The Great Small Cap Rotation is underway

How to play the great rotation and the accompanying mean reversion

Welcome back, dear readers!

It’s been a few weeks since my last note, as I have been busy digesting economic data to inform my thesis about the second half of the year and rethinking my strategy for continuing to share my thoughts with you, my dear community.

Before we dive in, I need your help, please.

I started this blog as a platform to share my investment thesis with you—the news and trends that are informing my investment decisions and how I translate those into my personal portfolio. Our readership has grown since then, and to help me serve you better, I would like to know what you’d like to read from me. Please leave me a comment or send me a message with your thoughts. I’d appreciate that very much!

Also, please help us grow by liking this post on Twitter and sharing it with an investor you know! It really helps a lot :)

The latest economic data supports our thesis

After the positive jobs report on Jul 5 and better inflation data on Jul 10, we have more proof that the US economy is resilient and inflation is heading in the right direction. This sets up the Fed to finally start its rate cutting cycle.

Given the strong growth trajectory of the markets, we think that we will see only a few rate cuts (perhaps 1 or max. 2) in 2024. With such a macro backdrop, cyclicals and small caps should perform well.

Small Cap Surge: Russell 2000 rises and small cap funds attract record inflows

Last week saw a notable shift from mega cap tech stocks to small cap stocks. The great rotation is gaining traction, and the numbers back it up: The Russell 2000 (RTY) index rose for the second straight week, gaining 1.5%. Small-cap funds drew in a staggering $9.9 billion over the past week, marking the second-largest weekly inflow on record, according to Bank of America.

Does this mark a paradigm shift in positioning from large cap to small cap?

To answer that question, let’s look at the technicals.

From a technical perspective, the recent rally in small caps was huge. The index surged 11.5% over a 5-day period, driving the Relative Strength Index (RSI) of the index above 80 and into overbought territory.

