The State of Femtech Investing 2024

Market Analysis and Trends

Welcome to the latest issue of the Femmehealth Ventures Publication—your trusted source for insightful analysis of femtech innovations through an investor's lens, helping you identify the latest opportunities in women's health technology.

If this email was forwarded to you, you have awesome friends—click below to join. Don’t forget, you can always explore our archives to catch up on any past stories.

In this edition, we cover:

A snapshot of 2024 funding trends

Emerging subsectors driving innovation

Challenges and opportunities on the horizon for femtech

Insights for investors and startups in 2025

2024 marked a pivotal year for femtech investment, with funding trends and emerging subsectors signalling both maturation and evolution in this rapidly growing healthcare vertical. As we approach 2025, key developments from the past year offer valuable insights for investors and startups alike.

2024: A Year of Growth and Lessons

Funding Milestones

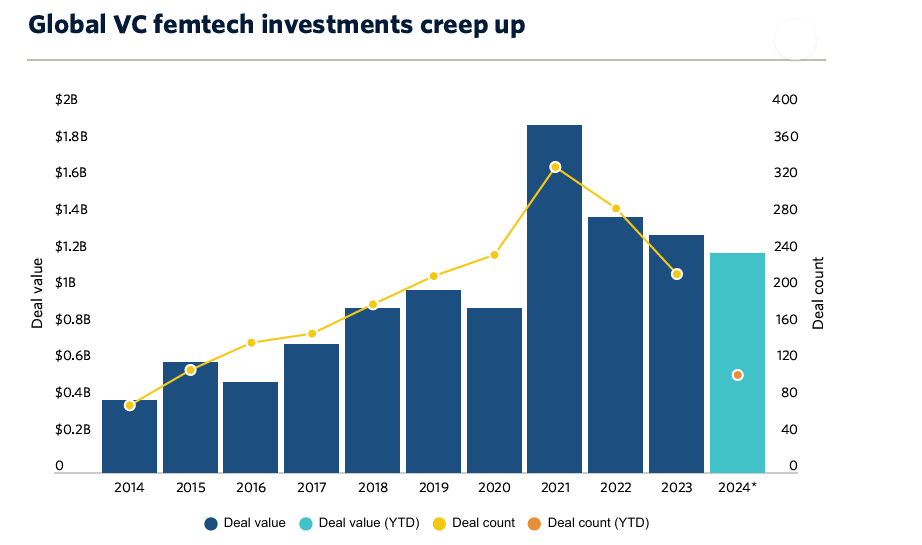

Global Growth: Femtech startups globally raised $1.2 billion in 2024, nearly surpassing the $1.9 billion record set in 2021. (1)

