Fed Rate Cuts on the Horizon, but Can the Economy Keep Up?

From Inflation to Job Growth: Why the Market’s Still Holding Its Breath

Last week, the S&P 500 had its fourth straight day of gains, erasing almost all of September’s rough patches. Before we break out the champagne, let's remember that September is usually the worst month for the market, so maybe the bulls shouldn't celebrate just yet.

But things are looking up!

This week's inflation data came in as expected, giving the Federal Reserve a green light to consider lowering short-term interest rates next week. Historically, when rates drop and the economy's still growing, markets are happy.

The Consumer Price Index (CPI) has settled at an annualized 2.5%, which is exactly where Chairman Powell wanted it to start easing up on monetary policy. For context, changes in interest rates affect the economy slowly—like steering a cruise ship rather than a speedboat. Meanwhile, the Producer Price Index (PPI), which measures wholesale inflation, rose by 0.2% in August. The annual wholesale inflation rate is now down to 1.7%, with the core rate at 2.4%.

Both are in the Fed's target zone, meaning we can confidently say: inflation—at least for now—is under control.

But just as we start to win the war on inflation, another wall of worry is building: growth fears.

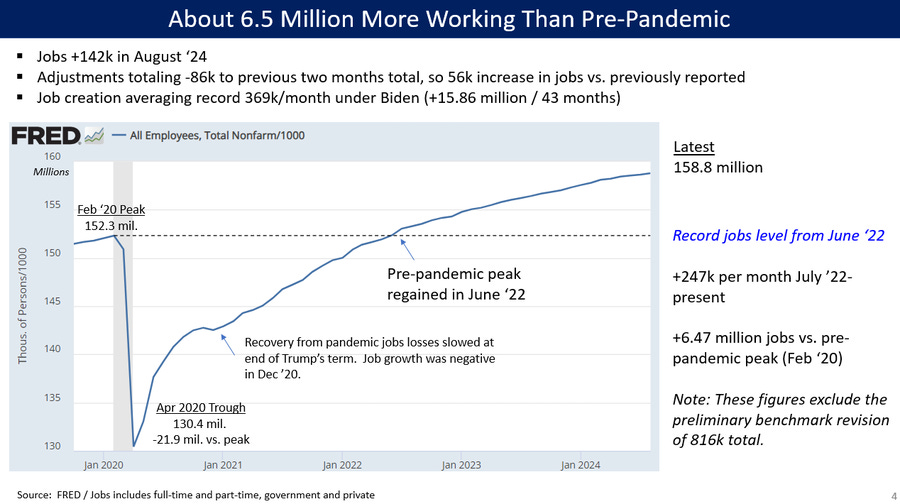

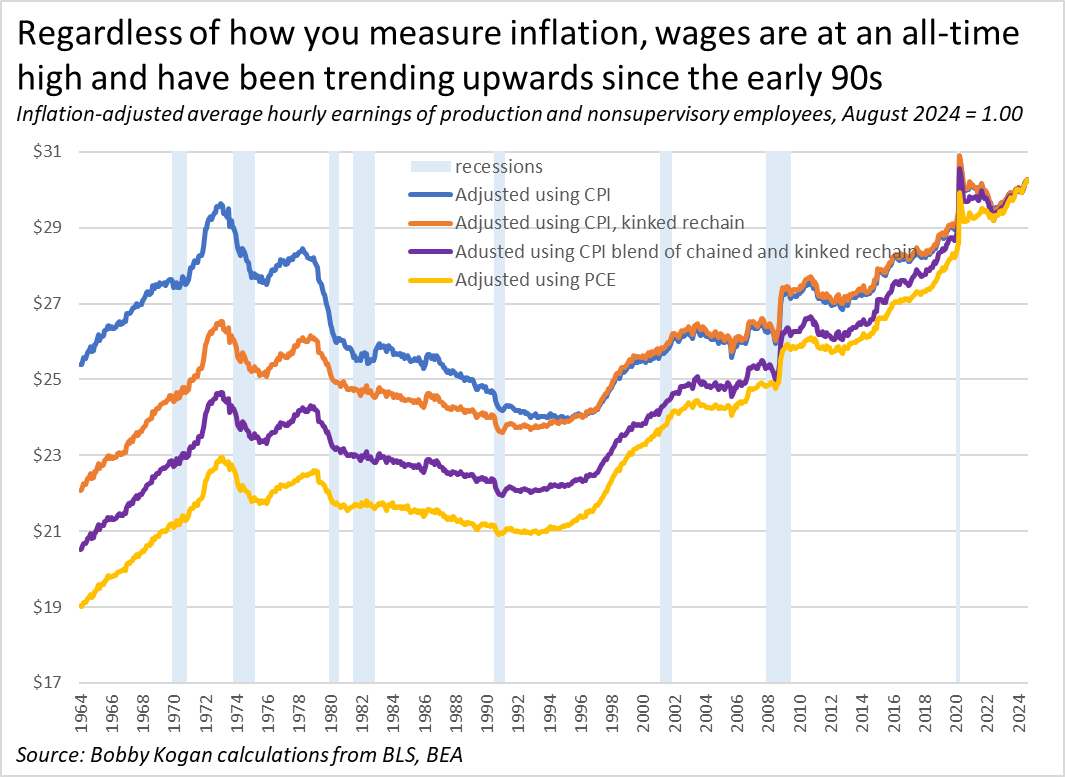

September’s selloff was fueled by worries about the labour market. But if you were ready to hit the panic button, don't. Last week’s data shows that jobs are still being created, and wages are actually growing in real terms.

Some sceptics question the accuracy of government jobs reports, but if the economy were truly losing jobs, we’d see unemployment claims rising—and that’s simply not happening. Claims remain steady, hovering around the two-year average.

However, there are some cracks in the labour market.

Nonfarm payrolls in August rose by 142,000, which sounds okay until you realize it missed expectations and was only a slight improvement over July's 89,000. The unemployment rate ticked down to 4.2%, but revisions to June and July’s nonfarm job gains weren't exactly exciting. That brings the three-month average to a not-so-exciting 116,000. Not exactly record-breaking stuff.

Why is the labour market showing signs of weakness?

