The Weekly Market Compass #1

Back in the year 2000, I embarked on a journey to Israel that would lead me into uncharted territory. My tour guides, well-meaning as they were, strongly urged me to steer clear of the West Bank, cautioning about the intense conflicts unfolding there. However, my adventurous spirit prevailed, and I was resolute in my decision to experience the so-called "conflict zone" first-hand.

My quest brought me to Jericho, a place vibrating with tension. The air was thick with the palpable presence of the military. Yet, amidst this backdrop of uncertainty, the heart of Jericho beat with the resilience of its everyday residents. It was as if they were weaving threads of normalcy into the chaos that enveloped them. Hundreds, perhaps thousands of ordinary people, navigating their lives against the turbulent backdrop, each one striving to etch out a semblance of normality amid the turmoil. The scene was both poignant and powerful, a testament to the human spirit's ability to endure and adapt in the face of adversity. As the Israel-Hamas war unfolds in Gaza, I am drawn back to the impressions I had in Jericho many years ago, and my heart goes out to all affected by this conflict.

And just like the residents of Jericho, todays note is yet another attempt to find the order within the chaos that is the financial markets. Last week, we saw yet again markets that showed resilience. U.S. stocks on Friday ended mixed, as solid Q3 earnings from major banks were countered by weak consumer sentiment data and a surge in crude oil.

A Recap of the major benchmarks weekly move as of Friday Oct 13th

The S&P 500 Index closed down 21.83 points (0.5%) at 4,327.78, up 0.45% for the week

The Dow Jones Industrial Average (DJI) was up 39.15 points (0.1%) at 33,670.29, up 0.8% for the week

The Nasdaq Composite (COMP) was down 166.98 points (1.2%) at 13,407.23, down 0.18% for the week.

The 10-year Treasury note yield (TNX) was down about 9 basis points at 4.623%.

Cboe's Volatility Index (VIX) was up 2.63 at 19.32.

Looking beyond the weekly price action, so far in October, markets are continuing to recover from September's sell-off.

Higher for longer or Just high for longer?

