To CLO or not?

What’s going on with collateralized loan obligations (CLOs)?

Earlier this month - April 2024, GoldenTree Asset Management successfully secured USD 1.3 billion in commitments to invest in the riskiest, first-loss equity tranches of collateralized loan obligations (CLOs). This achievement not only surpassed their initial goal of USD 1 billion but also highlights the growing investor confidence and demand for high-risk, high-return financial instruments.

The equity tranche, representing approximately the bottom 15% of the capital structure, attracted a global investor base consisting of pension funds, insurance companies, and family offices. "Demand for our CLO equity has increased as investors recognize the value it can create within their portfolio," stated Kathy Sutherland, CEO of GoldenTree.

GoldenTree is not alone in this regard. Similarly, Brightwood Capital Advisors also made significant strides by closing the second-largest middle-market CLO of the year, valued at $707 million. This deal in the private credit sector further signals a robust appetite for higher-risk products in evolving market conditions.

Market Trends: Pricing and Demand

Strong Demand Persists

The CLO market continues to experience a surge in growth, driven by investors diversifying their portfolios with these instruments, known for their attractive risk-adjusted returns - case in point - the oversubscribed GoldenTree CLO capital raise. This pursuit for yield has led to a demand that significantly outstrips the supply, causing a rise in prices and consequently, tighter spreads.

Anticipated Increase in Supply for 2024

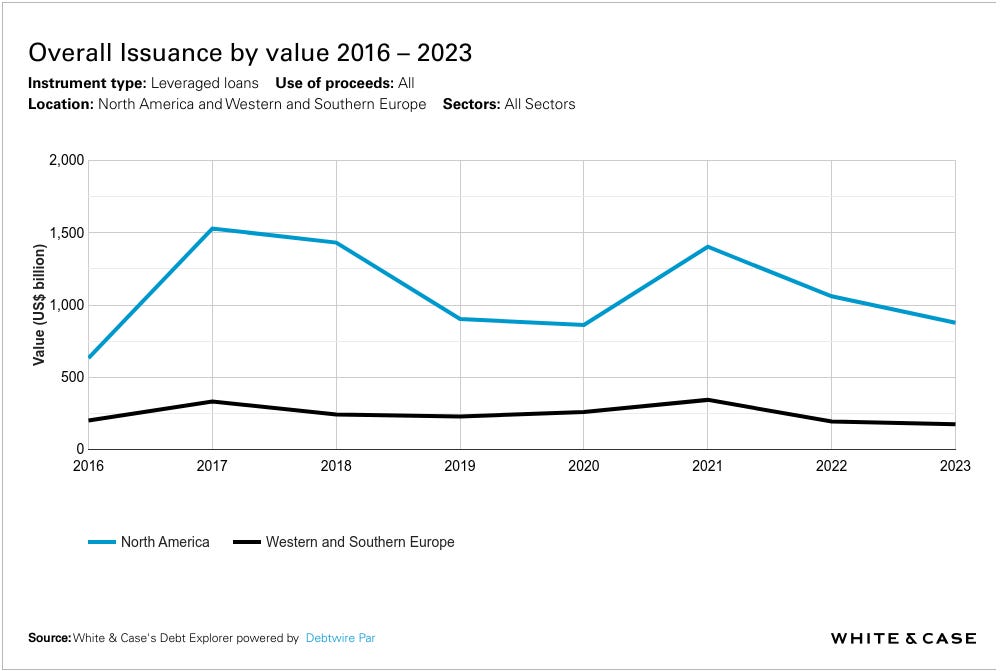

2023 was a year of subdued activity. New CLO issuances were down compared to previous years. 2023 saw CLO issuances in the U.S. reach USD 116 billion, a decrease from previous years. Europe also reported a downturn with EUR 26 billion issued, primarily due to reduced Mergers and Acquisitions (M&A) and buyout activities.

In 2024, the market anticipates a significant uptick in new CLO issuances. Indeed, asset managers are actively raising capital for new CLO funds to compensate for the limited issuances in 2023.

The anticipated increase in 2024 driven by high demands aims to balance the scales.

Spreads Should Continue To Tighten

New issuances in 2024 should also price tight. According to Trepp data, 36% of the CLOs in the market are in their amortization period, with another 10% projected to enter their amortization period by the end of 2024. In the amortization stage, CLOs are at the end of the lifecycle and repaying loans. This is expected to further weigh on supply, tighten spreads, and support new issuance.

Historical and Projected Market Adjustments

The market's growth trajectory since the 2008 financial crisis is notable, with the CLO market size tripling from USD 308 billion in 2008 to an impressive USD 1.3 trillion by the end of 2023. The Zero Interest-Rate Policy (ZIRP) implemented over the past decade significantly fuelled this surge, as investors sought higher-yielding opportunities in an ultra low interest rate environment. The floating interest rate feature of CLOs also appealed to investors looking for protection against future rate increases, creating a borrower's market.

Systemic Risks and Credit Concerns

Despite the growth and robust demand, the shadow of the 2008 crisis looms large, with many investors confusing CLOs with the notorious Collateralized Debt Obligations (CDOs) which were central to the U.S. subprime mortgage crisis. Although CDOs and CLOs may sound similar, they are distinctly different. Unlike CDOs, CLOs invest in pools of senior-secured corporate loans and are subjected to rigorous borrower and industry diversification standards, which enhances their stability and resilience against economic downturns.

