The Weekly Market Compass #2

It’s been a rough week for markets. Wall Street had plenty to pay attention to this week as the Israel-Hamas war continued to play out with fears of a regional escalation increasing by the day.

Meanwhile back in the US, congress staggered along with no clear leadership and no signs of being able to elect a speaker anytime soon. The focus was also on earnings season with the major banks Goldman Sachs, Morgan Stanley and Bank of America (BAC) reporting and sending mixed signals. BAC surprised positively while Goldman Sachs and Morgan Stanley presented results that reflected an overall challenging market environment.

The big news however was the economy as US retail sales came in much higher than anticipated at 0.7% MoM for September 2023 versus the 0.3% forecast. In other words, the US economy is still running strong despite higher borrowing costs and higher prices.

While it's important to remember that a single data point does not make a trend, this has undeniably triggered a wave of contemplation among market participants and financial commentators, and raised questions about the efficacy of the Federal Reserve's rate hikes in influencing the broader, tangible economy.

For the week, the S&P 500 slid 3%, the Nasdaq lost 3.8%, and the Dow declined by 2.3% to book their worst week in a month, while the 10-year yield crossed 5% for the first time in sixteen years.

Over in Europe, the situation was not much better. European shares also experienced a significant weekly drop, and the STOXX 600 hit a seven-month low ending the week down 3.4%. At the same time, disinflationary forces intensified in Germany with the Producer Price Index (PPI) falling 14.7% YoY - the largest drop since 1949!

Meanwhile, over in China, economic activity showed signs of stabilization in the recent data, although the ongoing debt crisis in the country’s real estate sector continues to affect consumer sentiment. The Hang Seng index declined 3.6% - its biggest weekly loss in two months. Elsewhere, the volatility index (VIX), Gold, Crude Oil and Bitcoin ended the week in the green.

Recession Calls

Over the past year, the spectre of a recession has loomed over the U.S. economy, casting a shadow of uncertainty. While the much-feared economic downturn has not materialized, in recent weeks, we are seeing a growing chorus of voices foretelling an impending recession on the horizon.

What If There Is A Recession?

In case the United States finds itself in a recession in the coming months of 2023 or early 2024, there's no need for investors to hit the panic button. Why, you ask? Well, let's break it down into some key points:

Recession Frequency: Recessions are part of the economic cycle and believe it or not, happen quite regularly. Since World War II, the U.S. has experienced roughly one recession every five years or so.

Recession Durations: On average, a U.S. recession since World War II has lasted just 11.1 months. Even the Covid-19 recession in early 2020, which was a major shock, only endured for a mere two months. So, when we look at history, it tells us that recessions are generally short-lived.

