The Weekly Market Compass #5

The Psychology of Crowds: Insights from the Swiss mountains

On my first trip to Lenzerheide, I discovered a part of me that had been hidden to me for decades. I discovered my love for the mountains. Awe-inspiringly beautiful to behold, and pristine in every sense. And dangerous if treated with disrespect.

This weekend, as Zürich was covered in a blanket of thick snow, I reflected on the markets. It is that time of year where wealth managers and investment strategists deliver their outlook for the year ahead.

Soft Landing: A Goldilocks Scenario?

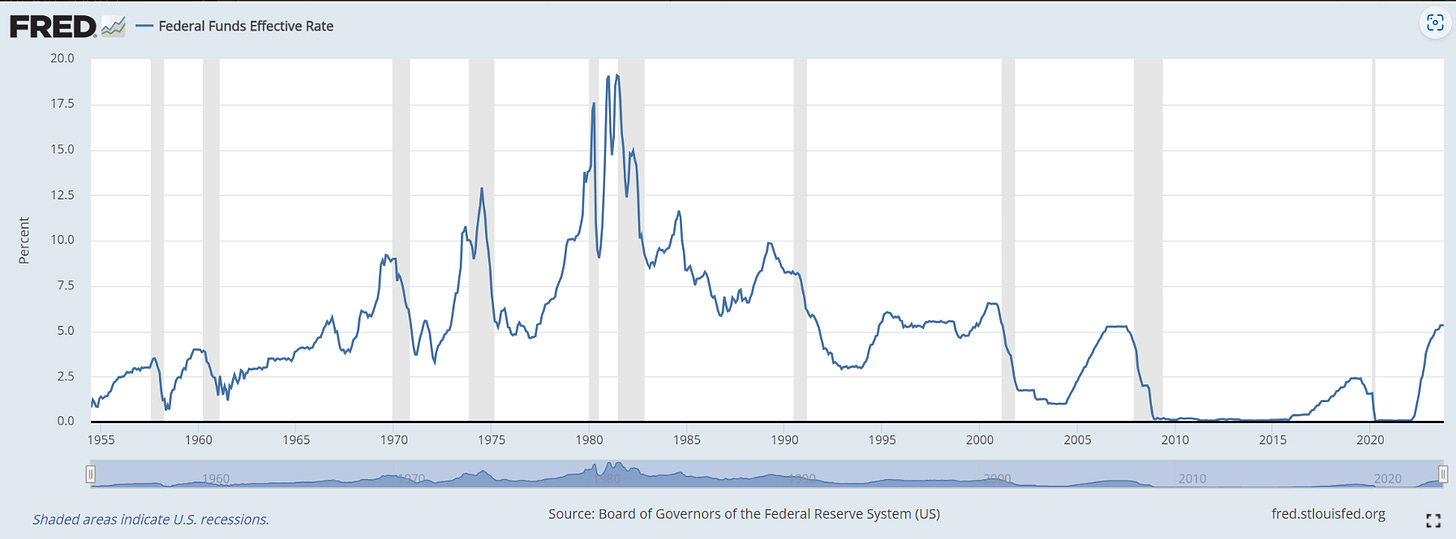

Markets are positioning for a soft landing. Recent news flow is positive and suggest that yields might have reached their peak, eliminating the concern of persistently high rates. Furthermore, it appears that inflation is on track to reach the Federal Reserve's targeted 2% mark by the second quarter. This anticipated decline in inflation could potentially pave the way for rate cuts whenever they are deemed necessary.

Additionally, the economy is slowing, as necessary, and the risk of recession still looks low, particularly with unemployment at 3.9%. Earnings for the S&P500 are expected to show double-digit growth. The perfect Goldilocks setting for a soft landing.

Looking at the outlook for 2024, it appears that most analysts also agree. After spending most of 2023 calling a recession, most analysts now expect a milder slowdown and '"soft landing.". UBS expects global growth to slow while avoiding a deep contraction. Goldman's Jan Hatzius Believes a Soft Landing Is in Store for 2024, and BofA has revised their outlook for the US economy in favour of a soft landing, where growth falls below trend in 2024, but remains positive throughout the forecast horizon.

The Human Psyche and Market Predictions

With the consensus leaning towards the soft landing narrative, I couldn’t help but reflect about the psychology of human behaviour, and the words of Warren Buffet with regards to detaching oneself from the crowd.

"An ability to detach yourself from the crowd — I don’t know to what extent that’s innate or to what extent that’s learned — but that’s a quality you need." - Warren Buffet

Navigating Unpredictability: Soft Landing Uncertainties

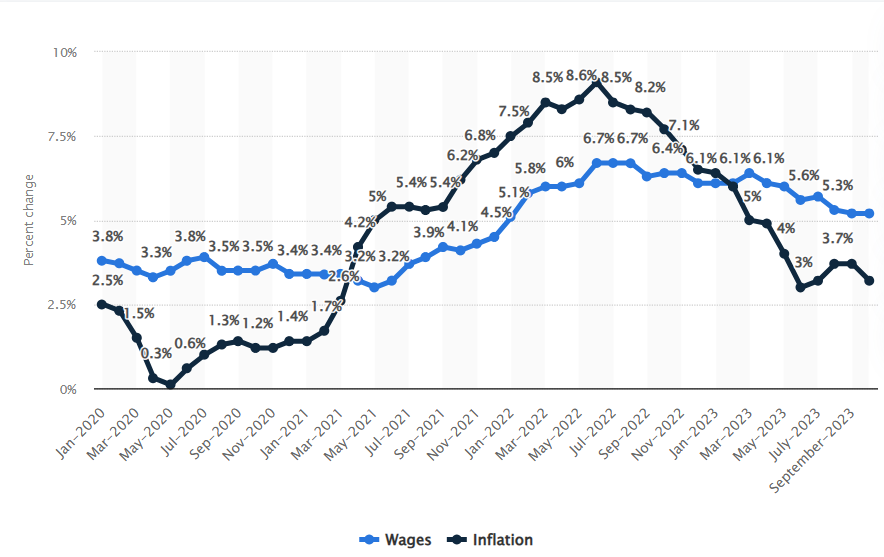

Can we really predict if we will have a soft landing in 2024? Looking at some of the facts and quite simply put, wage growth has been gradually moving toward lower, and looks set to reach levels that would be more consistent with 2 percent price inflation over time. This would reduce the probability of higher rates for longer.