Unlike CDOs, CLOs not only survived the 2008 global financial crisis, but they also performed exceptionally well. The senior tranches of CLOs showed remarkably low risk for investors as noted by S&P in the aftermath of the GFC.

For example, no AAA or AA rated CLO has lost principal so far, with only 0.1% of single-A tranches, 3% of BBB tranches and 6% of all BB rated tranches taking losses, according to Moody's. In comparison, 43% of CDO tranches originally rated AAA ended up taking losses, a number that would jump to nearly 63% for tranches originally rated BB - S&P Global Market Intelligence

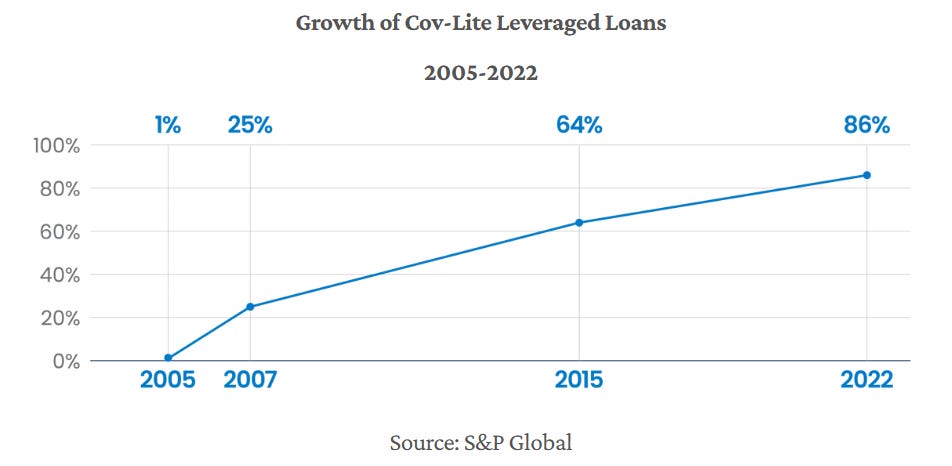

But, since the GFC, the institutional loan market has grown in size significantly, while the percentage of cov-lite loans has increased - most of the loans issued in 2021 and early 2022 have been "covenant-lite”. This is coming at a time when Fitch Ratings predicts higher default rates as highly leveraged issuers struggle to offset the increased interest expenditure through EBITDA growth in a high-interest-rate environment.

Should CLO Investors Be Concerned?

It is true that CLOs are by nature designed with protective features. Leveraged loans are typically senior secured loans with the most senior claim to assets in the event of a bankruptcy. CLO portfolios are typically highly diversified with between 150 to 250 loans which are actively managed. CLOs are also governed by investment guidelines that restrict investments into speculative assets.

"The CLO market has evolved significantly since the 2008 crisis, with better risk management practices."

Indeed, the CLO market has evolved significantly since the 2008 crisis, with better risk management practices. Post-GFC, CLOs benefit from more subordination and lower leverage. For example, AAA tranches range between 60–65%, compared to 75% pre-2008, while the riskiest equity tranches are larger than pre-2008. Lower CLO leverage reduces portfolio debt and increases debt overcollateralization. Post-GFC, CLOs also benefit from stricter rating and collateral tests.

Is This Enough To Manage The Risks?

Of course, a major economic downturn will pose significant risks to CLOs. Especially if the downturn broadly impacts multiple industries - given the diversified nature of CLOs. The cascading effects of increased defaults, credit downgrades, and cash flow disruptions would also directly challenge the stability and returns of CLO investments. Senior tranches might remain protected due to their prioritized claim on assets. Junior and equity tranches would bear the brunt of the downturn.

Two additional risk-related questions to investors arise.

The first involves the reliability of credit ratings from major agencies.

Since investors in CLO tranches depend on these ratings, their dependability is crucial for the CLO market's health. History has demonstrated that rating agencies can be notoriously late in responding to changing market conditions - so investors should bear this in mind.

The second involves a possibility of whether Collateralized Loan Obligations (CLOs) as securitization vehicles of leveraged loans could pose a systemic risk to the financial system.

The Loan Syndication and Trading Association (LSTA) argue that while institutional loans and lower-rated CLOs are subject to credit, price, and downgrade risks, they do not involve interest rate risks or pose a systemic threat. The report emphasizes that CLOs have been battle-tested in March 2020 during the COVID-driven redemptions where CLOs demonstrated an ability to endure a black swan event.

Looking forward, while the CLO market is positioned strongly, potential risks such as credit downgrades, rising defaults, and market saturation could pose challenges. Investors need to remain vigilant - due diligence is key - considering both the short-term economic indicators and long-term market trends.

The resilience of CLOs will be tested against the backdrop of an expected economic slowdown and sustained high-interest rates, which could impact highly leveraged issuers.

Have a great week ahead!

Maryann

Please Like and Subscribe if you enjoyed this post. It helps me get the word out about my newsletter, thank you!

***Disclaimer***

All opinions are mine and personal. Please do not construe any of my posts as investment advice. I do not provide any buying or selling recommendations, nor offer any investment advice. You are advised to conduct your own research and due diligence when making financial and investment decisions.