Femtech’s $1 Trillion Opportunity: Why Investors Are Watching Virtual Women’s Health

Femtech funding is stable, demand is surging, but investors are still waiting for big exits.

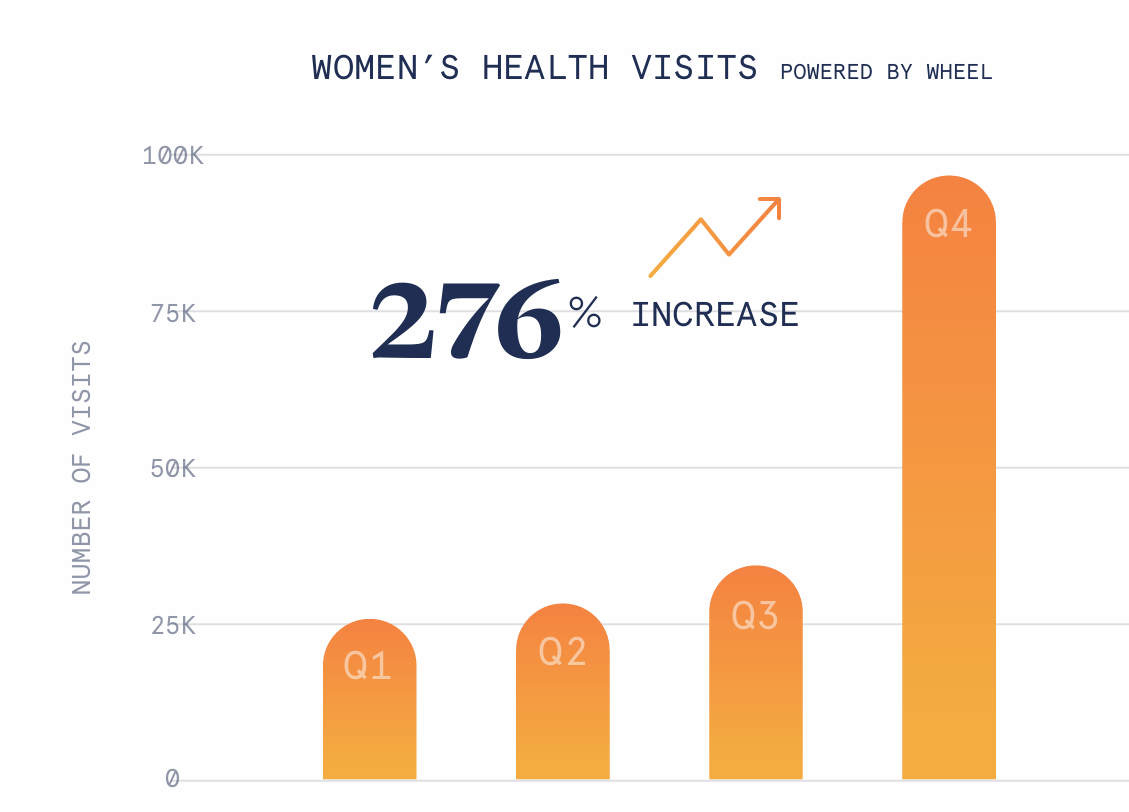

For decades, women’s health has been underfunded and underserved. But that’s changing. Virtual care is transforming access to women’s healthcare, driving a 276% surge in visits from Q1 to Q4 2024. As demand rises, so does investor interest. But can funding, business models, and exits scale fast enough to sustain this momentum?

Welcome to the latest issue of the Femmehealth Ventures Publication. Your trusted source for insightful analysis of femtech innovations through an investor's lens, helping you identify the latest opportunities in women's health technology.

If this email was forwarded to you, you have awesome friends—click below to join. Don’t forget, you can always explore our archives to catch up on any past stories.

The Good News in Women’s Health

The demand is undeniable.

The power of the female economy is in full force. Women today are more educated, have greater economic power, and actively seeking solutions to improve their healthspan. Women drive 80% of healthcare spending, and they are willing to invest in their well-being. This shift is reflected in the surge in demand for women’s health services on platforms like Wheel’s virtual care network.