Indeed, higher rates for longer is no longer priced in, and in my note last week I wrote about how investors have adjusted their expectations. UBS is also forecasting the Fed to cut rates by 275bps next year.

So, markets are presuming the Fed has got its policy just right and can moderate policy slowly, as needed. However, if history is anything to go by, rate cuts in response to economic weakness will likely come too late to be effective, leading to further cuts.

Navigating Towards A Soft Landing: Investor Strategies

We need to be humble and flexible enough to accept that predicting exactly how things will unfold in 2024 isn't a sure thing. But one thing's for sure about the coming year: there'll be periods of unpredictability and ups and downs as investors evaluate how well the Fed navigates the economy towards a soft landing.

For institutional investors, this means aiming for true diversification in the risk factors in their portfolios. They can achieve this by adjusting their investment style or strategy to balance risks more effectively.

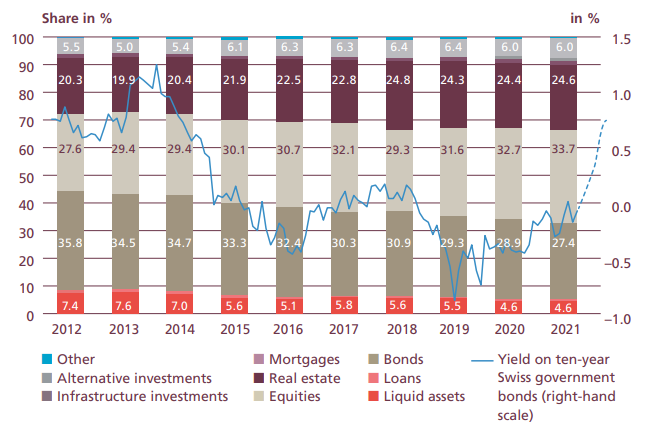

A Swisscanto study found that most Swiss pension funds allocate around 30% of their assets to real estate, 30% to equities, and 30% to bonds.

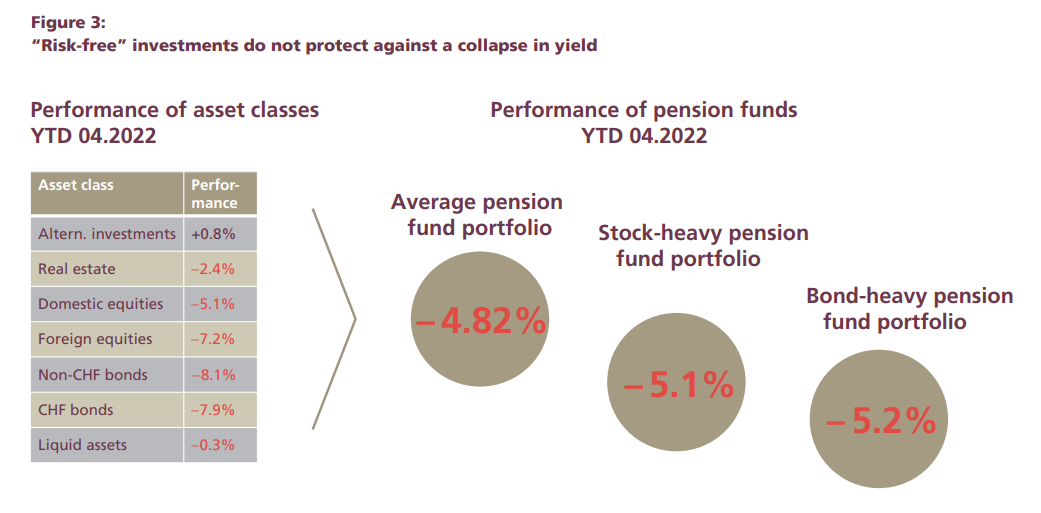

This setup means the pension funds rely heavily on interest-rate sensitive asset classes, which might not offer optimal diversification in risk factors. Consequently, this could raise the risk of drawdowns and financial losses during periods of market volatility.

To improve diversification, institutional investors could explore various strategies. For instance, they could consider incorporating different investment styles or alternative approaches. For example, an investor accustomed to a buy-and-hold strategy could diversify by adopting a more active trading approach. This might involve using a long/short equity trading strategy or incorporating long volatility exposures, both of which could help introduce de-correlated returns and reduce overall portfolio risk.

Lessons from Avalanche Safety in the Mountains

In the mountains, one crucial rule for avalanche safety is maintaining a specific distance between individuals and reducing crowding. This practice helps preserve the snow cover, decreasing the risk of danger. Similarly, understanding the psychology of crowds can protect against unintended risk exposure and its consequences for investors.

Have a great week ahead!

Please Like and Subscribe if you enjoyed this post. It helps me get the word out about my newsletter, thank you!

***Disclaimer***

All opinions are mine and personal. Please do not construe any of my posts as investment advice. I do not provide any buying or selling recommendations, nor offer any investment advice. You are advised to conduct your own research and due diligence when making financial and investment decisions.