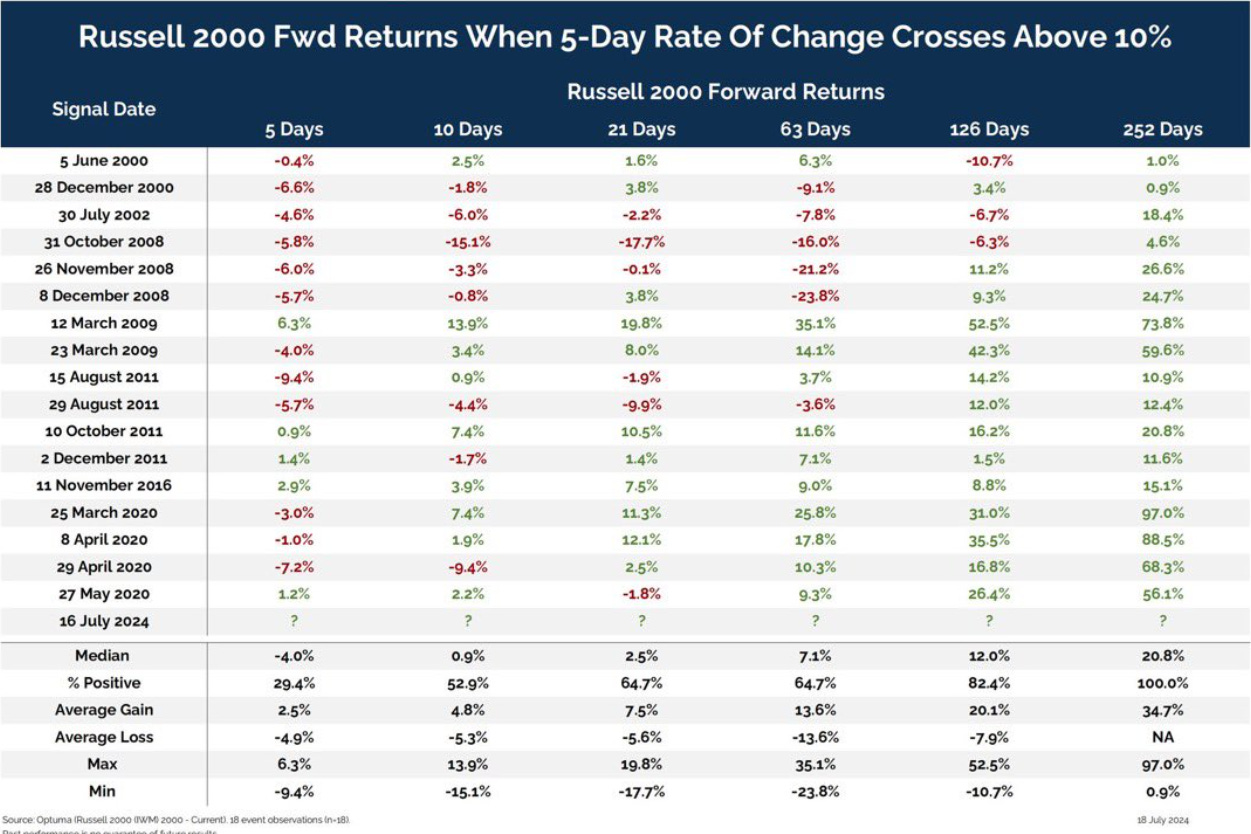

The 5-day rate of change in the IWM Russell 2000 (the ETF that tracks the Russell 2000 index composed of small cap U.S. equities) was enormous, and such a change has only been observed a few times in the last 25 years. Historically, a continued rally after such a rapid increase has been unsustainable, typically leading to lower returns in the very short term.

A historical analysis of the Russell 2000 returns when the 5-day rate of change goes above 10% shows that over the next 5 days we typically tend to see a 4% pullback. Thanks to Steven Strazza on Twitter for pointing that out.

Hence, it wouldn’t be implausible to suggest that these stocks may need to correct or consolidate in the short term before the rally can continue.

But, going back to that RSI indicator above - the RSI is an indicator of trend strength. Trends that break 70 are powerful. This suggests a significant small cap rotation trend is underway.

Is this time different?

That’s it for the free preview! You can read the full post by upgrading to a paid subscription (free trials are available!). If you enjoyed this so far, support us by sharing this post on LinkedIn and sharing it with an investor you know! It helps us a lot!

Subscribe now to continue reading this article, which discusses these topics:

Momentum is powering the small cap rotation

The problem with small cap stocks

Where do we go from here: How to position small caps in a portfolio context

How to trade a possible breakdown

Momentum is powering the small cap rotation

The large-to-small cap rotation is mostly a momentum story. And in fact, over the last few years, price momentum has become one of the most important drivers of performance over the short-to-medium term. It has become increasingly so given the growth of quantitative trading strategies after the Global Financial Crisis (GFC) and, more recently, algorithmic trading supported by generative AI.

The impact of these trading strategies is that flows worth trillions of dollars can be driven to a stock or sector….and then just as easily reversed. As with all fields where AI is becoming more and more prevalent, the main worry is that consumer behaviour may become less and less consistent with what is reasonable. But, I digress!

Having said that, with the Fed cutting rates and the prospect of a pro-growth, tax-cut, and tariff-friendly US president, it is unsurprising to see narratives about why the market rally will broaden, with small and mid-cap companies standing to benefit.

The problem with Small Caps

While this may well be the case, many problems still plague these companies.

