5 Trends That Prove Reproductive Health is a Macro Opportunity

Why LPs, GPs, and co-investors should reevaluate their exposure to the most undercapitalized segment of healthcare.

Reproductive health is not a niche. It is foundational to human capital, workforce productivity, and long-term economic resilience. Yet it remains severely undercapitalized across the private markets.

Creating work like this; slow, careful, independent is a choice. It takes time to resist the pull toward noise and stay anchored in depth. If this newsletter has offered you something valuable, I invite you to consider supporting it, either with a one-time gift or a regular contribution. Your support helps me stay true to the kind of work that asks better questions, listens longer, and builds something lasting. I’m deeply grateful you’re here.

New here? Tap the subscribe button to follow along each week inside the app.

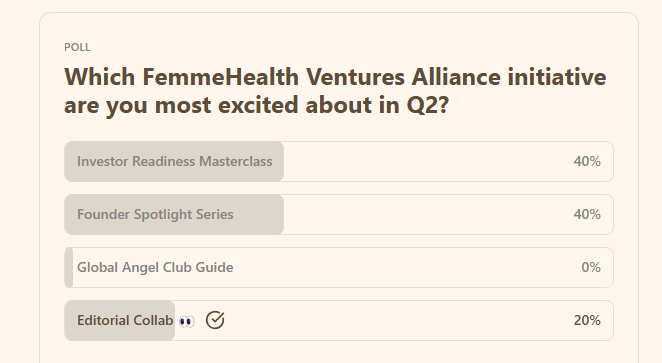

Before we dive into today’s article, a quick note on our recent community poll:

You voted and told me that Investor Readiness Masterclass and Founder Spotlight Series were your top areas of interest, followed closely by editorial collaborations. I am taking your feedback forward as we shape our Q2 25 initiatives😊 . More updates to come! Thank you for helping us build with intention.

We also just published this week’s Signal Not Noise - a focused briefing on the quiet but powerful shifts happening across women’s health investing, from major autoimmune funding rounds to the rise of employer-driven care models. You can read it here.

Signal Not Noise: What Mattered in Women’s Health Investing (Apr 20–26)

This week’s signals tell a clear story: women’s health is expanding, not through headlines, but through steady shifts in capital, corporate strategy, and care models.

Now, let’s turn to today’s deep dive.

Reproductive health is not a niche. It is foundational to human capital, workforce productivity, and long-term economic resilience. Yet it remains severely undercapitalized across the private markets.

In 2023, less than 2% of global healthcare venture funding went to women’s health [1]. This under-allocation exists not because the market is small, but because it is misunderstood, misclassified, and mispriced.

This article outlines five converging macro trends that make reproductive health a prime opportunity for LPs and allocators: cultural normalization, employer-driven demand, digital infrastructure maturity, regulatory tailwinds, and the rise of capital from non-traditional allocators.

Together, they are reshaping the capital stack and creating a new wave of scalable, investable companies.

This newsletter is 100% free. But it takes hours each week to research, write, and produce at this level. If you’d like to support this work, even with a small contribution, I’d be so grateful.

The Market Has Been Misunderstood

Reproductive health impacts half the global population across the lifespan from menarche to menopause. Yet historically, capital markets relegated it to fringe innovation or consumer wellness.

The prevailing mindset has been:

If it’s about periods or pregnancy, it’s niche.

If it’s not drug-based, it’s not biotech.

If it’s female-specific, it’s high risk and low return.

But the data tells a different story:

The global women’s health market is expected to reach $47.8B by 2030, growing at 5.6% CAGR [2].

Fertility services alone are projected to be a $41B market by 2026 [3].

Menopause-related spending in the U.S. exceeds $600B annually when factoring in healthcare costs and lost productivity [4].

Over 70% of healthcare decisions are made by women [5], yet clinical trials and diagnostics still centre male biology.

The market isn’t niche. It’s mispriced.

5 Macro Trends Changing the Game

1. Cultural Normalization = Market Readiness

Conversations around periods, miscarriage, IVF, and endometriosis are no longer whispered. From TikTok to Davos, from the New York Times to Deloitte reports, reproductive health is now squarely in the mainstream. With normalization comes demand: users are now looking for personalized, digital-first, non-stigmatizing solutions.

📌 Investment Implication: Markets follow attention. Cultural de-risking leads to category expansion and consumer adoption.

2. Employers Are Creating B2B Pull

Over 55% of large U.S. employers now offer fertility benefits [6]. Menopause support is becoming a new frontier in employee retention strategies particularly for senior women. As highlighted in this week’s Signal Not Noise, companies like Work& are launching holistic wellness suites integrating lactation and women’s health services, signaling a shift from optional benefit to strategic workforce investment.

📌 Investment Implication: Enterprise SaaS and platform models now have real buyers and budgets. B2B channels de-risk customer acquisition.

3. Digital Infrastructure Lowers Cost and Increases Reach

Telehealth has made abortion care, miscarriage support, and hormonal management more accessible. Meanwhile, startups like Overture, Alife, and Carrot are combining diagnostics, behavioral insights, and workflow automation into scalable platforms.

In parallel, companies like Granite Bio who recently emerging from stealth with $100M in funding to target autoimmune diseases show that infrastructure around women’s health is expanding into high-growth adjacent categories.

📌 Investment Implication: Scalable tech infrastructure is unlocking repeatable revenue models. This makes women’s health more fundable by traditional digital health or healthtech GPs.

