The Weekly Market Compass #6

Could this be the macro trade of 2024?

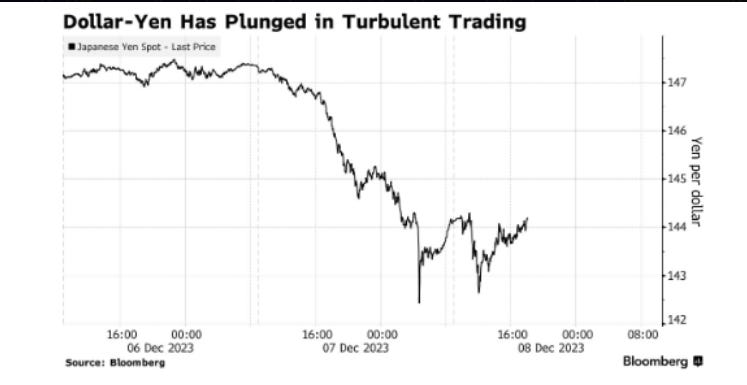

On a YTD basis, USDJPY is up over 10% in 2023. Yet, this week, this week saw the Japanese Yen take centre stage in the FX markets, experiencing its most significant rally against the dollar this year.

Reasons behind the Yen Surge

The yen's remarkable surge, the largest in almost a year, began in Asia following comments made by Bank of Japan Governor Kazuo Ueda and one of his deputies. Traders interpreted these remarks as indications of a potential earlier-than-expected normalization of negative rates.

A lackluster JGB bond auction only added more momentum. Traders quickly abandoned their bearish yen positions, propelling Japan’s currency to soar by nearly 4% at one point during Thursday’s New York session.

Analysis of Dollar Strength Against the Yen

Principal component analysis highlights the interest rate differential between USD and JPY as the key driver of dollar strength against the Yen in 2023. With the Fed at the end of the hiking cycle and normalization of negative rates by the BOJ, the interest rate differential should narrow supporting Yen strength.

Undervaluation of the Yen

Furthermore, the Yen scores very cheap on most valuation models out there. Looking through the lens of the REER (real effective exchange rate), the Yen is highly undervalued by over 30% of its fair value. BNP Paribas forecasts a USDJPY 12-month target price of 134 indicating an 8% move up for the Yen from today’s levels.

Potential as the Macro Trade for 2024?

Could the strengthening of the Yen emerge as the significant macro trade of 2024? Exploring this possibility raises considerations regarding the likelihood of the Yen's ascent and potential risks or downsides accompanying this scenario.

Factors Influencing the Interest Rate Differential

The scope for the interest rate differential to narrow hinges on several conditions. Historically, the BOJ has not increased rates concurrently with a Federal Reserve engaged in rate cuts. While it's feasible in this cycle, it necessitates specific conditions:

1) Extreme Fed rate cuts

2) Avoidance of a US recession

3) BOJ's comfort and capability to adjust policies upward

The Macro Outlook

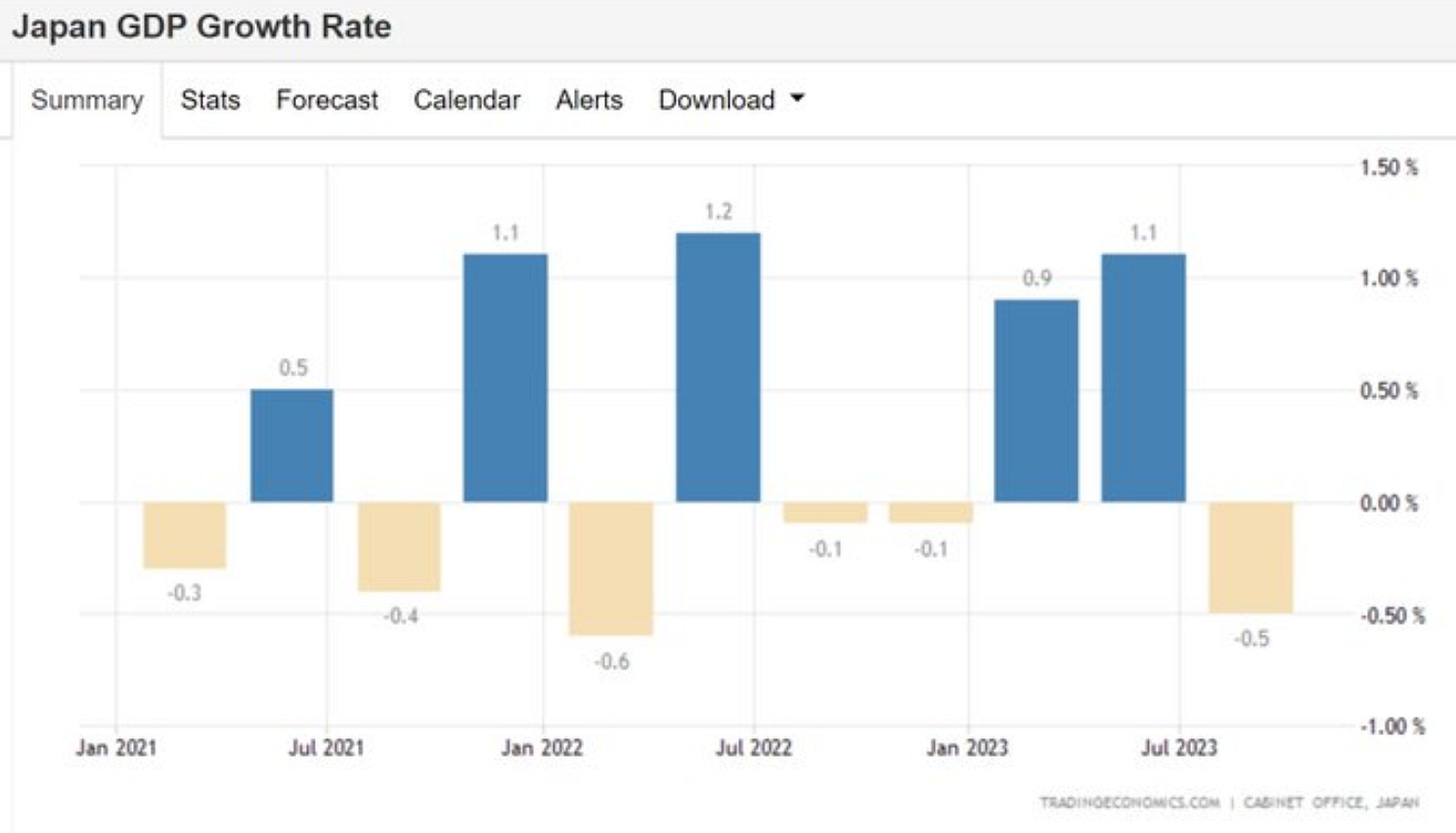

Moreover, the macro outlook doesn’t readily support rapid normalization. For instance, inflation trends showcase continuous moderation in core inflation, remaining below consensus expectations. Unlike the US, Japan's inflation isn't domestically driven. Nominal wage growth remains subdued, and overall growth is tepid. As a net importer, inflationary pressures primarily stem from imported price inflation. Additionally, Japan's recent negative GDP print doesn't align with the rapid normalization of rates.

The recent dynamics between the USD and JPY have sparked considerable interest in the Yen's potential trajectory among Yen bulls. However, one should be careful to extrapolate the recent surge in Yen to transcend over the entirety of 2024. Current economic conditions and historical precedents pose challenges in this regard.

Have a great week ahead!

Please Like and Subscribe if you enjoyed this post. It helps me get the word out about my newsletter, thank you!

***Disclaimer***

All opinions are mine and personal. Please do not construe any of my posts as investment advice. I do not provide any buying or selling recommendations, nor offer any investment advice. You are advised to conduct your own research and due diligence when making financial and investment decisions.