The Weekly Market Compass #4

One of the most memorable parts of my recent trip to Luxembourg was the return flight to Zürich. Everything was pretty routine until the pilot started descending for landing. That's when things got a little intense. There was this massive windstorm over Zürich airport, and being in the plane as it battled the turbulence felt a little like being a leaf caught in a gusty wind.

We had a rough time. After at least one aborted attempt at landing, and circling the airspace for what seemed like an eternity, we finally made it down in one piece. The moment the plane's wheels touched the runway, there was a round of applause from everyone on board. It was a soft (and largely uneventful) landing, no doubt, but one replete with sudden jolts, moments of feeling weightless and lots of anxiety.

Economic Soft-Landing Predictions

Shifting gears, one would have had to be under a rock not to notice the price action in the S&P 500 in November so far. The equity markets reacted strongly to the weaker-than-expected Jobs data and the lower CPI print for October. This led to a drop in long-term rates, easing financial conditions.

Investors have adjusted their expectations, anticipating not just the end of the Fed’s rate hikes but potentially four rate cuts with around a 75% chance the first one is in next May.

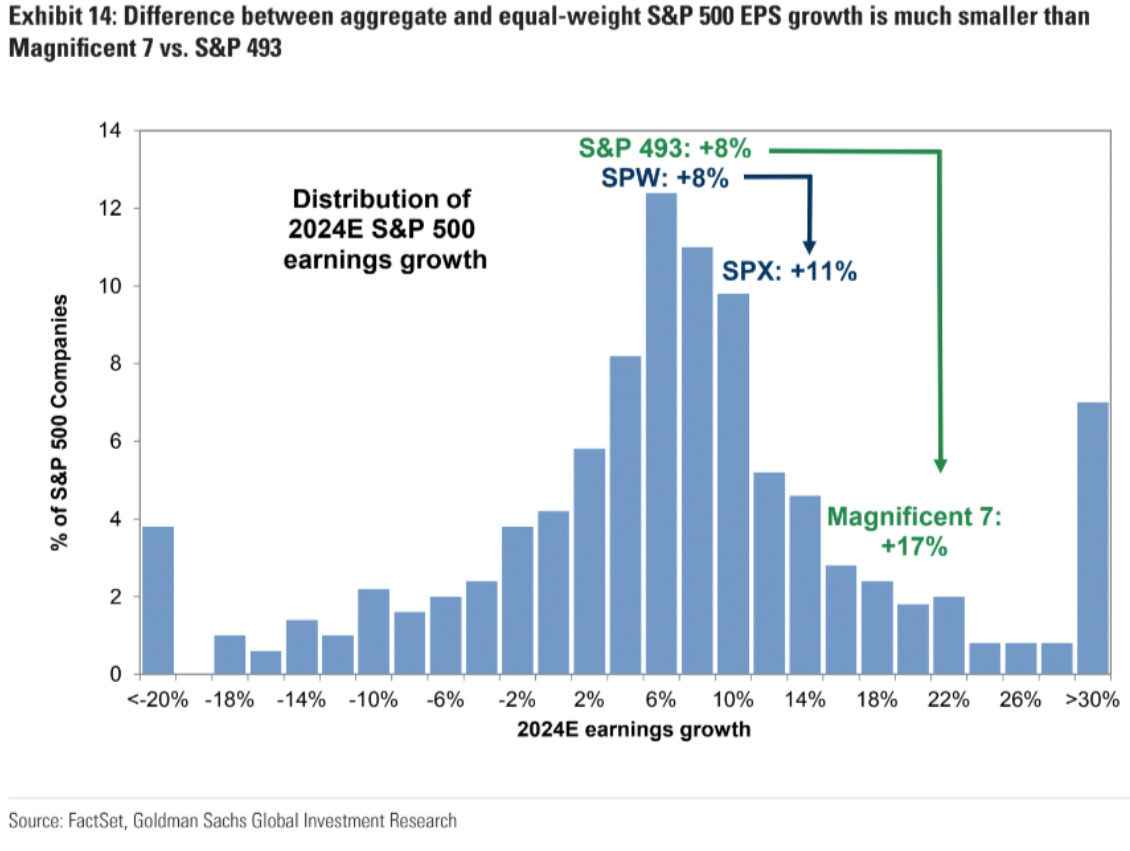

The prevalent belief among investors is that the economy will slow down, without tipping into a recession—a scenario often referred to as a "soft landing." And, equity analysts remain optimistic, projecting a solid 11% (double-digit) earnings growth for S&P 500, boosting sentiment as we head into 2024.

Potential Market Overestimation?

But has the market gone ahead of itself?

Despite this optimism, recent economic data suggests a potential slowdown. The US economy, which showed robust growth in Q3, is likely to confirm a dip in Q4. Manufacturing remains sluggish, consumer confidence is on a downtrend, and delinquencies in consumer debt are on the rise.

Similar concerns echo in China, where indicators like Industrial Production and Retail Sales have fallen below historical growth trends (although there is the expectation from many investors for an acceleration in China as we head into 2024 due to fiscal spending). Europe faces its own set of challenges, with CPI and GDP plateauing or dipping, hinting at a looming or even ongoing recession in the Eurozone.