4. Policy and Reimbursement Tailwinds

While U.S. federal research funding faces cuts including recent threats to the Women’s Health Initiative, European nations are moving forward:

Norway launched a Women’s Health Strategy (2024) with public funding to close gender gaps in care and research [7]

Switzerland reaffirmed SRHR as a global health priority through its support for UNFPA, UNAIDS, and multilateral cooperation [8]

Finland achieved a 66% drop in teenage abortions by combining national access to free contraception and mandated sex education [9]

Denmark, in 2024, extended its legal abortion limit to 18 weeks and removed parental consent requirements for teens aged 15–17 [10]

At the same time, the U.S. is starting to recognize the macroeconomic stakes. Recent proposals from the White House, including a $5,000 “baby bonus” aimed at boosting birth rates, signal rising concern over demographic decline.

Yet most initiatives focus on incentives after birth not on strengthening the reproductive healthcare system itself. This mismatch highlights a critical gap: governments are reacting to symptoms, while private markets have the chance to build foundational solutions.

📌 Investment Implication: Progressive regulation and payer alignment increase access, unlock reimbursement, and de-risk innovation.

❤️ Enjoying this?

If this post sparked something for you, click the ❤️ at the bottom. It helps more than you know and tells me you're reading.

5. Capital Is Changing Hands

By 2030, women are projected to control $30T of global private wealth [11]. Female angels, gender-lens funds, and values-aligned family offices are deploying early checks.

Traditional LPs are also beginning to recognize the asymmetric opportunities often hidden in overlooked sectors. Seed-stage momentum remains active, even in a cooling venture market. Coologics, which raised $3M for drug-free vaginal health technology, is one example of how overlooked categories continue to find backers when the clinical rationale is strong.

📌 Investment Implication: The capital stack is changing. LPs that build exposure now will have asymmetric access as institutional momentum builds

The Capital Stack Bottleneck and the Opportunity

The seed-to-Series A market is active. But Series B and beyond remains a critical bottleneck where companies must prove clinical scale, enterprise distribution, and payer alignment [12].

Few traditional healthtech funds underwrite women’s health with conviction, creating a barbell structure: oversupply of early capital, undersupply of growth capital.

✅ LP opportunity:

Back emerging managers with gender-lens or femtech depth

Build direct co-investment programs in the Series B/C gap

Offer anchor commitments to funds building women's health verticals in digital health or biotech portfolios

Exit Environment: Emerging but Real

While this sector lacks blockbuster IPOs (for now), the acquisition landscape is maturing:

Maven Clinic: Raised $425M+, valued over $1.7B; expanding into international markets and employer contracts

Progyny (NASDAQ: PGNY): $1.83B+ market cap; B2B fertility benefit model

Kindbody: Acquired Vios, has multiple clinics across the U.S. with employer contracts

Consolidators like LabCorp, Teladoc, and private equity roll-ups are active in diagnostics, telehealth, and care delivery

Exit timelines remain medium horizon (5–8 years), but DPI potential is improving as strategics and PE funds seek differentiated assets with scale, loyalty, and data moats.

Final Thought: Reproductive Health Is Economic Infrastructure

The historical oversight of reproductive health was never about discomfort alone. It was and remains a failure to recognize reproductive care as central to workforce participation, demographic strength, and economic growth.

If we recognize roads, electricity, and internet access as infrastructure, we must recognize reproductive health in the same way.

Those who invest accordingly will not just create returns; they will help build the backbone of future economies.

Call to Action

At FemmeHealth Ventures, we explore how media, founder insights, and investor dialogue can help surface overlooked opportunities in women’s health.

If you are an allocator, founder, or operator working at the intersection of reproductive health, digital infrastructure, and capital strategy, we would love to hear your perspective.

Let’s reimagine how capital flows into this critical space.

Sources:

[1] PitchBook, 2023, “Global Healthcare VC Investment Trends”

[2] Global Market Insights, 2023

[3] Fortune Business Insights, “Fertility Services Market,” 2023

[4] Mayo Clinic Proceedings, “Economic burden of menopause,” 2022

[5] Boston Consulting Group, “Women as the Next Wave of Growth in US Wealth Management,” 2020

[6] Mercer National Survey of Employer-Sponsored Health Plans, 2023

[7] https://www.regjeringen.no/en/dokumenter/the-womens-health-strategy/id3056099

[8] https://www.eda.admin.ch/deza/en/home/themes-sdc/health-development/sexual-reproductive-health.html

[9] https://www.reuters.com/business/healthcare-pharmaceuticals/free-contraception-helps-finland-reduce-teenage-abortions-by-66-2024-06-03/

[10] https://apnews.com/article/5e7d096182dff514c1ed409b2d2e1e39

[11] McKinsey & Co., “Women as Wealth Holders,” 2022

[12] SVB Women’s Health Report 2025

Ways to Connect with FemmeHealth Ventures Alliance

Thanks for reading. If you liked what you read, consider:

signing up for FemmeHealth newsletter, which is published weekly

sending to a friend or co-worker

Disclaimer & Disclosure

This content is for informational and educational purposes only. It does not constitute financial, investment, legal, or medical advice, or an offer to buy or sell any securities. Opinions expressed are those of the author and may not reflect the views of affiliated organisations. Readers should seek professional advice tailored to their individual circumstances before making investment decisions. Investing involves risk, including potential loss of principal. Past performance does not guarantee future results.

I really enjoyed reading this Maryann - thank you! I'm from the US originally but live in the UK now. I've been having some female health issues for about 2 years now and am truly baffled by how long it's taken to even see a doctor (no telehealth option, they insist on in-person) and how casually it's being treated by the physicians I do see. The healthcare industry seriously needs to improve how it treats female related issues.