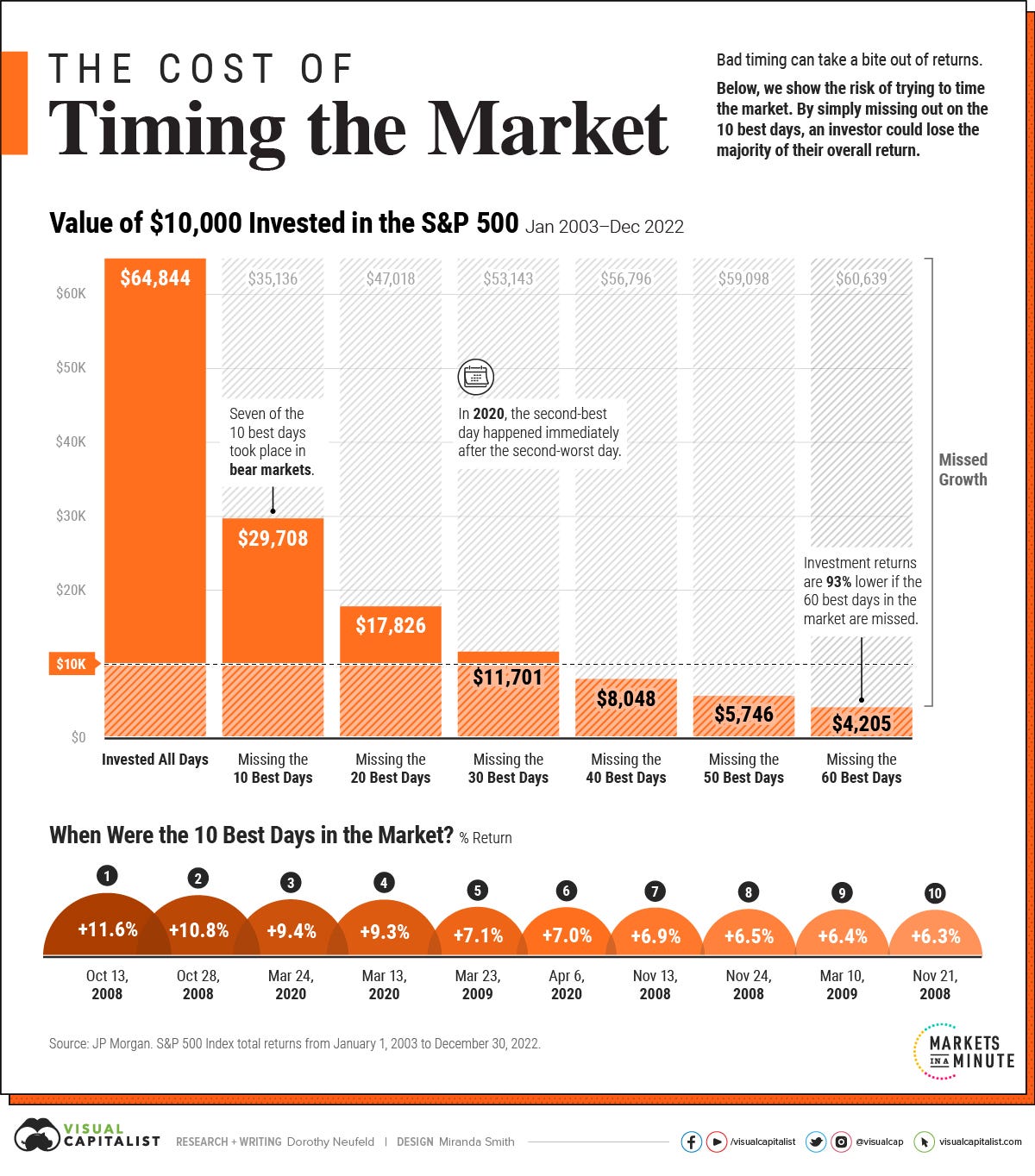

Investment Opportunity: It's not all doom and gloom during a recession. For long-term investors, these periods have historically presented excellent buying opportunities. Timing the market perfectly is tough as this chart from Visual Capitalist illustrates, so the best course of action is to remain invested.

Implications for My Model Portfolio

This is a summary of how I am thinking about the current situation:

The inflation problem is complicated by the uncertainty around the rate of transmission of the hikes to the consumer and the real economy i.e. how much of the rate hikes is actually being felt by the end consumer? This uncertainty will most likely result in volatility at the long end of the curve as the Fed seeks to gain control and bring inflation down in line with their mandate.

Hence, in Fixed Income, I continue to favour the short end of the curve - so, no changes to my portfolio.

The risk premium for holding equities has come down to zero and for the first time, has turned negative. In other words, investors get compensated higher for holding risk-free assets like treasuries or cash, than for holding risky assets!

Hence within equities, I continue to hold US equities for growth and Swiss equities for their defensive characteristic. Given the relative unattractiveness of equities (from a risk premium perspective), I took profits from some equity exposures I held and will be reallocating to hedge fund CTAs as part of my asset allocation rebalancing.

I sign off today with a poignant reminder that when it comes to investing, it is about time in the market as opposed to timing the market. As Nick Murray says “timing the market is a fools game, whereas time in the market is your greatest natural advantage.”

Let’s see what next week brings us…

***Disclaimer***

All opinions are mine and personal. Please do not construe any of my posts as investment advice. I do not provide any buying or selling recommendations, nor offer any investment advice. You are advised to conduct your own research and due diligence when making financial and investment decisions.