The Weekly Market Compass #3

Navigating the financial landscape - a week in review

Hawkish Pause Extended

Last week's FOMC meeting, spearheaded by Jerome Powell, brought us an extension of the "hawkish pause." This marks four months without any rate changes after a hefty 500bps of hikes over 17 months. However, Powell made it clear that the door remains open for potential future rate hikes if the need arises.

Mixed Signals: Weak Payrolls and Moody’s Downgrade

October's weak payrolls and the Moody’s downgrade of the US credit rating outlook added some clouds to the economic horizon. The downgrade suggests that even Wall Street is a bit sceptical about the US debt situation.

Market Appetite Test: US Treasuries Auction

And so the auction of £24 billion in 30-year U.S. treasuries this week served as a litmus test for market appetite. Yields surged by 20bps during the auction, hitting 4.83% - the most significant one-day jump since March 2020. The bid-to-cover ratio hit a low not seen since Dec 2021 at 2.24, signalling a reduced appetite among market participants.

Debt Dilemma: A Looming Refinancing Challenge

Looking ahead, nearly half of all Treasuries will mature by the end of 2025. With the current average interest rate on federal debt at 2.6% and the prevailing rate over 5%, the US government might face the daunting task of refinancing at double the current rate. This could catapult interest expenses from 14% to 29% of federal tax revenue or a whopping 22% of total outlays.

Two Roads Ahead: Tough Choices for the US Government

From my living room couch, I see two plausible scenarios: the US government must either cut spending and raise taxes simultaneously or explore a combination that involves cutting rates.

Market Sentiment: A Rollercoaster Ride

Investors' Take: Rally Amidst Uncertainty

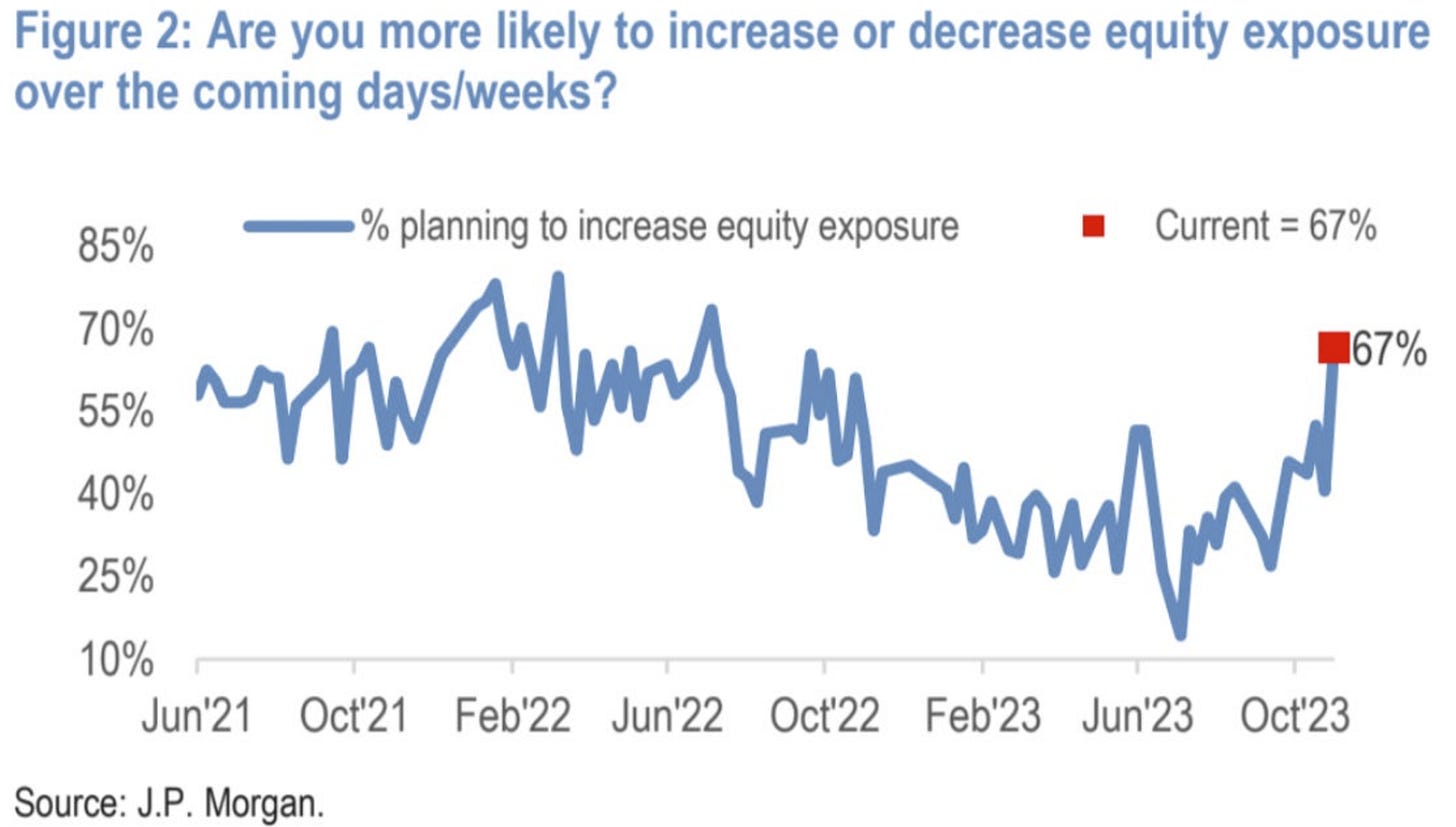

Observing stock prices last week, it's evident investors have made a call: they believe the Fed is done with rate hikes, despite Powell's open door policy for future adjustments. If this sentiment sticks, it could trigger a sustained shift in sentiment as investors flock back into stocks.

Reality Check: Navigating a New Market Regime

In my view, the market psychology is haphazard and tinted by recency bias as investors assume that we will revert to the lower interest rate environment that preceded today’s economic environment. While the market seems convinced of a return to pre-pandemic interest rates, it's essential for investors to recognize that we are in a new market regime. One that is marked by heightened uncertainty, inflation, interest rates, and, consequently, higher volatility.

Impacts on My Model Portfolio: A Strategic Approach

Downside Risks and Economic Slowdown

Given the scenario, I believe the risk is skewed to the downside. Risk assets are susceptible to an economic slowdown, also especially as the market adjusts expectations for interest rate cuts, exposing them to increased volatility.

Strategic Cash & Cash-like Positioning

While cash and cash-equivalents remain appealing, I stick to the strategic weight defined by our portfolio asset allocation. This ensures a balanced portfolio, avoiding the negative impact on long-term returns.

Embracing Bonds for Stability

I am leaning into bonds, capitalizing on the highest yields in a decade, to generate income and act as a hedge against potential equity downturns.

Diversification with Alternative Strategies

I am also complementing our core exposure in fixed income and equities with liquid alternatives hedge fund strategies to (a) improve risk-adjusted return by capturing alternative risk premia and (b) build a more durable and diversified portfolio.

***Disclaimer***

All opinions are mine and personal. Please do not construe any of my posts as investment advice. I do not provide any buying or selling recommendations, nor offer any investment advice. You are advised to conduct your own research and due diligence when making financial and investment decisions.