Sustainable Investing in Europe

A Guide for Beginners

Once upon a time, profit and purpose were diametrically opposed. These were mutually exclusive terms which did not belong in the same sentence, let alone paragraph. Thankfully, the world has moved on a lot since then, and today sustainable and environmental, social and governance (ESG) investing are mainstream. Today, it is possible to invest intentionally in line with your values and achieve both financial and non-financial outcomes.

The good news for a beginner investor is that there is a regulatory framework with a plethora of rules designed to confirm the ESG criteria of investment portfolios in order to protect investors from greenwashing and dubious claims.

The not-so-good news is that regulatory guidelines are sometimes vague, and so it falls upon the asset managers to provide a clear framework of how their products fit sustainable investing classifications, meaning there isn’t one common standard.

But, by the end of this guide, you'll have the tools to easily navigate and invest sustainably with confidence. Let's dive in!

How To Start Investing Sustainably

Understand Your Values: What causes or issues are close to your heart? Do you care about clean energy, social equality, or maybe reducing waste? Identifying your values will help you pick the right kind of sustainable investments that align with what matters most to you.

Learn the Basics: Sustainable investing has a few different approaches. You've got Environmental, Social, and Governance (ESG) investing, Impact investing, and more. ESG looks at how companies handle environmental and social issues, while Impact investing focuses on making a positive impact alongside financial gains. Take some time to understand these approaches to find what resonates with you.

Do Your Research: Once you've figured out what matters most and what approach you prefer, it's time to research. Look for companies or funds that match your values and goals. Check out their track record on sustainability, how they operate, and what they're trying to achieve.

The Role of Regulation in Europe

Unveiling MIFID II’s Impact: One major player is MiFID II (Markets in Financial Instruments Directive). MiFID II introduced investor profiling, aiding investment advisors in understanding your values and risk attitudes. It harmonizes with sustainable investing, ensuring investments align with your ethical beliefs.

Spotlight on SFDR: Think of the EU’s SFDR (Sustainable Finance Disclosure Regulation) as a spotlight illuminating the sustainability aspect of investments. SFDR increases the transparency in investment portfolios by having firms classify products as Article 6, 8 or 9 products.

Here’s how the SFDR helps:

Clearer Information: It requires financial firms to provide detailed info about how sustainable their investment products really are. This means you get a clearer picture of whether an investment aligns with your values, whether it's about reducing carbon emissions or supporting social equality.

Comparable Investments: SFDR makes it easier for you to compare different investment options. It sets common standards for how sustainability is measured, so you can easily weigh one investment against another and pick the one that best matches what you care about.

Encouraging Sustainable Choices: With SFDR in place, companies are encouraged to be more sustainable to attract investors like you. This means more companies might start taking environmental and social issues seriously, which is a win-win for everyone!

Accountability: SFDR holds financial firms accountable for the sustainability claims they make. So, if they say they're eco-friendly or socially responsible, they have to walk the talk. This helps you trust that your investments are genuinely making a positive impact.