VC funding is Holding Steady

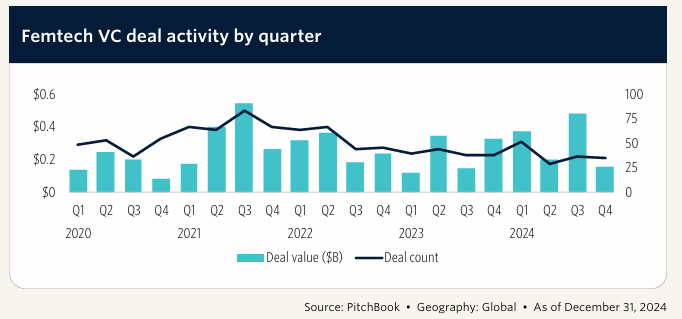

Three years ago, femtech was still fighting for attention. Today, women’s health is one of the most active categories in digital health but is still far from reaching its full potential.

📌 Maven Clinic has raised $437.5M and is now valued at $1.75B.

📌 Midi Health secured $25M to scale virtual menopause care.

📌 Evvy, a leader in at-home vaginal microbiome testing, is expanding with AI-powered diagnostics.

📌 Fairtility is redefining fertility treatment with AI, attracting serious investor interest.

Although still at a low level, Femtech investment has remained stable while other digital health sectors have seen a sharp decline in VC funding

Exit Activity is Picking Up

2024 saw some major acquisitions in women’s health, including:

Hologic’s $350M acquisition of Gynesonics (minimally invasive gynecology)

Compass Diversifies $380M acquisition of The Honey Pot (natural feminine care).

In 2025, Cosette’s $672M acquisition of Mayne Pharma marks private equity’s growing interest in femtech.

And now, a major digital health IPO is on the horizon.

Does Hinge Health’s IPO Signal a Turning Point for Virtual Healthcare?

For years, investors questioned whether digital health startups could achieve large-scale exits. That could be changing.

Hinge Health, a leader in digital musculoskeletal care, is reportedly preparing for an IPO as early as April, following $390M in revenue in 2023, a 33% year-over-year growth rate (Bloomberg). If successful, this would be one of the first digital health IPOs since 2021, proving that virtual-first healthcare can scale profitably.

What Could This Mean for FemTech?

A successful IPO could reignite funding in digital health, benefiting women’s health startups in telehealth, AI diagnostics, and digital therapeutics.

It could set the stage for femtech unicorns like Maven Clinic, Midi Health, and Kindbody to pursue public listings or larger acquisitions.

“Hinge Health’s IPO will be a litmus test for virtual-first healthcare startups. If successful, it could unlock the next wave of investment and exits in women’s health.”

The question now: Can femtech scale fast enough to capitalize on this momentum?

The Challenges in Women’s Health

Despite growing demand and stable VC funding, femtech still faces major hurdles.

Government funding for women’s health research is shrinking, particularly in the U.S.

Femtech still receives just ~2% of total healthcare VC funding—despite being a $1T market

Later-stage capital remains scarce—Series B+ funding is harder to secure.

Exits in the form of IPOs are rare, creating liquidity challenges for investors.

“Femtech isn’t niche, but it still has something to prove. The next two years will determine whether virtual women’s health companies can scale or whether funding plateaus.”

The Opportunities in Women’s Health

For years, femtech was synonymous with fertility. But today, the sector is rapidly evolving, with investors looking beyond reproductive health to untapped, high-growth categories that serve women across all life stages. The numbers tell a clear story.

Menopause & Chronic Conditions

Women spend half their lives post-menopause, yet menopause care has been ignored for decades. In the U.S. alone, an estimated 6,000 women reach menopause daily.

By 2028, the menopause market alone is expected to reach $24.4 billion, driven by demographics, increasing awareness, employer-sponsored benefits, and digital health solutions. 42% of U.S. employers now cover fertility benefits and as workforce retention strategies evolve, menopause is the next category to watch.

Companies like Midi Health are scaling menopause telehealth, securing employer-backed partnerships to provide virtual care at scale. While FemTec Health is betting big on personalized, AI-driven women’s health solutions, targeting menopause, longevity, and preventive care.