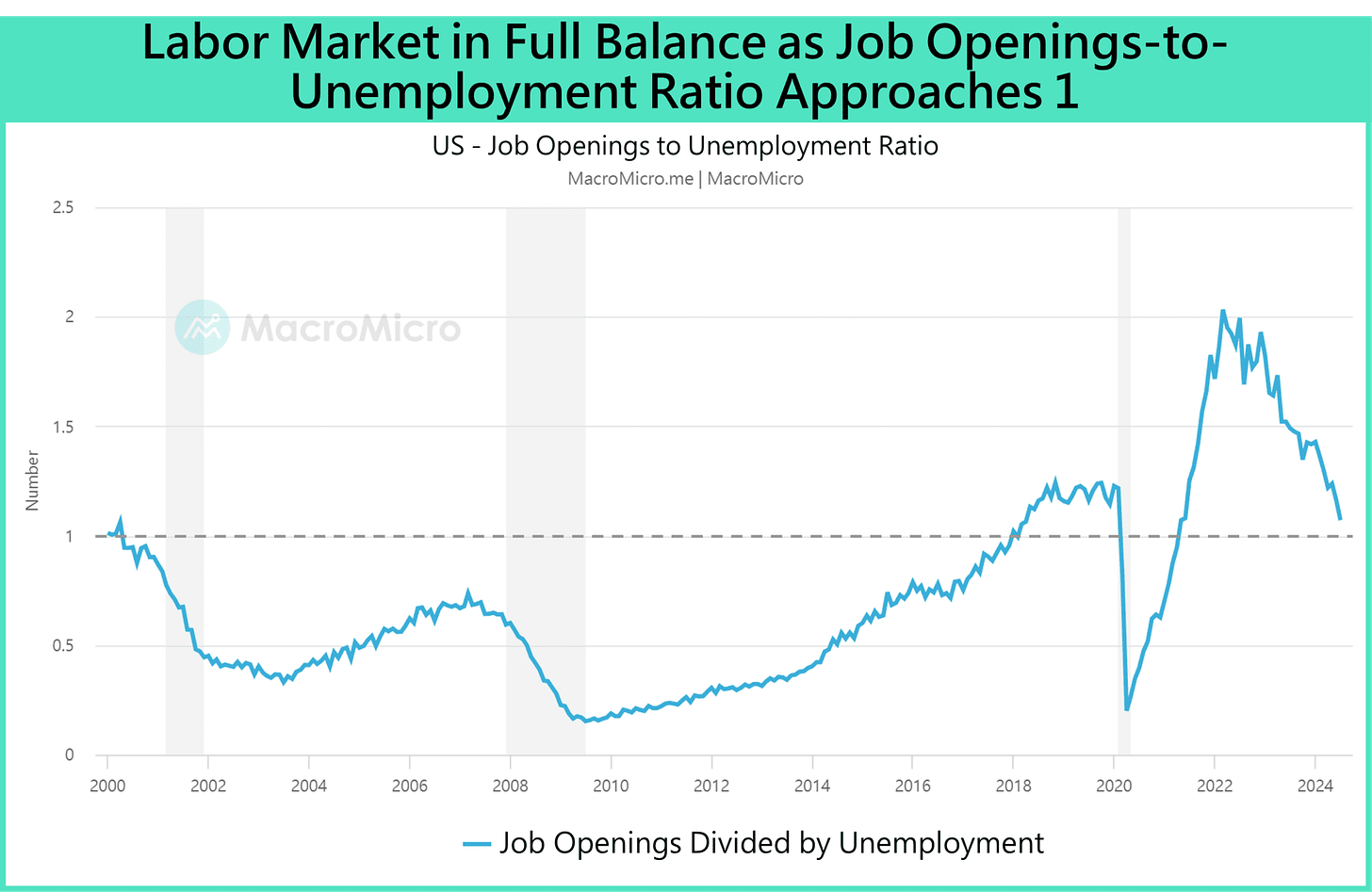

The primary reason is that labour supply and demand are back in balance.

The Beveridge curve, which compares the unemployment rate with job openings, uses a ratio of 1 as the tipping point. When the ratio is above 1, there are more job openings than unemployed people. When it’s below 1, it means there are more people looking for jobs than available positions.

The job openings-to-unemployment ratio is sitting at 1.07—basically, there’s one job for every person unemployed.

It’s like musical chairs, but everyone gets a seat... for now. If that ratio drops below 1, the labour market could shift into oversupply, potentially driving unemployment higher. Basically, we might be in for a game where the music stops and too many people are left standing.

All Eyes on the Fed: Rate Cuts, Projections, and Market Reactions

After two and a half years of interest rate hikes, with a pause at 5.25–5.50%, we’re finally at the much-anticipated Fed meeting on September 18th. Everyone’s been holding their breath, and the market seems pretty confident—there’s a 100% chance of at least one rate cut coming. But this meeting isn’t just about the rate decision. The Fed will also release its Summary of Economic Projections (SEP), which could be just as important (maybe more) than the actual rate cut.

According to the CME Fed Watch Tool, the market’s evenly split on what to expect—there’s a 50-50 chance we’ll see either a 25 or 50 basis point cut. The real question is: how will the market react? The SEP will likely steal the spotlight, offering a deeper look into what the Fed’s thinking, no matter how big (or small) the rate cut turns out to be.

Stock-Bond Correlation Turns Negative: A Sign of Recession Fears?

In other news, the relationship between stocks and bonds has flipped. Since Q3 2023, they have moved in tandem, but lately, stock-bond correlations turned negative.

When this happens, something big has shifted in the market. Could this be a sign that recession fears have spooked investors?

Either way, it’s great news for diversified portfolios. Bonds are once again proving their worth as a safe haven while inflation remains tame and economic uncertainty lingers.

So, will this negative stock-bond correlation hold?

Honestly, I’m not sure yet. If inflation keeps easing or we see a major "flight to quality" event—think global turmoil or an economic shock—then bonds could continue to be a great hedge.

Have a great week ahead

Maryann

***Disclaimer***

All opinions are my own and personal. This is not investment advice. I do not provide any buying or selling recommendations, nor do I offer any investment advice. You are advised to conduct your own research and due diligence when making financial and investment decisions.