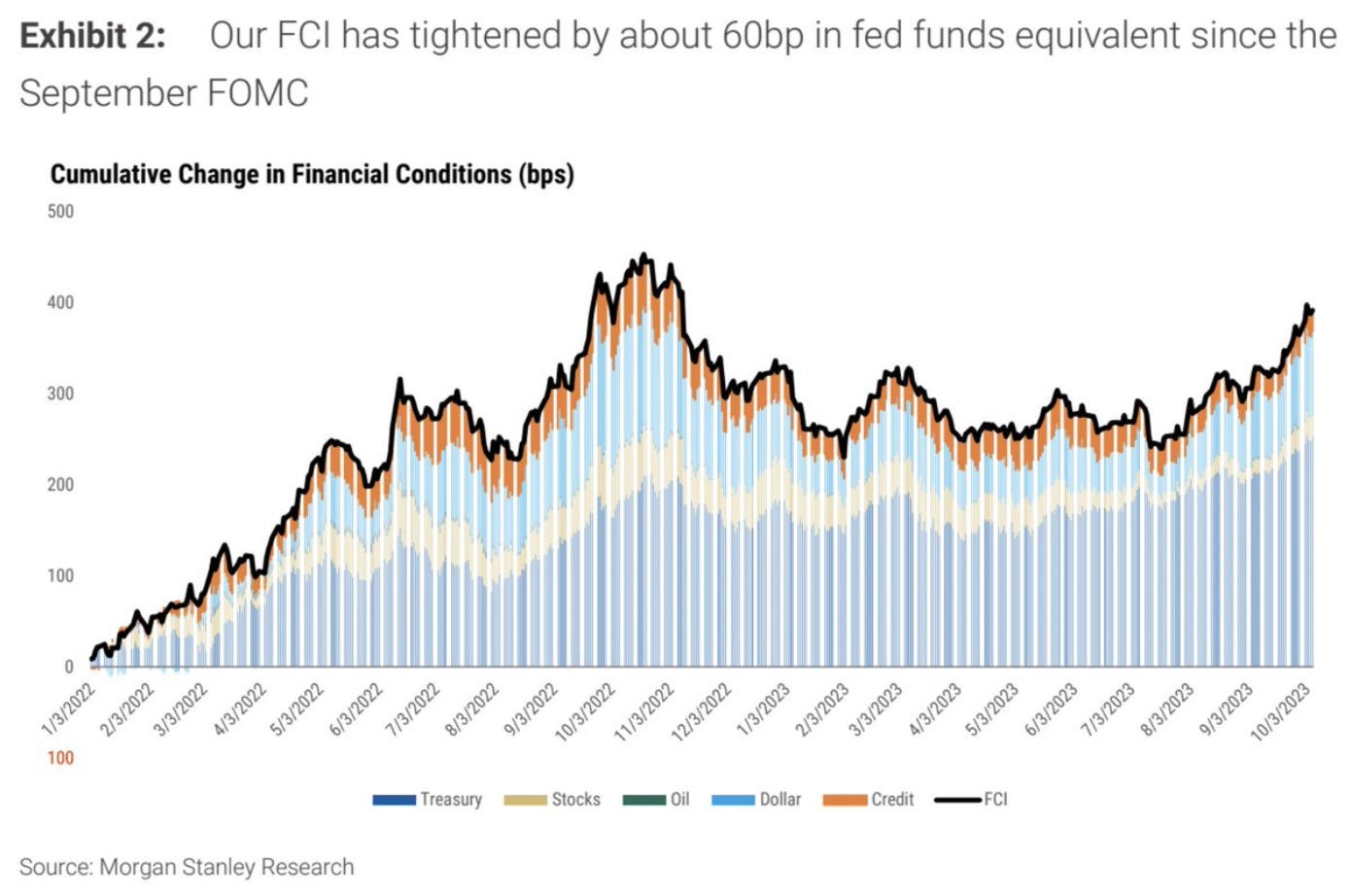

This week brought a mixed bag of news on the economy. FOMC minutes reveal a cautious Fed, who expect restrictive interest rates until confident in inflation decline. However, since the September meeting, treasuries sell-offs triggered a market-driven rate hike, prompting some Fed officials to argue against further rate increases.

A Crooked Path to 2%?

Elsewhere during the week, the September readings for the Consumer Price Index (CPI) and the Producer Price Index (PPI) showed that consumers are still facing inflationary pressures for shelter, gasoline and food. And although the broader inflationary trends continue to ease on a year on year basis, inflation is still running hot and above the Fed’s target of 2%.