Deciphering SFDR Article 6, 8 and 9 Products

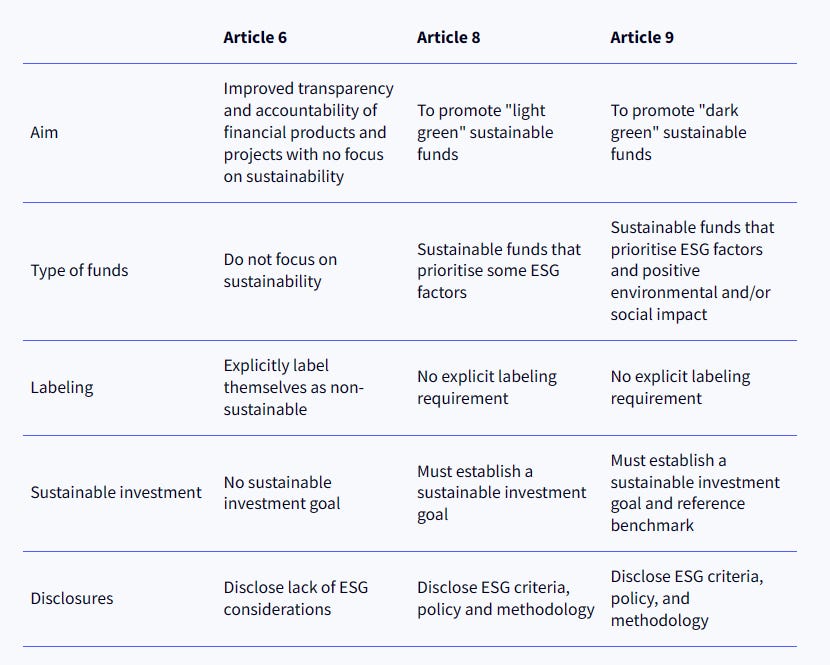

SFDR Article 6 are funds which do not prioritize sustainability in their investment strategy, while SFDR Article 8 products, also known as light green products, promote investments or projects with positive environmental or social qualities, or a combination of such characteristics, as long as the investments are made in enterprises that adhere to sound governance practices. A key distinction between Article 8 and 9 products is that Article 8 products do not have ESG as a core objective.

To determine whether a financial product meets the criteria of Article 8, financial market participants must use a variety of criteria, such as the United Nations' Sustainable Development Goals and the OECD Guidelines for Multinational Enterprises, in addition to conducting their own due diligence.

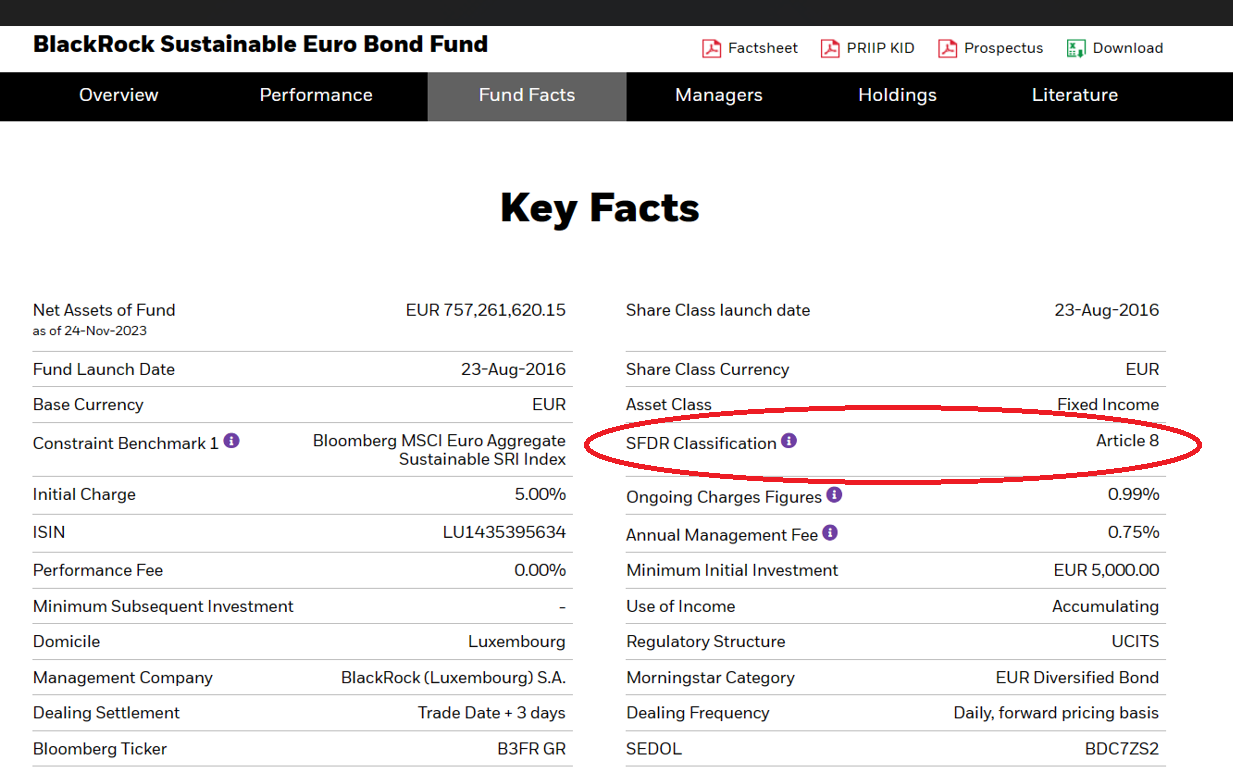

One example of a light green fund that complies with Article 8 is the BlackRock Sustainable Euro Bond Fund.

The fund provides pre-contractual and periodic disclosures that explain how it meets the requirements of Article 8, including information on how it selects its investments and how it evaluates their sustainability impact.