“Fertility benefits were the first wave. Menopause is the next big femtech opportunity—$400M in funding and counting.”

At-Home Diagnostics

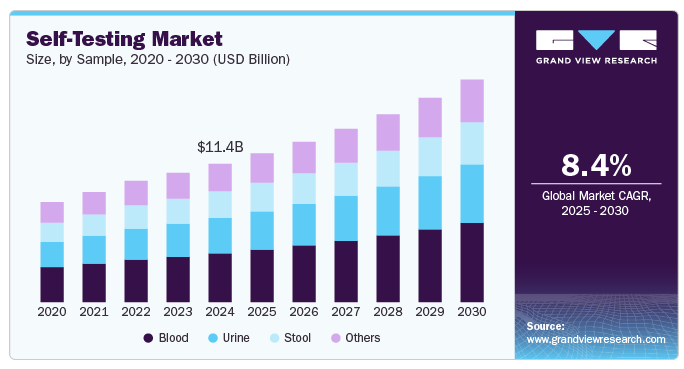

Women’s health has long been dependent on in-clinic testing and doctor visits, but the rise of at-home diagnostics is reshaping access to care. Self-administered testing allows women to track hormonal health, fertility, and vaginal microbiome balance without the barriers of traditional healthcare settings.

The global self-testing market, valued at $11.4 billion in 2024, is projected to grow at a CAGR of 8.40% from 2025 to 2030, driven by increasing emphasis on personalized healthcare, technological advancements in rapid diagnostics, and rising demand for convenient and rapid diagnostics kits.

Companies like Evvy are pioneering AI-powered vaginal microbiome diagnostics, providing personalized insights into vaginal health and its connection to fertility, infections, and overall wellness. While Future Fertility is leading the expansion of at-home hormonal health testing, helping women monitor their reproductive health with greater ease and accuracy.

The next frontier? AI-driven virtual diagnostics that not only provide real-time insights but also connect directly to telehealth providers, ensuring faster, more targeted treatment.

Corporate Health Benefits: The Trojan Horse for Femtech Growth

Employers are becoming the key distribution channel for women’s health startups.

75% of large companies now offer specialized women’s health benefits, signaling a shift in corporate healthcare priorities.

42% of employers now cover fertility treatments—menopause is next (HR Executive, McKinsey & Co.).

Maven Clinic, Kindbody, and Midi Health are capitalizing on enterprise partnerships to drive adoption.

“Virtual women’s health isn’t just growing—it’s becoming the new standard in corporate healthcare benefits.”

Expect more employer-backed solutions and insurance reimbursement expansion to fuel the next wave of virtual women’s healthcare.

Demand for Women’s Health Services is Expanding But Investors Should Stay Measured

Femtech isn’t hype. It’s a real market shift. But investors need to be aware of both the opportunity and the risks.

✅ Virtual-first women’s health platforms have seen a 276% increase in demand.

✅ The market is consolidating—M&A deals in women’s health are scaling past $350M.

✅ Employers are fueling adoption, creating a new path for startup success.

Challenges remain:

❌ Femtech investment is still concentrated in early-stage rounds—series B+ funding is harder to secure.

❌ No major femtech IPOs have happened yet. Exits are uncertain.

❌ Reimbursement policies for digital women’s health services are inconsistent.

The opportunity is real, but the next stage of femtech will be about execution, not just potential.

Are you paying attention?

Sources:

FemTech VC Market Snapshot 2025

PitchBook

RockHealth

Ways to Connect with FemmeHealth Ventures

Thanks for reading. If you liked what you read, consider:

signing up for Femmehealth Ventures newsletter, which is published weekly

sending to a friend or co-worker

Disclaimer

The content in this newsletter is for informational purposes only and does not constitute financial, investment, legal, or medical advice. Opinions expressed are those of the author and may not reflect the views of affiliated organisations. Readers should seek professional advice tailored to their individual circumstances before making decisions. Investing involves risk, including potential loss of principal. Past performance does not guarantee future results.

Great post! It’s about time for accessible women’s healthcare to be taken seriously. Looking forward to new care options in the future.

Great roundup!