Navigating the 60/40 portfolio in 2024

What does 2024 hold for the traditional 60/40 portfolio?

One of my favourite lessons in Business School was on Modern Portfolio Theory (MPT). The MPT introduced by Harry Markowitz, starts from the premise that investors should maximize returns while staying within their comfort zone of risk. The crux of this approach lies in constructing an investment mix that combines both stocks and bonds, carefully tailored to create a diversified portfolio.

The Power of Diversification

At its core, the principle is straightforward yet powerful. Stocks offer the potential for higher returns but come with higher risk, while bonds generally provide lower but more stable returns. Combining these asset classes constructs a portfolio that yields better risk-adjusted returns by limiting drawdowns - a portfolio that should navigate market turbulence more effectively. The key principle being that stocks and bonds have historically tended to move in opposite directions during times of financial market stress.

60/40 Portfolio: A Historical Perspective

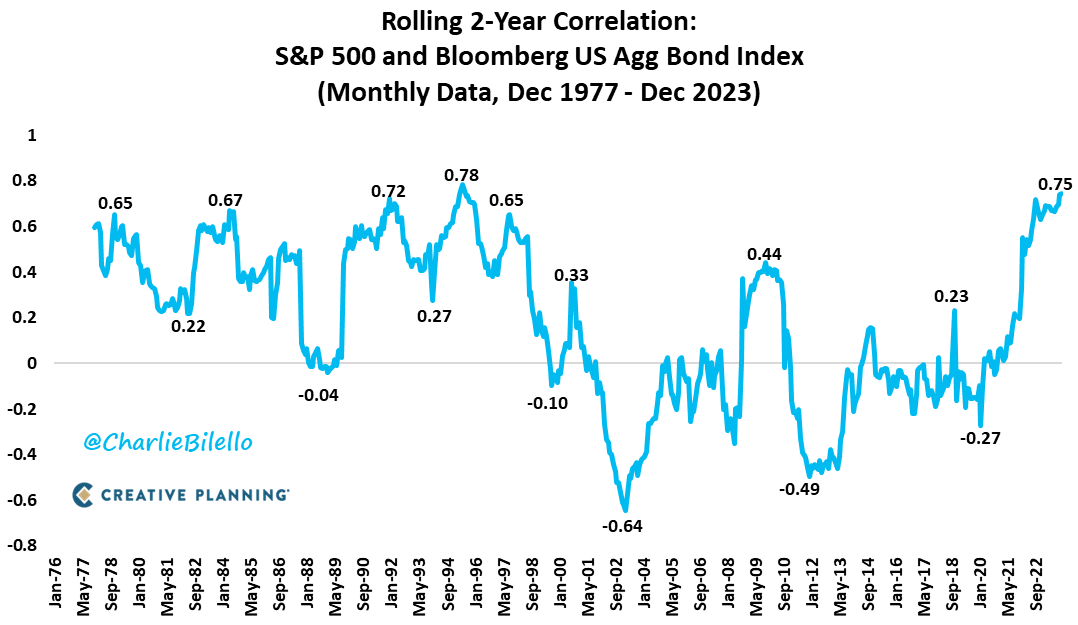

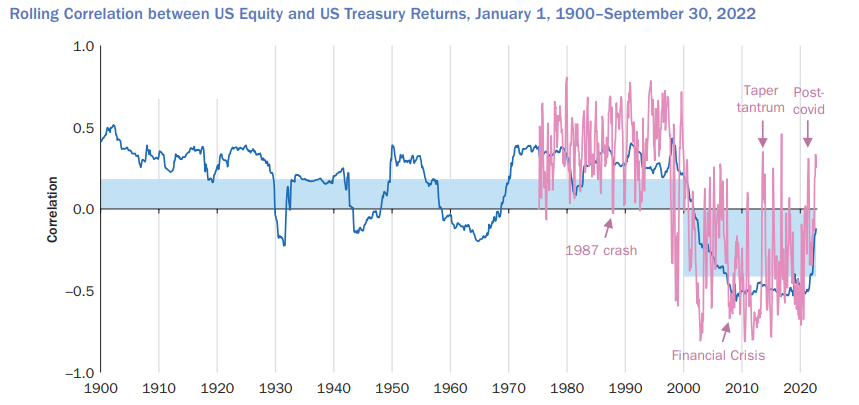

Looking back over the last two decades, and indeed since the Global Financial Crisis, the 60/40 portfolio has worked very well - in nominal terms and in real terms. The stock–bond correlation was consistently negative and investors were largely able to rely on their bond investments for protection when equities sold off.

But, if we go back to a longer time series starting from 1900, stocks and bonds haven’t always been negatively correlated. If anything, stocks and bonds have displayed more of a positive correlation between 1900 and the 2000s.

Performance of the 64/40 portfolio in 2023

In 2023, the 60/40 portfolio has recorded a remarkable year of growth with an exceptionally strong growth in the last two months of this year. Using the iShares Core Allocation Growth ETF as a proxy, as of Dec 28, the 60/40 portfolio is up 15.45% YTD.

What stood out in the last two months is how strong the bond portion of the 60/40 strategy has been. In the last two months, bonds put up a stand-out 8.87% performance, despite trailing stocks which rallied even harder. While bonds should typically lag during periods of equity strength - in line with their role as a diversifier - it is interesting to note that their impact on the strategy during this strong period was not as detrimental.

So what does 2024 hold for the 60/40 portfolio?

Looking ahead, the macro outlook for 2024 seems to be predicated on rate cuts and falling inflation amid slowing growth. Markets are currently pricing in approximately seven rate cuts by the Federal Reserve next year. Globally, central banks are planning one hundred and fifty two (152) rate cuts in 2024.

Personally I don’t think seven rate cuts will materialize in the US as that would imply a material slowdown in the economy far beyond what would be expected a soft landing scenario. I believe instead that we will see circa four interest rate cuts from the Federal reserve during 2024 to prevent monetary policy from becoming too tight. Central to this thesis is that inflation is under control.

Rate cuts should send bond yields lower and should be supportive for interest-rate sensitive sectors such as the real estate and financial sectors.

Conversely, a deviation in inflation trends or unexpected external shocks might lead the Federal Reserve to revise its rate cut agenda. This could potentially disrupt stocks and bonds, triggering a re-pricing of interest rate projections by market participants, which would impact both stocks and bonds negatively.

The Changing Stock-Bond Correlation Dynamics

Recent trends showcase a noteworthy shift in the correlation between US stocks and bonds, marking the highest levels of positive correlation in the past two decades. This evolving positive correlation challenges the reliability of bonds as a sole diversification tool in a balanced portfolio.

Diversification: A Call to Action

In a year where macro uncertainty is forecast to remain high, investors may be well served to introduce strategies with low correlation to the broad equity markets as additional diversifiers beyond bonds into the portfolio.

Have a great 2024 ahead!

Maryann

Please Like and Subscribe if you enjoyed this post. It helps me get the word out about my newsletter, thank you!

***Disclaimer***

All opinions are mine and personal. Please do not construe any of my posts as investment advice. I do not provide any buying or selling recommendations, nor offer any investment advice. You are advised to conduct your own research and due diligence when making financial and investment decisions.