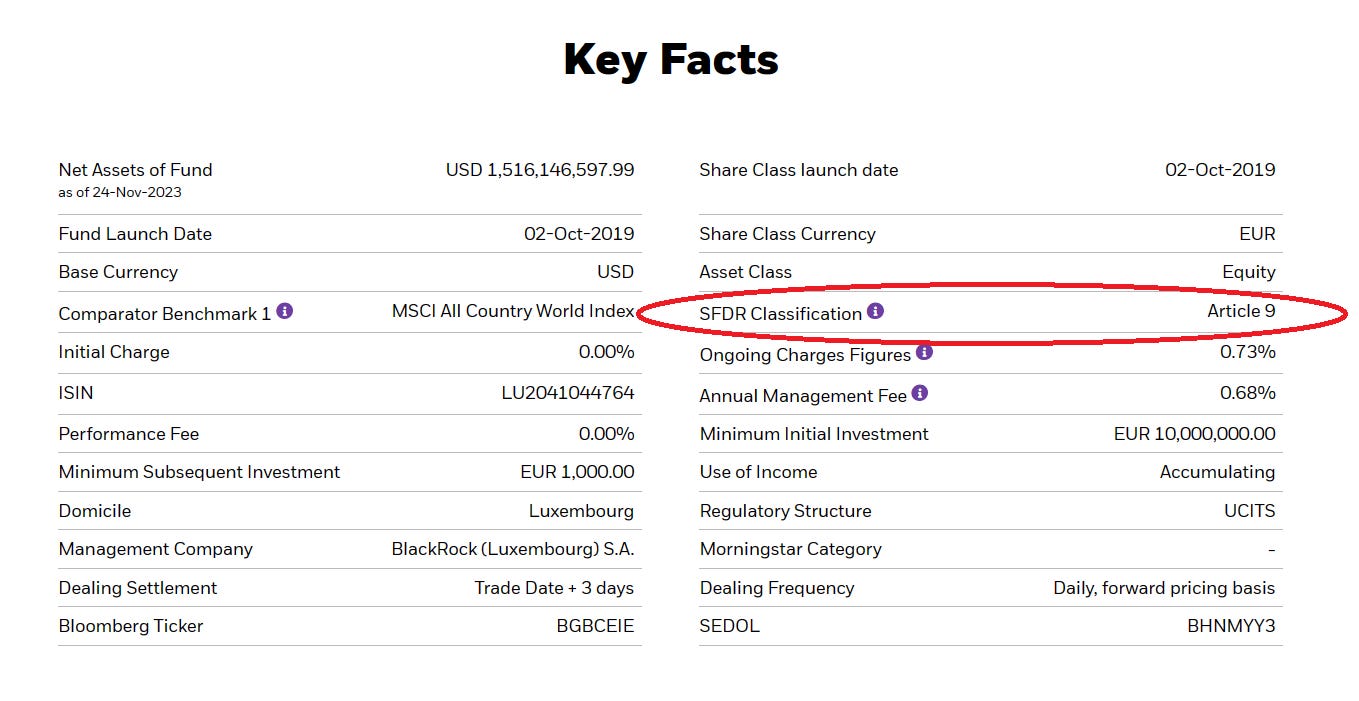

SFDR Article 9 products are known as “dark green” products and are funds that have sustainable investment as their core and distinct objective. One example of a dark green fund is the BGF Circular Economy Fund.

Below is an overview of the three articles of the SFDR

Sustainable and ESG investing in Europe has transitioned from niche concepts to mainstream principles, offering investors the remarkable opportunity to align their values with their financial endeavours while fostering positive impacts on society and the environment.

For beginners venturing into this domain, understanding the European landscape is key. Firstly, identify your values and learn the basics; comprehend Environmental, Social, and Governance (ESG) investing versus Impact investing. Once your preferences align, conduct diligent research on companies or funds reflecting your values and sustainability goals. Embrace regulatory frameworks like MiFID II and the Sustainable Finance Disclosure Regulation (SFDR) to ensure your investments echo your ethical beliefs. With a clear understanding of these principles and regulations, sustainable investing can be both financially rewarding and socially impactful.

***Disclaimer***

All opinions are mine and personal. Please do not construe any of my posts as investment advice. I do not provide any buying or selling recommendations, nor offer any investment advice. You are advised to conduct your own research and due diligence when making financial and investment decisions.