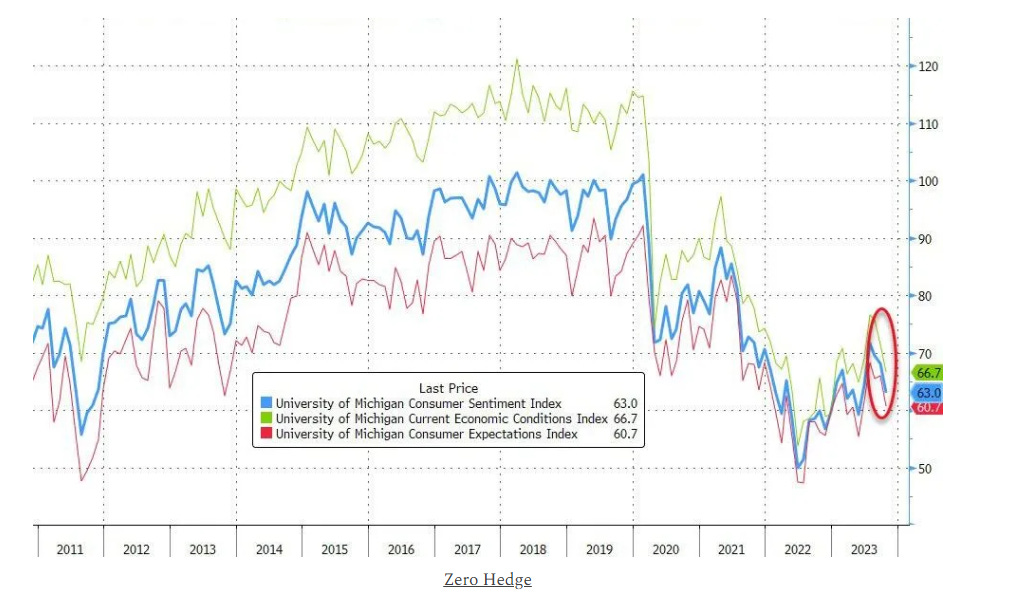

This is also consistent with the results of the consumer sentiment survey which came in on Friday 13th with a record 49% of Americans surveyed saying that high prices are eroding living standards. The University of Michigan consumer sentiment for the US fell to 63 in October 2023 from 68.1 in September, the lowest in five months, and missing market estimates of 67.2, preliminary estimates showed.

Despite the data, investors are not convinced about another rate hike, even though inflation remains above the Fed's 2% long-term target. Investors are pricing in a 94% chance the Fed will keep rates unchanged at its meeting at the end of this month, and a 70% chance they'll hold tight in December as well, according to the CME FedWatch Tool. Elsewhere, Goldman Sach’s investor survey also mirrors the sentiment that the end of the bond market selloff is near.

Indeed, research analysts at Goldman Sachs and Cresset Capital expect interest rates may be turning lower soon. Praveen Korapaty of Goldman Sachs said in a podcast that he sees the fair value of the 10Y Treasuries at 4.25% and expects markets to “feel their way” to the level of yields that is sustainable as we transition from the old zero-interest rate regime to the new normal.

My Take

My expectations are that the Fed proceeds with caution leading to bond yield stabilization. Elevated borrowing costs are already being felt in the US economy; the housing market has slowed, credit card delinquency is on the rise and it has cranked up the risk for low-credit-quality corporate bonds. Even if the Fed moves from a higher for longer regime to a high for longer, it will still be a defacto tightening as they continue to reduce the balance sheet.

My Portfolio Implications

In Fixed Income, I am still favouring at the short end (1Y - 2Y) of the curve. The time will come to start adding duration to lock in some of these yields we are seeing at the long end, but for now I favour the short end. My equities portfolio remains unchanged and I still remain overweight US equities. I took profits earlier in September on oil positions.

