The Investment Potential in Female Longevity

Some weeks ago, I found myself thinking about my grandmother back in Africa, who had outlived my grandfather.

Watching her navigate the challenges of aging was an eye opener. She had lost the vitality she once had, and it became clear that living longer doesn’t necessarily mean living better.

For many women, the later years of their lives are marked by long-term conditions that could have been avoided or handled better with early care and innovative ideas. This fact makes it clear that we need to pay more attention to female longevity. This idea aims to close the healthspan-lifespan gap so that women not only live longer but also have a better quality of life as they get older.

Female longevity isn’t just about living longer—it’s about living better

The market for women who live longer is huge and growing quickly. As of 2023, the world economy of living longer is worth more than $8.3 trillion, and women spend most of this money. More than $31.8 trillion of the world's spending is controlled by women, and their influence in the healthcare market is only set to rise higher.

Key Areas of Investment in Female Longevity

Female longevity investments cover a range of industries, including digital health, nutrition, exercise, biotechnology, and medicine. These sectors are creating innovative products and services meant to prevent and control disorders disproportionately affecting ageing women including menopause, osteoporosis, and cardiovascular disease. Here are some key areas that could provide interesting opportunities for investors:

1. Reproductive Longevity

The goal of reproductive longevity is to prolong and enhance reproductive health, especially in the years preceding and after menopause. Menopause management strategies, fertility preservation methods, and hormone replacement therapy are some of the innovations in this field. Innovations in this field have the potential to improve overall health outcomes for women by reducing the risk of diseases which are crucial to female lifespan.

2. Bone and Skeletal Health

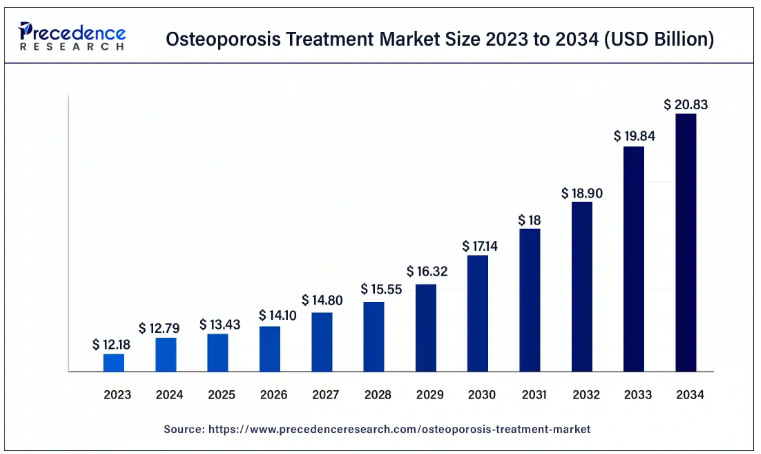

For older women to remain mobile and independent, bone health is essential. The industry has seen innovations in the form of osteoporosis medications, bone density supplements, and wearable technology that guards against fractures and falls. Given that women account for 80% of persons with osteoporosis, the global market for osteoporosis treatment is predicted to reach $21 billion by 2034 expanding at a CAGR of 5% from 2024 to 2034, offering substantial potential opportunities for investors.

3. Cardiovascular Health

The main cause of death for women, especially after menopause, is cardiovascular disease. Personalised medicine, early detection, and innovative therapies catering to the particular cardiovascular requirements of women are the main areas of investment in this field. According to projections, the market for cardiovascular drugs is expected to reach $146.5 billion by 2028, driven by advancements in personalised treatment choices and the rising incidence of heart disease among women.

4. Cognitive Health

Women are disproportionately affected by cognitive decline, which includes diseases like Alzheimer's disease. The goal of this field's research and development is to reduce or reverse cognitive decline by early diagnosis, preventative measures, and therapeutic approaches. By 2030, the market for dementia and Alzheimer's care is predicted to grow to be worth over $1 trillion, necessitating and perhaps rewarding investments in cognitive health solutions.

5. Digital Health and Femtech

The use of wearable technology, telemedicine, and smartphone apps, among other digital health innovations, is changing the way women take care of their health. The menstrual monitoring and menopause management digital products offered by the femtech industry are experiencing fast growth. By 2027, the femtech market is expected to grow to $60 billion due to rising customer desire for individualised, technologically advanced health solutions.

The Right Time to Invest: Opportunities and Challenges

Several factors make this the ideal time to invest in female longevity:

Demographic Shifts: With the ageing of the world's population, the proportion of older women is rising quickly. Given that the proportion of women over 60 is predicted to more than double by 2050, investing in female healthspan is crucial.

Technological Advancements: New markets and investment opportunities are being created by breakthroughs in biotechnology, digital health, and personalised medicine to address the particular health concerns that women experience as they age.

Enhanced Awareness: As the need for gender-specific healthcare solutions becomes more widely recognised, there is a growing market for products and services that specifically address the health issues faced by older women. This creates a favourable environment for investment.

Government and Policy Support: Ageing populations and gender-specific health challenges are receiving more attention from governments and health organisations worldwide, which is probably going to result in financing possibilities and policies that are advantageous for companies in the female longevity field.

But it is critical to recognise the difficulties in this developing field. A lot of innovations are still in the early phases of development, thus they might not be viable or scalable just yet. Long holding times are necessary in some industries, like biotechnology and pharmaceuticals, before significant revenues can be obtained. Furthermore, the intricacies of aging present important obstacles that need to be properly addressed, particularly for women who frequently deal with chronic diseases.

The Future of Female Longevity

Female longevity offers a unique opportunity to address some of the most pressing health challenges facing women today. By closing the health span-lifespan gap, we can ensure that women not only live longer but live better, enjoying a higher quality of life well into their later years. For investors, this is a chance to be at the forefront of a rapidly growing market that could deliver substantial returns, both financially and socially.

Have a great week ahead,

Maryann

***Disclaimer***

Yes! This has been on my mind lately. Do you have any recommendations for seeking out investments in this realm? I feel like most companies addressing these issues are start ups or privately owned and that few publicly owned companies truly focus on these issues as of now, so curious to hear your thinking on finding the investments in this area.

LOVING your substack! Binging all the past issues :)