So You Want to Invest in Women’s Health? Start Here

A beginner-friendly guide for individuals ready to back the future of healthcare with or without a finance background.

Welcome to the latest edition from FemmeHealth Ventures Alliance — delivering strategic insights into women’s health innovation and investment. We help you track emerging opportunities in Femtech and beyond, through a disciplined investor lens.

If this email was forwarded to you, you have awesome friends. Click below to join. Don’t forget, you can always explore our archives to catch up on any past stories.

You’re here because you care about equity, innovation, and what the future of healthcare looks like for women.

Maybe you’ve lived through the gaps yourself. Maybe you’ve seen a founder solve a problem no one else would touch. Or maybe you’re simply asking: Where do I even start if I want to invest in this space?

This guide is for you, whether you’re curious, cautious, or ready to commit capital.

This guide is for informational purposes only and does not constitute investment advice or a solicitation of any kind.

Where Innovation Is Happening and How You Can Participate

We are in a powerful moment. Innovation in health, longevity, and women’s health is accelerating and it’s happening in two main arenas:

Track 1: Public Markets

This includes listed companies: pharmaceutical giants, biotech innovators, and healthtech firms developing everything from hormonal diagnostics to menopause therapies. These are publicly traded on stock exchanges and accessible to anyone with a brokerage account.

Examples:

Organon (NYSE: OGN), spun out of Merck, focuses exclusively on women’s health.

Hologic (NASDAQ: HOLX) leads in diagnostics and breast health technology.

Myovant Sciences, before its acquisition by Sumitomo Pharma, was a major player in hormonal health.

If terms like “stock” or “exchange” are unfamiliar, don’t worry. I have written a simple, beginner-friendly post here:

👉 Investing 101: What You Need to Know to Start

Track 2: Private Markets

This is where the real energy in women’s health is right now: startups tackling everything from endometriosis and fertility to menopause and autoimmune disease, often led by women with lived experience. These are privately held companies, meaning they’re not accessible via the stock market.

Investing in these companies typically happens through what’s known as the private markets.

The Private Investing Landscape Simplified

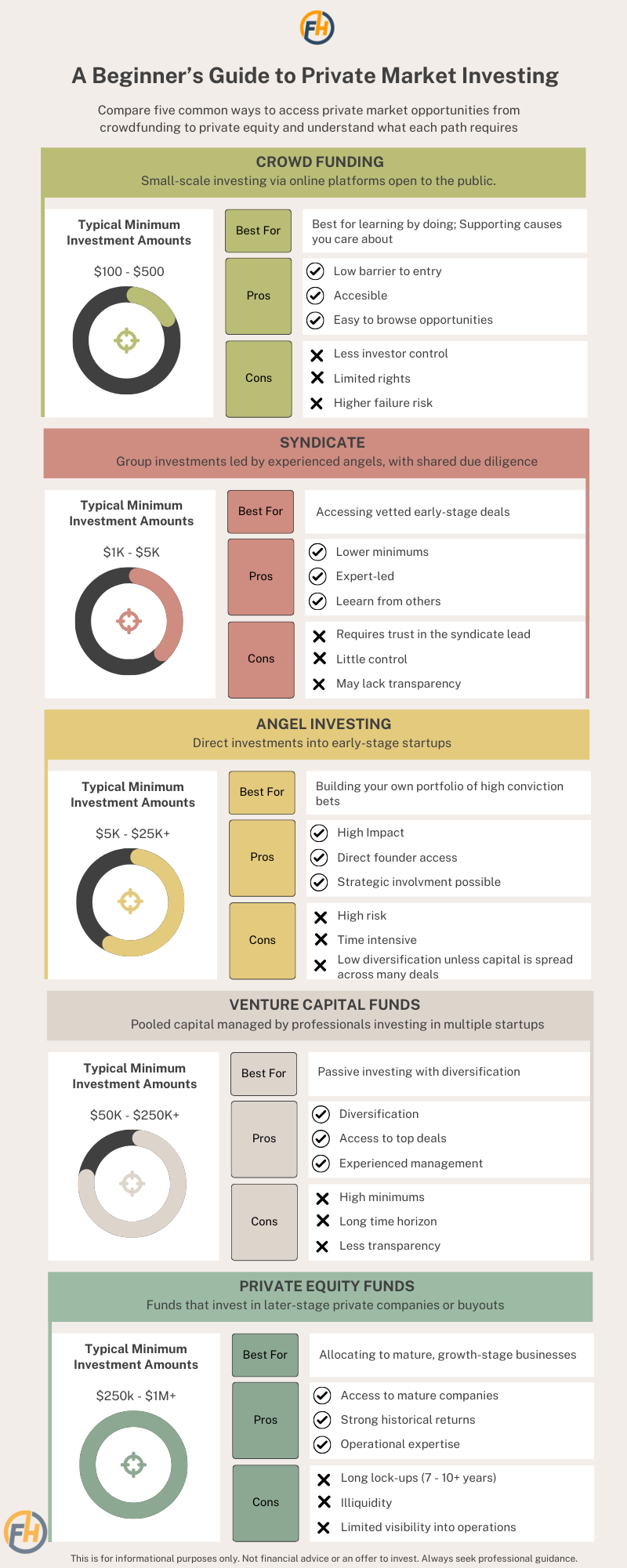

Let’s break it down into four common paths:

Angel Investing

You invest your own capital directly into a startup, usually at an early stage. Typical check sizes range from $5k–$25k. You’re backing the founder, their vision, and their potential to scale. It's high-risk, high-reward—and deeply impactful.

Venture Capital Funds

Instead of choosing individual companies, you invest in a fund managed by professionals who build a portfolio of startups. Minimums are usually higher (often $50k+), but the fund handles all diligence, selection, and support.

Syndicates or Angel Groups

You co-invest with others, often led by an experienced investor. Minimums are lower ($1k–$5k), and you benefit from shared expertise, due diligence, and access to vetted deals.

Crowdfunding

Platforms like Seedrs (UK), Crowdcube, or Wefunder (US) allow individuals to invest as little as $100 in private companies. These platforms increase accessibility, but investors may have limited protections and should carefully review each offering’s terms and disclosures. Depending on your country of residence and platform eligibility, these may offer a starting point to explore the process of investing in private companies.

What to Look For in a Startup

Not every startup is a good bet. Here are four core things I always look for when evaluating a femtech or women’s health company:

The Problem

Is it painful, urgent, and widely experienced but still underserved? Women’s health is full of massive unmet needs that mainstream systems have overlooked.The Founder

Do they have credibility, deep expertise, or lived experience? Are they obsessed with solving this problem?Traction

Is there any early demand? Customers, partners, pilot programs, or strong user feedback?Moat

What makes them hard to copy? Is it tech IP, clinical data, community, or distribution partnerships?

📽️ I break this down further in a short Instagram Reel here:

👉 Watch: What to Look for in a Femtech Startup

How Much Money Do You Need to Start?

The Myth: You need millions.

The Truth: You can start small and grow your knowledge as you grow your capital.

Whether you're exploring crowdfunding platforms, co-investing in syndicates, or allocating to professional funds, there's a path for every experience level and budget.

👇 The infographic below outlines five common ways to invest in privately held companies, including typical minimums, who each path is best for, and key pros and cons.

Important: Private market investing carries risk and is typically illiquid. Only invest what you can afford to lose, and never feel pressured to act before you're ready.

What to Watch Out For

While the space is exciting, not every startup is investment-ready. As you build your confidence, be alert to signals like:

Overreliance on buzzwords with no real science

No customer traction or early adoption

Lack of clinical or regulatory awareness (for healthtech)

Founders who resist transparency or avoid hard questions

You don’t need to spot everything alone. That’s what syndicates, mentors, and angel networks are for.

You Belong in This Room

The future of healthcare is being built right now.

And women deserve to be in the rooms where decisions and investments are being made.

You don’t need a finance degree or a Silicon Valley zip code. You just need the curiosity, commitment, and capital to start where you are.

Want More?

I send private briefings focused on education, market trends, and early-stage innovation in health designed to help you better understand the private investing landscape.

👉 Sign up here to join the investor memo list

Sources:

Women control ~80% of healthcare decisions in the U.S.

(Source: Deloitte Center for Health Solutions)Organon: $6B+ women’s health-focused public company (NYSE: OGN)

Hologic: Global leader in breast and cervical health (NASDAQ: HOLX)

The global femtech market is projected to reach $103 billion by 2030

(Source: Market Research Future)2% of venture capital goes to women-founded companies

(Source: PitchBook, 2023)Equity crowdfunding in Europe and the US allows retail investors to participate with as little as $100

(Platforms: Seedrs, Wefunder, Crowdcube)

Ways to Connect with FemmeHealth Ventures Alliance

Thanks for reading. If you liked what you read, consider:

signing up for FemmeHealth newsletter, which is published weekly

sending to a friend or co-worker

Disclaimer & Disclosure

At the time of writing, I do not hold any financial positions in the publicly listed companies mentioned in this article. This content is for informational and educational purposes only. It does not constitute financial, investment, legal, or medical advice, or an offer to buy or sell any securities. Opinions expressed are those of the author and may not reflect the views of affiliated organisations. Readers should seek professional advice tailored to their individual circumstances before making investment decisions. Investing involves risk, including potential loss of principal. Past performance does not guarantee future results.

SOOO excited for this post -- thank you for helping women like me see where we fit in! You know I will also crosspost this one AND I signed up for your monthly recap thangs. Thank you for your work!