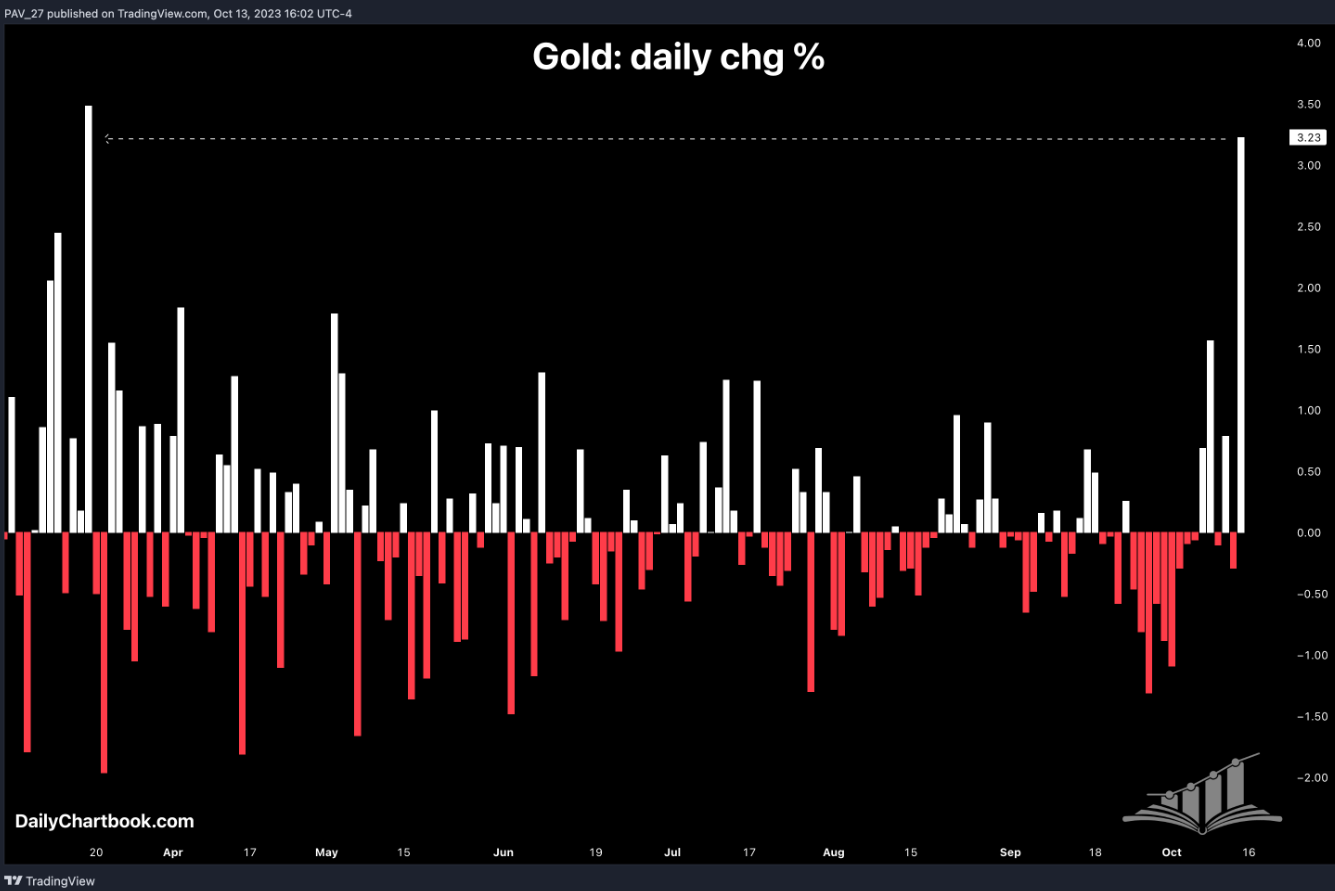

I am also looking to diversify the sources of return in the portfolio and improve the risk/return profile by allocating into hedge fund CTAs, Gold and Oil. Stay tuned for this update!

What I am Watching as the sun rises over Zürich

Gold saw its largest daily gain since March and the second largest since March 2020. Is this move all driven by the flight to safety triggered by the Israel-Hamas war or is the inflation hedge story beginning to take hold of Gold?

Daily Chartbook

Oil volatility has picked up sharply since going into the latest Middle East crisis. Is it time to monetize that volatility via covered calls or not?

TheMarketEar

Week Ahead

Here are a few events of note taking place next week:

Earnings: 3rd quarter earnings season is in full swing and a number of notable companies (BAC, GS, MS, Tesla etc) will be reporting on 3rd quarter earnings.

Fed Speak: Jerome Powell will be speaking on Thursday ahead of a blackout period for Fed members. Analysts will be watching for hawkish comments to guide speculation on rate expectations

On the economic front, it promises to be a busy week with a slew of economic data from US (retail sales, building permits and existing home sales), China (Q3 GDP growth), Eurozone and Japan.

As I sign off today, I am cognizant that the 24-hour deadline to the residents of Gaza has passed, as Israel prepares for a ground assault. I ask that you join hands with me virtually to pray for a quick end to the crises and the loss of innocent Israeli and Palestinian lives in the Middle East.

Notes to Selfe Disclaimer

Please do not construe any of my posts as investment advice. I do not provide any buying or selling recommendations, nor offer any investment advice. You are advised to conduct your own research and due diligence when making financial and investment decisions.