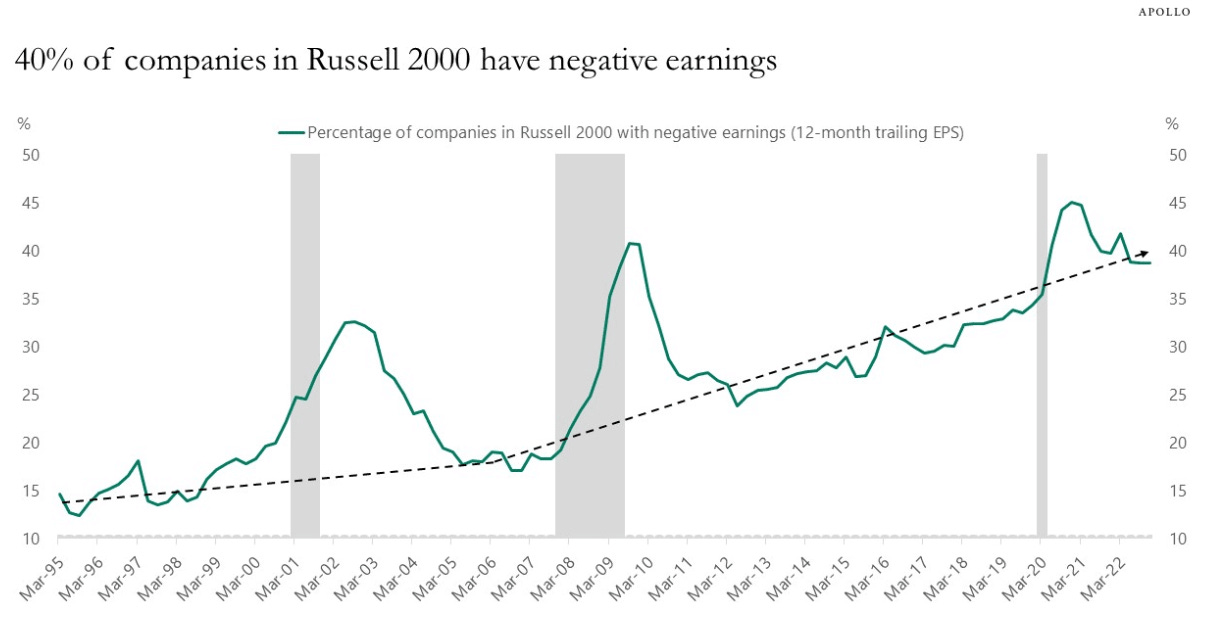

First, nearly 40% of the Russell 2000 is unprofitable. As can be seen in the chart below, in 2014, just under 30% of the companies in the Russell 2000 were unprofitable. That was ten years ago. That percentage is currently close to 40% today.

