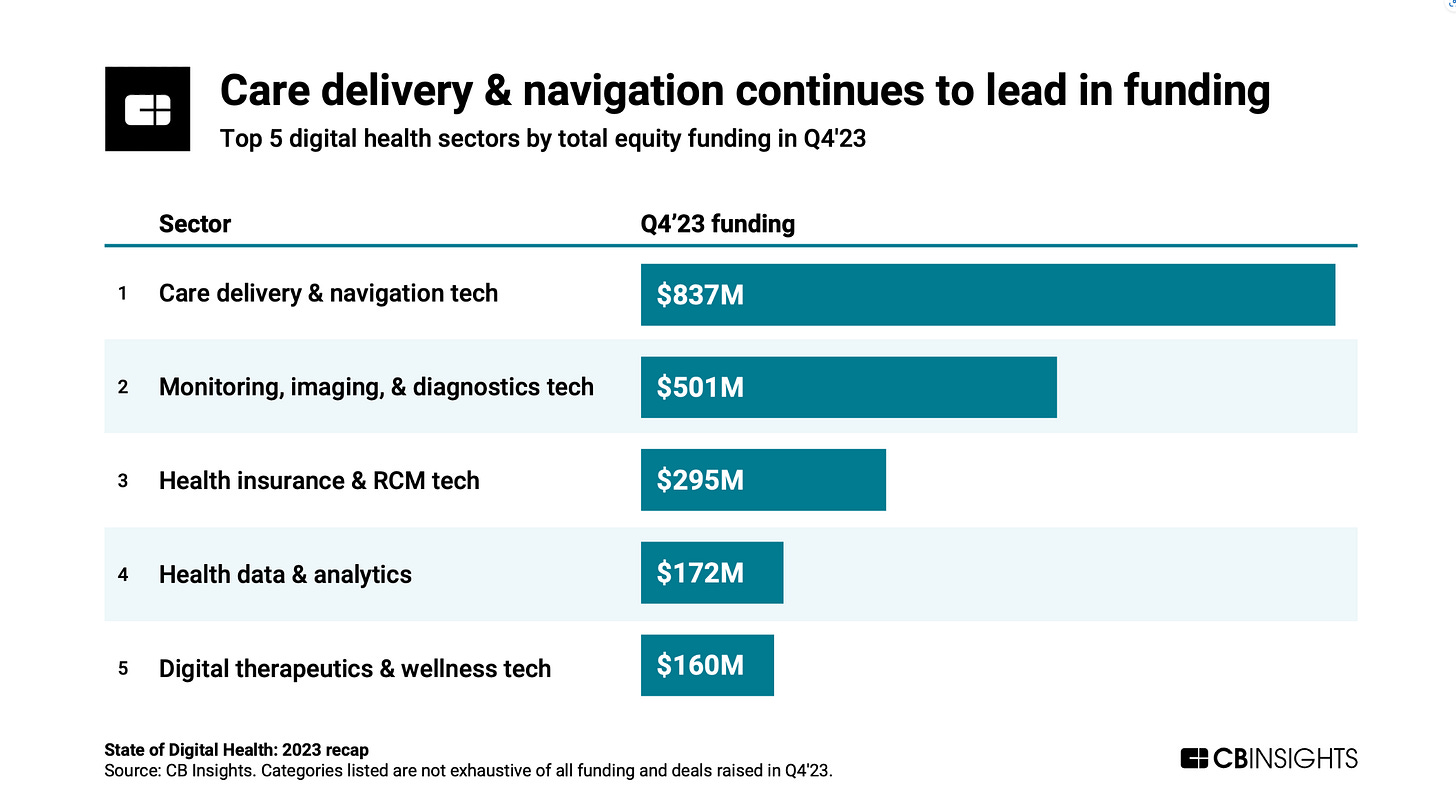

Compare how quickly we have funded and scaled treatments for high-demand conditions like oncology or cardiometabolic disease. These are areas that attract the lion’s share of healthcare investment. Oncology alone receives over US $30B annually in global R&D spending, with expedited review pathways helping accelerate drugs to market.¹ Cardiometabolic and mental health startups routinely command 25–30% of digital health funding.²

Now contrast that with the pelvic speculum, which hasn’t meaningfully changed in over a century. Or with the fact that uterine and cervical biopsies still happen without pain relief.

Women’s health remains critically undercapitalized: less than 2% of venture healthcare funding in 2023 went to women’s health-specific startups, and even less to diagnostics or devices.

This isn’t about intent. It’s about inertia.

Capital markets drive innovation. And where capital sees niche markets, slow reimbursement, or discomfort it doesn’t fully understand, innovation stalls.

Yet the numbers tell a different story:

Cervical cancer is the 4th most common cancer in women, yet millions remain unscreened.⁴

Only 16% of women aged 30–49 in low-income countries have ever been screened.⁴

Even in high-income countries, discomfort leads to avoidance. That has real cost implications.