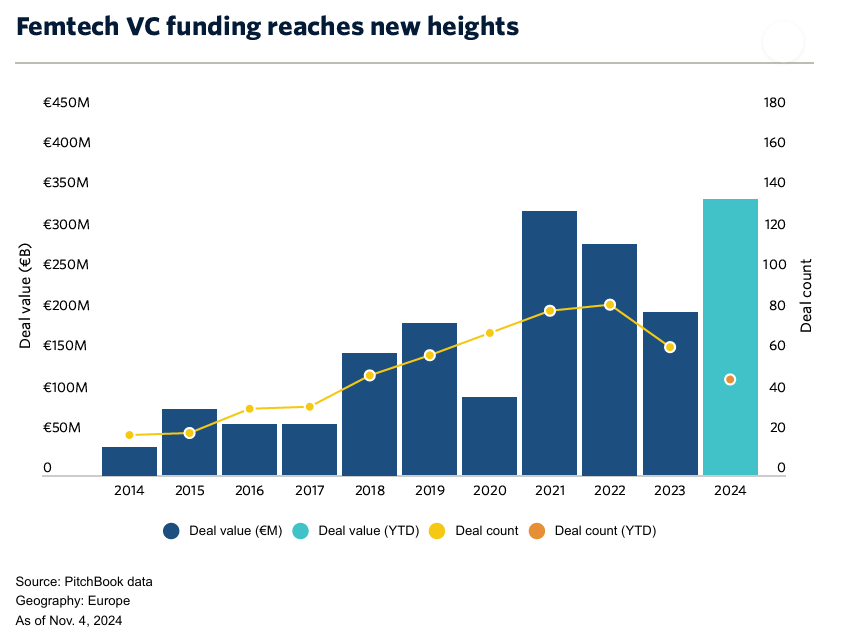

European Surge: European startups reached a new peak with €339.4 million across 47 deals, led by Flo Health’s $200 million Series C round.

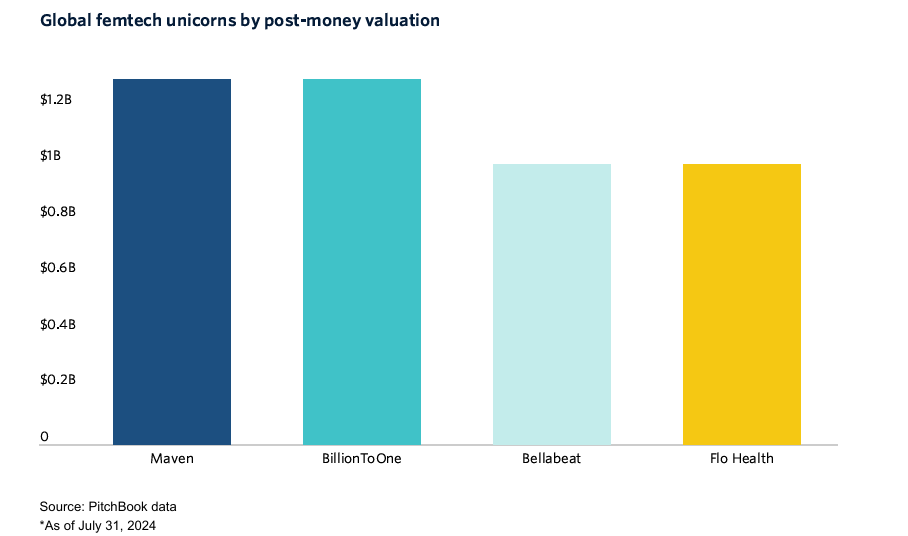

Unicorn Milestone: Four femtech unicorns emerged, including Flo Health, Maven Clinic, and BillionToOne, reflecting growing investor confidence.

Emerging Subsectors Driving Innovation

Digital Health

In 2024, femtech demonstrated its potential to fundamentally reshape women’s health, driven by trends that highlight both its innovation and growing maturity. Digital health stood out as a critical pillar, providing accessible and scalable solutions.

Artificial Intelligence Integration

Artificial intelligence emerged as another transformative force, advancing diagnostics and treatment personalization. Companies leveraging AI for personalised healthcare insights saw increased investor interest. Platforms combining user-inputted data with machine learning to provide customised health recommendations proved particularly attractive to both users and investors.

Wearable Technology

The role of wearable technology grew significantly, with Oura partnering with fertility apps and Roche introducing an AI-powered wearable for women with diabetes. These tools are not just innovations. They are empowering women to take control of their health in real time.

Mental Health Focus

The intersection of women's health and mental wellness emerged as a key growth area, with startups like Spring Health and Lyra Health expanding gender-specific mental health services to address postpartum depression, hormone-related mood changes, and general mental health support.

Value-based Care Approaches

Companies developing comprehensive care delivery platforms, particularly those focusing on maternal health outcomes and menopause management, gained traction as healthcare systems increasingly embrace value-based care approaches.

Challenges and Opportunities on the Horizon

Despite the sector's growth, several challenges persist that will shape development in 2025:

Data Privacy Concerns:

As femtech apps collect increasingly sensitive health information, ensuring robust data protection while maintaining user trust remains crucial. Regulatory compliance and transparent data practices will be critical success factors.