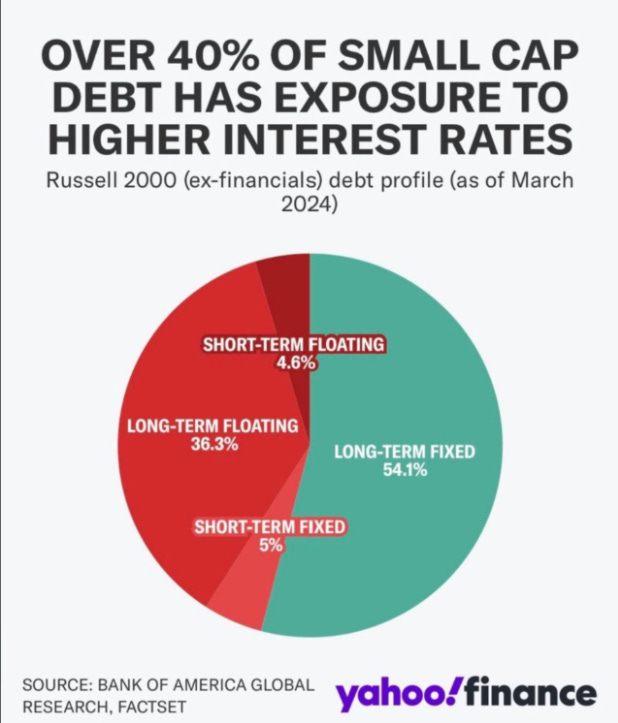

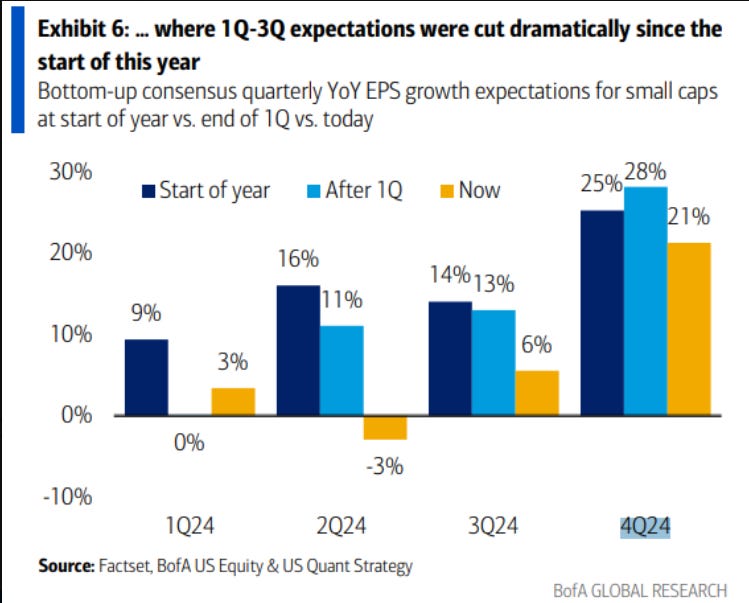

Secondly, the composition of the Russell 2000 is heavily weighted towards consumer sectors. Healthcare, industrials, and financial services make up almost 48% of the benchmark index. These companies therefore depend heavily on consumers to generate revenues. In an economy that is slowing, consumption is expected to decrease, which will have a knock-on impact on company profitability and thus earnings. Already this year, earnings expectations for small-cap companies have been cut sharply. While analysts are still optimistic looking forward, the risk to those expectations is increasing as the economy slows.

How to position small caps in a portfolio context

The ongoing rotation represents a positive development in the market landscape. Investors have the chance to reduce risk in their technology-heavy positions and explore opportunities within the Russell 2000. There are compelling reasons to believe that the Russell 2000 will maintain its upward momentum. Nevertheless, heightened volatility may complicate this rotation.

As noted, the Russell 2000 is highly overbought. If you want to add some small or mid-cap exposure to your portfolio, it might be wise to wait and try to capture better entry points.

How to trade a possible breakdown

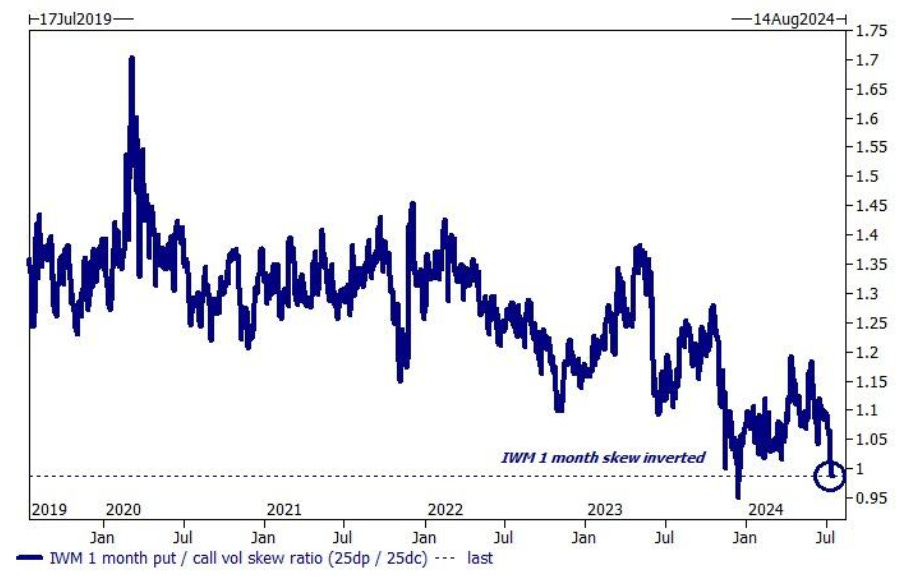

As Markets & Mayhem pointed out on Twitter, following the significant uptrend in the Russell 2000, there is a noticeable imbalance in call skew, indicating that optimism towards small-cap stocks has intensified, as reflected in the premium distribution of IWM Russell 2000. This is yet another sign that the move is getting well ahead of itself in the near-term.

Options skew is one of the signals that I like to use for short-term trading. The skew serves as a window into market sentiment and risk appetite. When traders prioritize capturing upside gains over protection, the skew flattens, signalling a bullish outlook.

A spike in the skew indicates market concerns about downside risk, suggesting that the subsequent days or weeks could be volatile. In such periods, often lasting 5–10 days, traders might consider shifting to mean-reversion strategies, while investors should watch for an exit signal, such as a breach of the 50-day moving average.

Have a great week ahead!

Maryann

***Disclaimer***

All opinions are my own and personal. This is not investment advice. I do not provide any buying or selling recommendations, nor do I offer any investment advice. You are advised to conduct your own research and due diligence when making financial and investment decisions.