The New Guard: Companies Shifting the Paradigm

A new wave of founders is treating this as the infrastructure opportunity it is:

CC Diagnostics is using epigenetics to develop a more accurate, less invasive screening method. You can listen to my podcast with the founder here.

Teal Health is developing self-swab kits that meet women where they are; private, evidence-based, and comfortable.

Ceek Women’s Health and Yona are reimagining the speculum and screening experience altogether.

These aren’t fringe moonshots. They represent emerging infrastructure opportunities in women’s health.

For a deeper dive on the business case for early detection in cervical cancer, read my LinkedIn essay: “Why LPs Are Missing The Next Healthcare Upside - Cervical Cancer as a Case Study”

This newsletter is 100% free. But it takes hours each week to research, write, and produce at this level. If you’d like to support this work, even with a small contribution, I’d be so grateful.

Where Capital Is and Isn't Flowing

While women's health is gaining cultural traction, capital deployment hasn’t caught up:

In 2023, only 2% of global healthcare venture funding went to women’s health-specific startups (PitchBook).

Within that, diagnostics remains even less funded despite being foundational to preventive care.

Meanwhile, digital men’s health startups have collectively raised over $800 million in recent years. Companies like Hims, Numan, Manual, and Ro have attracted significant investment to address lifestyle-driven conditions such as erectile dysfunction, hair loss, and low testosterone.⁵

This isn’t because the market is small. It’s because it’s underestimated.

Cervical cancer screening represents a $10B+ global opportunity.

WHO's strategy for elimination creates long-term tailwinds for at-home screening.

Employers are increasingly looking to integrate women's health into benefits, especially as retention and menopause support rise on the agenda.

What savvy investors should evaluate:

Clinical Validation: Is there a path to FDA/CE approval? Are pivotal trials underway?

Reimbursement Strategy: Does the solution slot into existing codes or require innovation there too?

Adoption Potential: Will providers, payers, or employers champion this and why now?

Exit Outlook: Are diagnostics companies being acquired? (Spoiler: Yes - Roche, Hologic, Exact Sciences are watching.)

This isn’t a trend. It’s delayed infrastructure waiting for capital to unlock it.

The Bigger Picture: When Intimate Health is Treated as Optional

This goes beyond Pap smears.

One woman wrote of crying through a smear test post-menopause due to untreated vaginal atrophy.

A doctor commented she was taught in med school to simulate a pelvic exam, just so male classmates would grasp the emotional toll.

Others wrote about years lost to PMDD, misdiagnosed pelvic pain, and dismissive doctors.

These aren’t edge cases. They are the operating norm and that norm shapes capital allocation, too.

When discomfort is normalized, urgency evaporates. No urgency means no funding. No funding means no pipeline.

That is not just a moral failure. It’s a market inefficiency.

❤️ Enjoying this?

If this post sparked something for you, click the ❤️ at the bottom. It helps more than you know and tells me you're reading.

Yes, Men Suffer Too… But That’s Not the Point

A few replies pushed back on the original Note that sparked all this.

“What about prostate cancer?” “What about male mental health?”

These are valid questions. And they are not mutually exclusive with what this piece is calling out. But what we see, again and again, is that innovation tends to accelerate when the affected population holds greater social or political power.

Of course, there are powerful counterexamples like HIV/AIDS where activism and political will created urgency despite stigma and marginalization. But that kind of mobilization is rare.

But this isn’t about who suffers (or should suffer) more. It’s about what gets prioritized faster and why.

What Investors Should Take From This

To LPs, fund managers, angels, and strategic allocators: this moment is not just cultural. It’s investable.

Diagnostics are not secondary. They’re infrastructure.

Comfort isn’t a nice-to-have. It’s compliance, access, retention.

Women’s pain isn’t niche. It’s a billion-dollar blind spot.

When capital overlooks solutions like Teal, CC Diagnostics, or better menopause care, it may be missing both impact and long-term opportunity.

Call to Action

If you are a founder building in this space — diagnostics, screening, menopause, or anything challenging the status quo in women’s health — I’d love to hear what you are seeing. The most interesting opportunities often start where the system still assumes women will tolerate more.

Sources:

Evaluate Pharma, World Preview 2023 Report

Rock Health, 2023 Midyear Digital Health Funding Report

World Health Organization, Global Strategy for the Elimination of Cervical Cancer

Funding data compiled from public sources:

– Numan

– Manual

Ways to Connect with FemmeHealth Ventures Alliance

Thanks for reading. If you liked what you read, consider:

signing up for FemmeHealth newsletter, which is published weekly

sending to a friend or co-worker

Thanks for reading FemmeHealth Ventures Alliance! Subscribe for free to receive new posts and support my work.

Disclaimer & Disclosure

This content is for informational and educational purposes only. It does not constitute financial, investment, legal, or medical advice, or an offer to buy or sell any securities. Opinions expressed are those of the author and may not reflect the views of affiliated organisations. Readers should seek professional advice tailored to their individual circumstances before making investment decisions. Investing involves risk, including potential loss of principal. Past performance does not guarantee future results.