All in all, not the most positive backdrop for corporate earnings.

Oil Market Insights on Economic Expectations

Meanwhile, what is the oil market trying to tell us about the near-term economic expectations?

Observing crude oil, the recent peak just above $95, supported by OPEC+ supply cuts and steady energy demand, has shifted. The geopolitical tensions in the Middle East initially propped oil prices at $80. However, once it became clear that an escalation from Iran wasn't happening, prices began to drop.

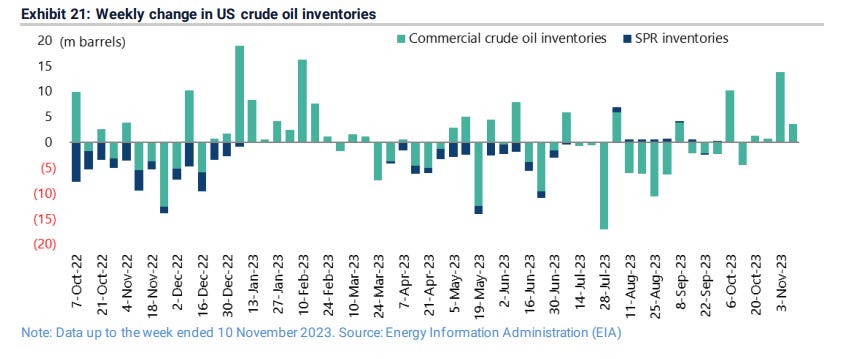

Meanwhile, inventories have started building up, signalling potential weakening demand. US crude oil inventories in the Strategic Petroleum Reserve have stopped declining since early July, while commercial crude oil inventories started rising this quarter by 25m barrels after declining by 55m barrels in the previous two quarters.

And, the WTI futures curve has also reshaped in the last few days with the 3 month spread moving into contango, suggesting that energy traders are concerned about an imminent recession.

Investment Strategies Amidst Uncertainty

While rising interest rates and aggressive monetary policy have been a headwind for the equity and bond market over recent months, investors believe all will be well when the Fed ends the tightening cycle.

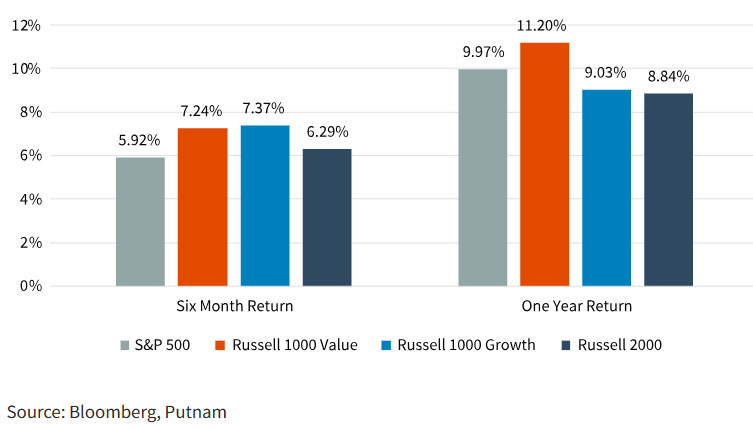

Based on a historical analysis conducted by Putnam Investments, returns across major U.S. equity indexes were positive, on average, in both the six months and 12 months after the last rate hike.

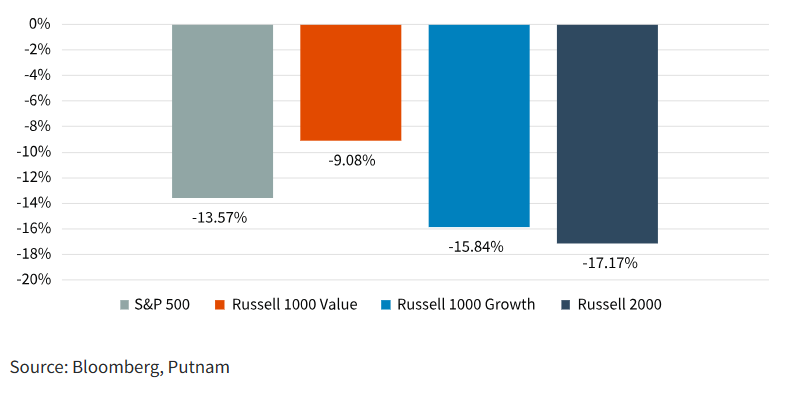

But it’s is not all smooth sailing as the analysis shows these periods were accompanied by market volatility

There are a number of scenarios where everything could go right and change the scenery from storm clouds to peace and tranquillity. Considering the uncertain economic landscape, constructing well-diversified portfolios appears to be the prudent thing to do. Focus on portfolio construction, diversify with alternative investments and stay balanced. Because, even if we get a soft landing, there may be sudden jolts, weightless moments, and some anxiety before we get there.

Have a great week ahead…

***Disclaimer***

All opinions are mine and personal. Please do not construe any of my posts as investment advice. I do not provide any buying or selling recommendations, nor offer any investment advice. You are advised to conduct your own research and due diligence when making financial and investment decisions.