Market Saturation:

The proliferation of period and fertility tracking apps has led to market saturation in certain subsectors. Differentiation through unique features, clinical validation, or novel use cases will become increasingly important.

Clinical Validation:

Investors and healthcare providers are demanding stronger evidence of clinical efficacy, particularly for AI-driven solutions and digital therapeutics. Startups that can demonstrate clear health outcomes will have an advantage in attracting both funding and partnerships.

Insights for 2025:

How Can Investors and Startups Seize Opportunities in Femtech’s Fast-Growing Market?

As we look toward 2025, the trends shaping femtech in 2024 are expected to accelerate. Digital health is expected to grow at an annual rate exceeding 16%, with AI continuing to revolutionise personalised care. The wearables market should continue to grow, creating new opportunities to integrate real-time health monitoring with actionable insights.

These developments reflect a growing recognition of femtech’s critical role in addressing long-overlooked gaps in women’s healthcare.

While challenges like scaling, securing funding, and navigating regulatory complexities persist, the sector’s momentum is undeniable. The question is no longer whether femtech will transform healthcare but how quickly and expansively it will do so.

For investors and startups eager to capture this momentum, several strategic focus areas will be key:

Enterprise Focus

Startups with strong B2B strategies are thriving, particularly those forging partnerships with healthcare providers, employers, and insurers. These collaborations have driven adoption and integration into mainstream healthcare, and this trend will likely grow in 2025 as demand for enterprise-ready solutions increases.

Holistic Solutions

Investors are gravitating toward platforms that address women’s health comprehensively, spanning life stages and diverse health needs. Solutions targeting underserved areas like menopause, mental health, and chronic conditions are gaining traction, signaling a shift toward integrated care models that can capture greater market share.

Geographic Expansion

While the US and Europe dominate femtech investment, emerging markets present untapped opportunities. Companies capable of adapting their solutions to fit different healthcare systems and cultural contexts while maintaining scalability will be well-positioned for growth.

Clinical Partnerships

Partnering with healthcare providers and research institutions has become critical for demonstrating clinical value and integrating solutions into care delivery. These partnerships not only validate effectiveness but also build trust among providers and patients. In 2025, such collaborations will likely play an even more significant role as the sector matures.

Looking Ahead

As femtech evolves beyond its early focus on reproductive health, the combination of technological advancements, increasing awareness, and growing investor interest creates fertile ground for innovation. Companies that can demonstrate clinical impact, ensure data privacy, and scale sustainably will attract funding and drive growth.

For investors, the opportunity lies not only in discovering early-stage innovators but also in scaling proven solutions through later-stage funding. The sector’s rapid maturation suggests that femtech will remain a high-potential investment category in 2025 and beyond.

What do you think?

As we look ahead to 2025, I’d love to hear your thoughts: What trends are catching your attention? What areas of innovation should we be watching closely? Share your ideas in the comments and I’ll read and respond.

Warmly,

Maryann

Ways to Connect with Femmehealth Ventures

Sign-up for Femmehealth Ventures newsletter, which is published weekly on Sundays

About This Report

This analysis draws on data from PitchBook, Rock Health, and proprietary research.

Footnotes

(1) Year-to-date activity defined as activity between January 1, 2024 and July 31, 2024

Disclaimer

The content in this newsletter is for informational purposes only and does not constitute financial, investment, legal, or medical advice. Opinions expressed are those of the author and may not reflect the views of affiliated organisations. Readers should seek professional advice tailored to their individual circumstances before making decisions. Investing involves risk, including potential loss of principal. Past performance does not guarantee future results.

I had similar takeaways from the trends in FemTech in 2024! I’m curious - were there any major trends in exits (IPOs or acquisitions) in FemTech that teach us something in 2024?